Chattel Form Paper For Sale In Texas

Description

Form popularity

FAQ

In addition to filing with the state, the UCC is filed with the County office that holds the county real estate records for the property. Filings for ownership entities are made in the state where the entity is registered. Filings for individuals are made in the state in which the individual resides.

A rule of thumb when filing a UCC record is to file at the central filing office of the state where the debtor is located. However, there are exceptions, such as when the UCC records is filed as a fixture filing.

UCC stands for Uniform Commercial Code and is a set of laws applicable in business and commercial transactions. They are not considered federal laws but as uniformly adopted state laws. UCC contains nine articles with provisions on certain areas of commercial law.

Correct filing location: File the fixture filing in the real property records of the county where the real estate is located and, if the collateral includes both personal property and fixtures, also in the central UCC filing office where the debtor is “located” (as per UCC Article 9's definition of debtor location).

Article 9 provides a secured creditor with the advantage of taking possession of collateral immediately on a debtor's default.

A filed financing statement is good for FIVE years unless a continuation is filed. Effective July 01, 2001, all UCC filings are to be made with the Texas Secretary of State.

Uniform Commercial Code Article 9 provides a statutory framework that governs secured transactions--transactions that involve the granting of credit secured by personal property. Each state maintains an office for filing finance statements to publicly disclose security interests in encumbered property.

No new counties shall be created so as to approach nearer than twelve miles of the county seat of any county from which it may in whole or in part be taken.

A Q&A guide to Uniform Commercial Code (UCC) Article 9 Sales in Texas. Article 9 of the Model UCC is intended to create a uniform system across the country for creating, perfecting, and enforcing security interests in personal property.

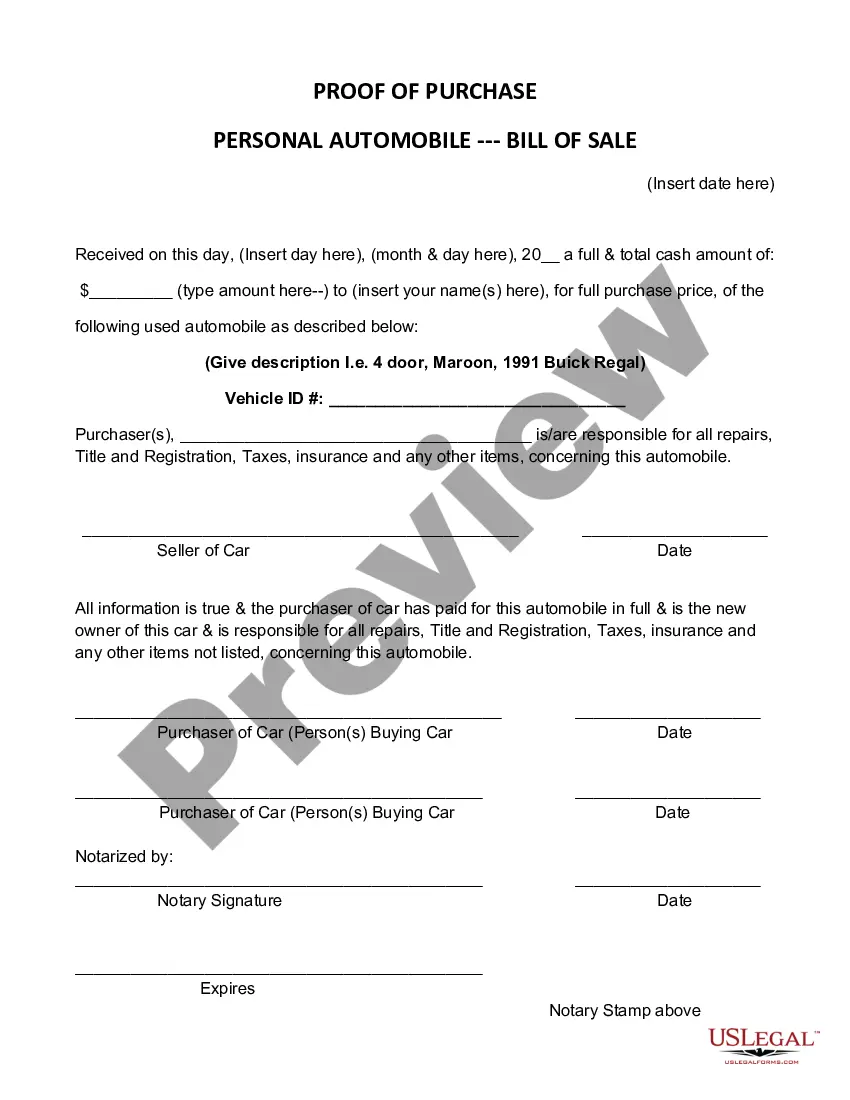

It is important to note that a bill of sale does not necessarily indicate total ownership of a vehicle. While it can help protect you from malicious lawsuits, true ownership is generally only able to be proven with possession of a title.