Sample Letter To Irs Requesting Payment Plan In Fairfax

Category:

State:

Multi-State

County:

Fairfax

Control #:

US-0003LTR

Format:

Word;

Rich Text

Instant download

Description

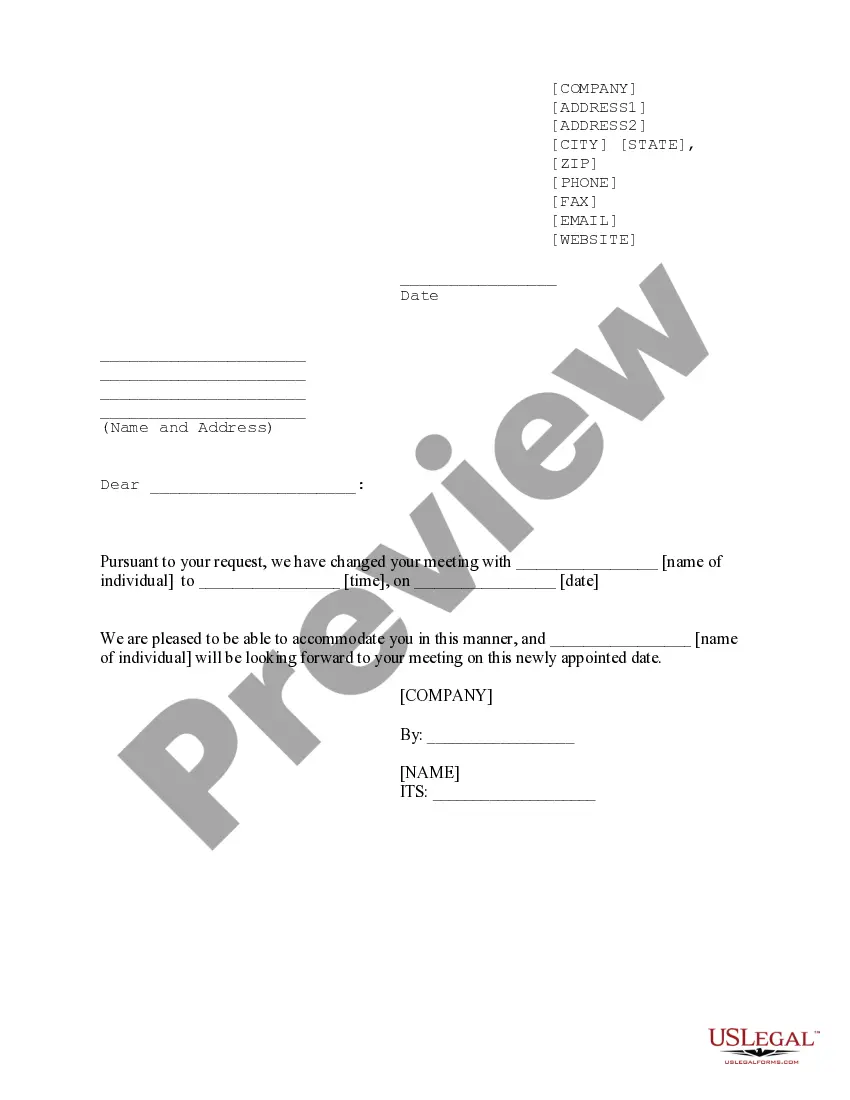

The Sample Letter to IRS Requesting Payment Plan in Fairfax serves as a model for individuals needing to negotiate a payment plan with the Internal Revenue Service. This letter format allows users to clearly present their request while providing essential information such as their name, address, and specific case details. Key features include a professional tone, a straightforward structure, and editable sections to personalize the content as needed. Filling instructions emphasize the importance of adapting the letter to fit individual circumstances. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who assist clients in managing tax obligations. It streamlines communication with the IRS, ensuring that all necessary information is included for a timely response. Additionally, this letter can serve as documentation of the user's efforts to resolve tax issues, reflecting their willingness to communicate and negotiate with the IRS. Overall, it is a practical tool designed to facilitate the tax payment process for various users.

Form popularity

FAQ

Responding to a Request for Information Format a business letter. Add the IRS address. Include your personal information. Insert your salutation. Include a copy of the notice you received from the IRS. Identify the information you are providing. Close the letter on a friendly note. Identify any enclosures.

Sample Letter to the IRS Dear Sir/Madam, I am writing to request a correction to my tax return. My social security number is 123-45-6789, and I filed my tax return for the 2020 tax year. I received a notice from the IRS stating that I owe additional taxes due to an error in my return.