Cancellation Form Fillable With Calculations In Georgia

Description

Form popularity

FAQ

A Certificate of Authority shows that you are authorized to do business in a state other than your original formation state.

A certificate of authority is a document that provides states—other than the one in which your business is registered—all of a business's important information, including official name, owners' names, and legal status (limited liability company, corporation, limited partnership, etc.).

Businesses that are incorporated in another state will typically apply for a Georgia certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.

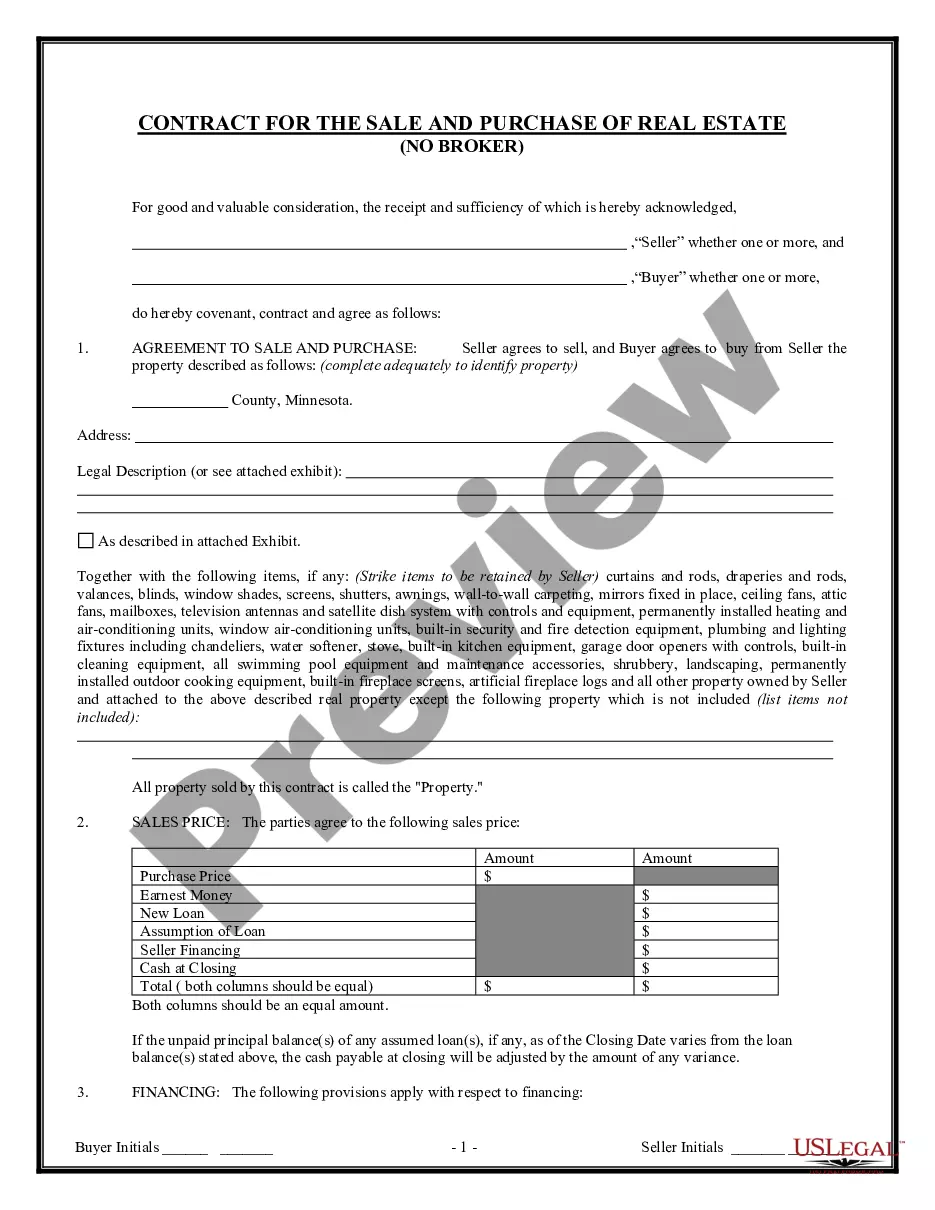

To cancel or withdraw an entity's registration in Georgia, file an Application for Withdrawal of Certificate of Authority with the Georgia Secretary of State, Corporations Division (SOS). There is one form for all entities, so indicate which type of entity the application is for.

To obtain your Georgia Certificate of Authority, you will submit an Application for Certificate of Authority, along with required certificates or certified copies from your home state. You will need to appoint a registered agent in order for your filing to be approved.

Online: Georgia's Secretary of State (SOS) will process online applications in about 7 to 10 business days. In Person: Filings submitted by mail or in person are processed in about 15 business days after receipt of paperwork by Georgia's SOS.

How to Dissolve a Georgia LLC Hold a meeting with other LLC members to approve dissolution ing to the LLC's operating agreement. File a Certificate of Termination with the Georgia Secretary of State, either online or by mail. Settle any outstanding debts and obligations, and distribute remaining assets to members.

A Georgia Certificate of Existence (Good Standing) is required when your business expands to another state (otherwise known as a foreign qualification) and needs to register in that state as a foreign corporation or LLC.

Since Georgia doesn't require LLCs to list their members on the Articles of Organization or Annual Registration, you typically won't need to inform the state when your LLC changes owners. However you will need to update your LLC operating agreement and change your responsible party with the IRS.