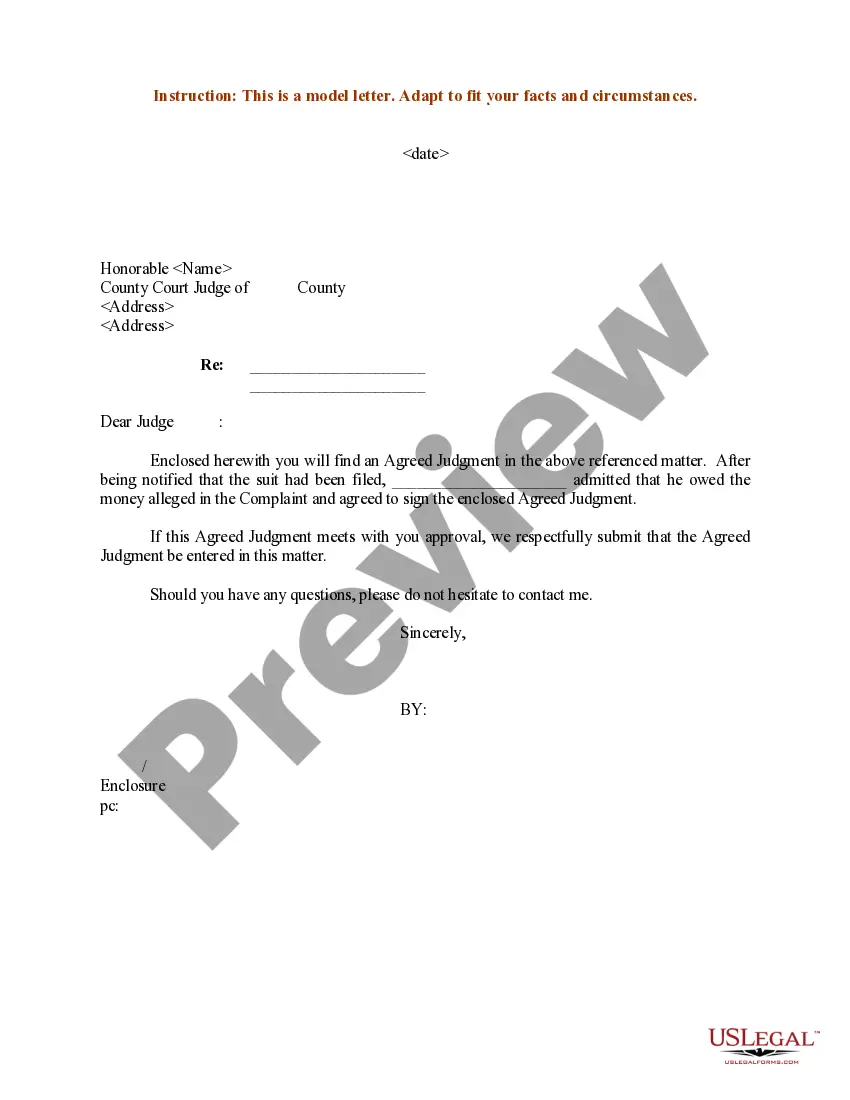

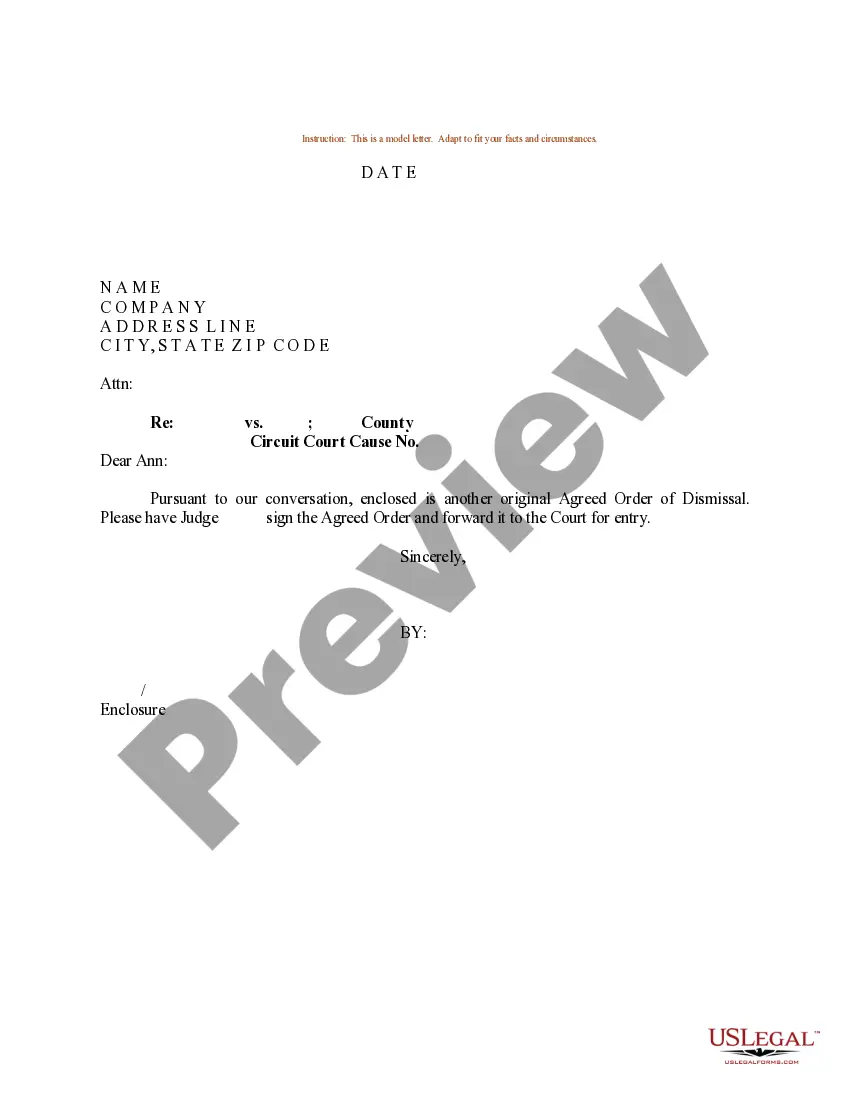

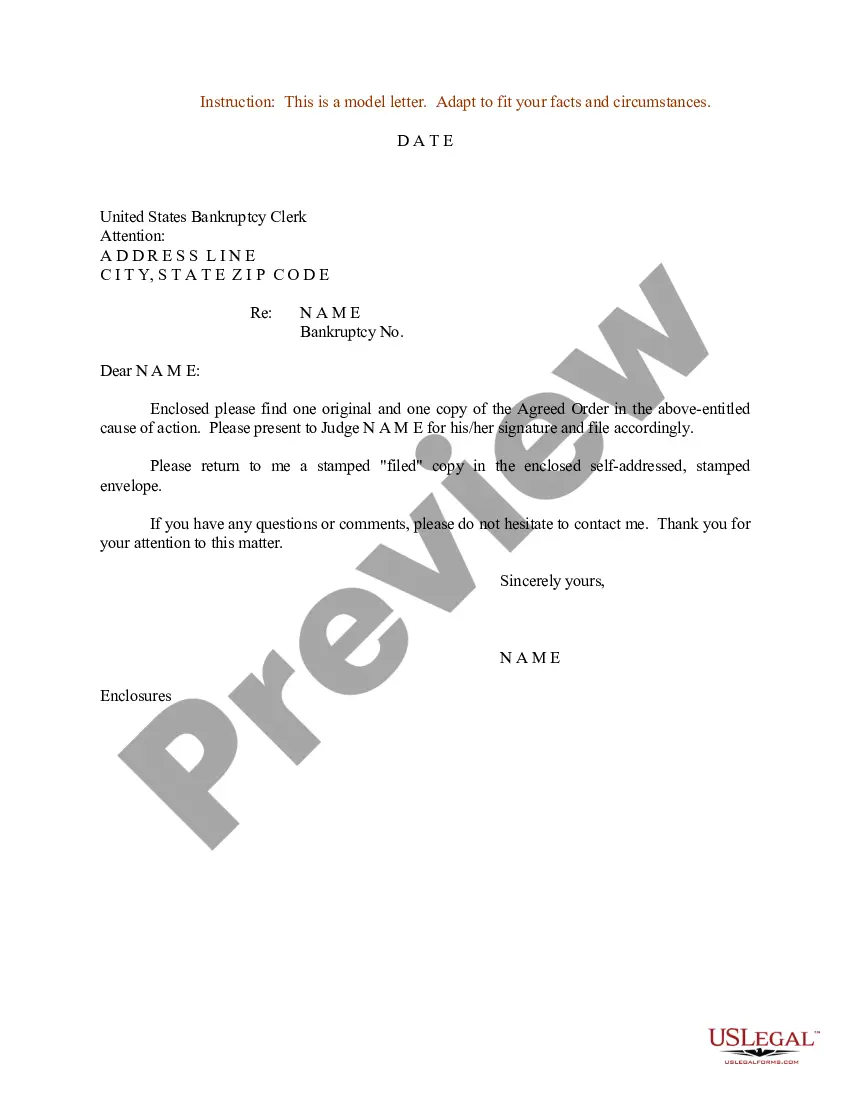

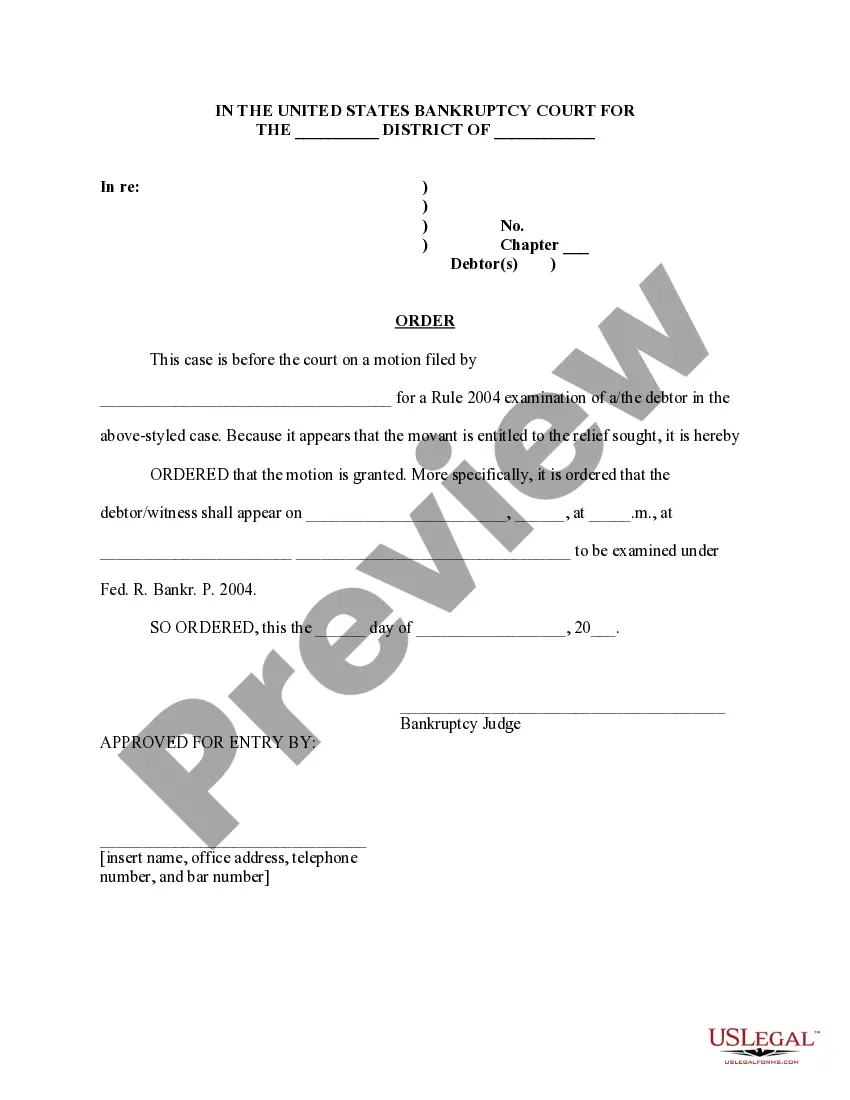

Sample Judge Order With A Credit Card In Utah

Description

Form popularity

FAQ

Check to see if their complaint included the original contract of the written instrument. Some states require a contract or some proof that you owe the debt. If it requires that, and they didn't include it, then you can file a motion to dismiss.

In the United States, nobody can get a judgment against you without demonstrating to the court that you were served with the summons and complaint. A showing of deficient or fraudulent service is or should be sufficient to overturn a judgment.

You can attempt to settle the debt and remove the Judgment, however a credit card company may be reluctant to remove the Judgment. Your best bet would be to reach out to the credit card company's attorney and discuss settling this matter.

Statute of Limitations considerations for credit card collections. Utah law has established that credit card agreements are governed by the six-year limitations period of Utah Code § 78B-2-309, not the four year “open account” statute, Utah Code § 78B-2-307.

In a debt collection lawsuit, a judgment is a court order that allows the debt collector to use stronger tools, like garnishment, to collect the debt. A judgment is an official result of a lawsuit in court.

Statute of limitations on debt for all states StateWrittenOral Utah 6 years 4 Vermont 6 years 6 Virginia 5 years 3 Washington 6 years 346 more rows •

Short answer: Judgments generally last three to seven years, but they can also be valid for over 20 years in some states.

Removing A Judgment from Your Record There are only three ways in which a judgment can be made to go away: paying the debt, vacating the judgment or discharging the debt through bankruptcy.

Summary. A summons is a notice served on a person to let them know that a complaint or petition has been filed against them. The summons requires the person to answer the complaint or petition within a certain amount of time, or attend a court hearing on a certain day and time.

Old (Time-Barred) Debts In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.