Sample Letter To Irs Requesting Refund In Phoenix

Description

Form popularity

FAQ

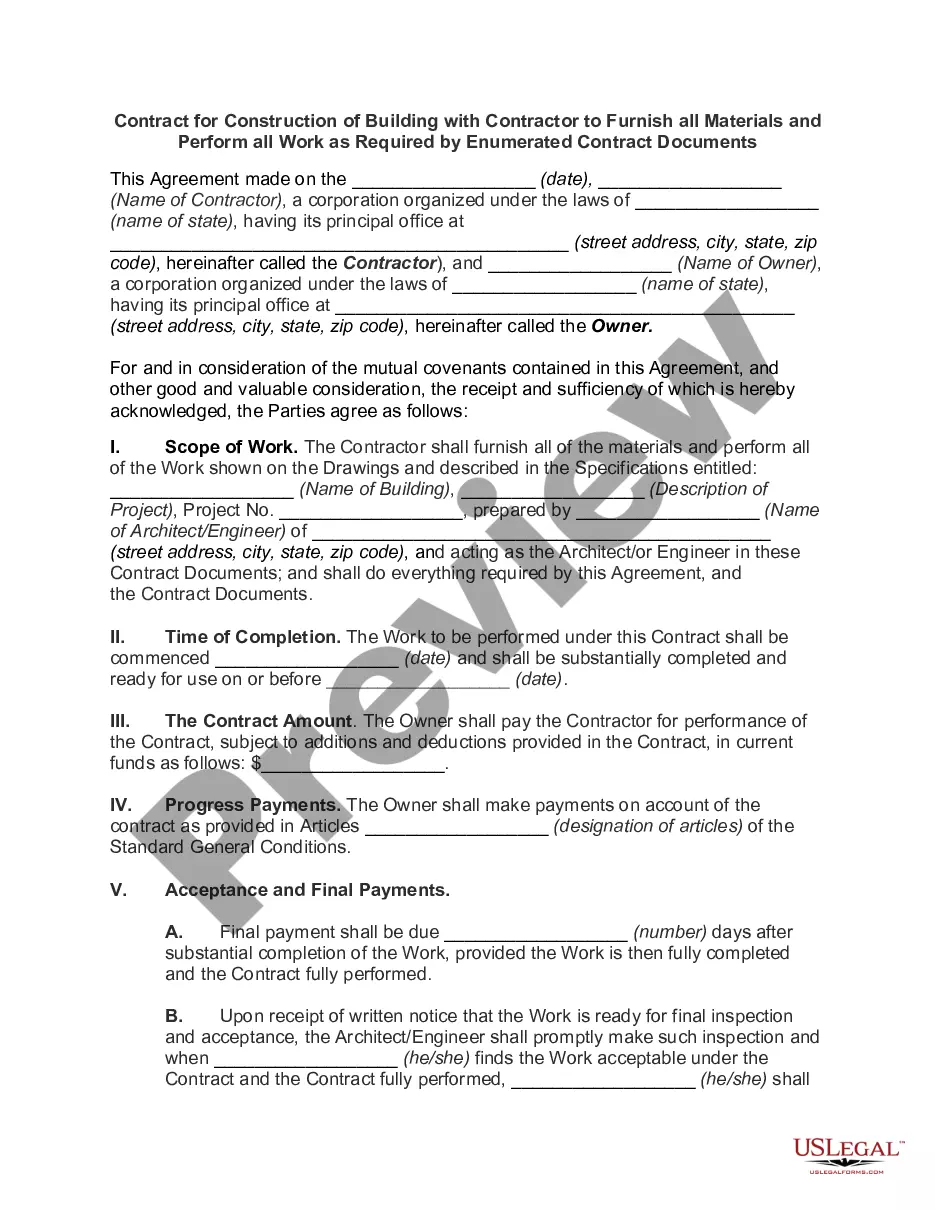

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

Sample Letter to the IRS Dear Sir/Madam, I am writing to request a correction to my tax return. My social security number is 123-45-6789, and I filed my tax return for the 2020 tax year. I received a notice from the IRS stating that I owe additional taxes due to an error in my return.

IRS Penalty Abatement Request Letter State the type of penalty you want removed. Include an explanation of the events and specific facts and circumstances of your situation, and explain how these events were outside of your control. Attach documents that will prove your case.

If you don't have internet, call the automated refund hotline at 800-829-1954 for a current-year refund or 866-464-2050 for an amended return. For prior-year refunds, check Where's My Refund.

When requesting abatement of penalties for reasonable cause, your statement should include supporting documentation and address the following items: The reason the penalty was charged. The daily delinquency penalty may be charged for either a late filed return, an incomplete return, or both.

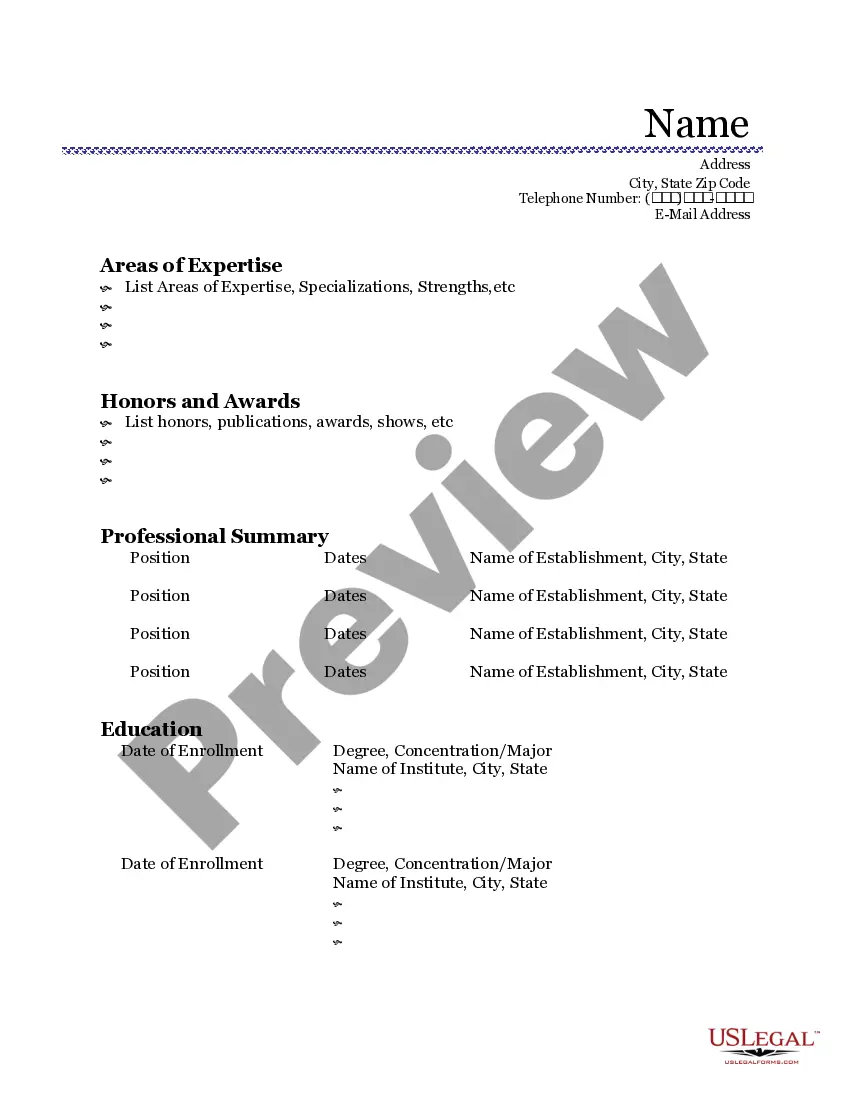

What are the parts of a formal letter? Header (date/address/return address) Date: When you write a formal letter, it's crucial to include the date on which you wrote it. Salutation. In a formal letter, the standard salutation is “Dear” followed by the recipient's title and last name. Body. Closing. Signature.

The IRS provides clear guidelines on what your letter should include: Your name, address, and contact information. A statement expressing your desire to appeal the IRS's findings. The tax period(s) in question. A list of the items you disagree with and why. Facts supporting your position.

The IRS will review your correspondence and respond ingly. Allow at least 30 days for reply. There's usually no need to call the department.

Use the correct postage: Check the weight of your mailpiece and affix the appropriate amount of postage. When sending important documents, consider using a mailing option that provides tracking and delivery confirmation. Use the correct address: Ensure you are sending your mailpiece to the correct IRS address.