Employee Form Documentation For Behavior In Washington

Description

Form popularity

FAQ

Employees and former employees have a right to access their own personnel files at least once a year. Employers must allow access to any or all of an employee's records within 10 business days at the employee's usual place of employment, or a mutually agreed upon location.

A good employee information form should be comprehensive yet straightforward. It should include: Personal Information: Full name, address, contact details, marital status, and spouse's details. Job Information: Title, department, supervisor, work location, start date, and salary.

Whenever you hire a new employee, you'll need to collect some key information, including: Personal details: Name, address, employee contact information, and emergency contact details. Employment information: Job title, department, start date, and salary.

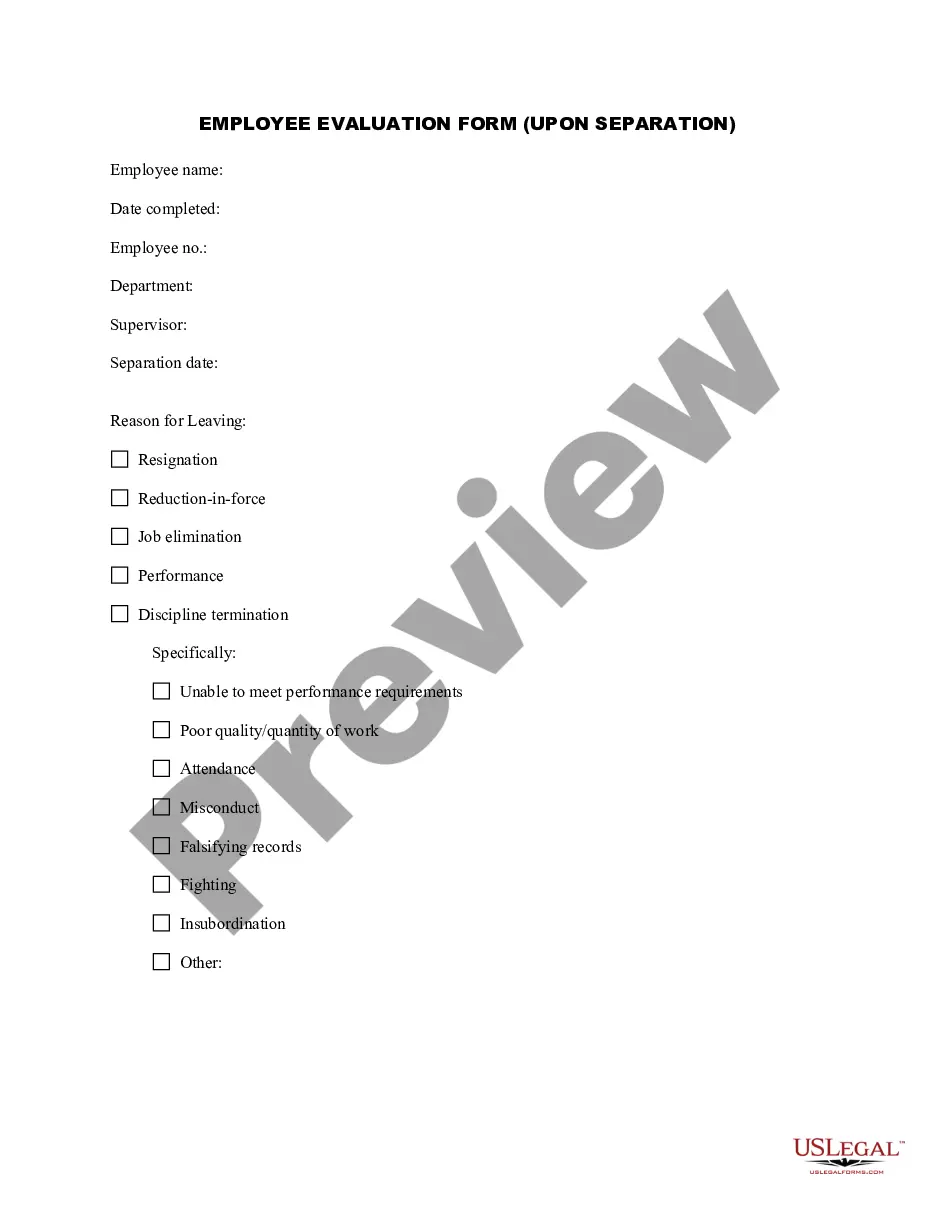

When you fill the form: Be honest and critical. Analyze your failures and mention the reasons for it. Keep the words minimal. Identify weaknesses. Mention your achievements. Link achievements to the job description and the organization's goals. Set the goals for the next review period. Resolve conflicts and grievances.

It should include: Personal Information: Full name, address, contact details, marital status, and spouse's details. Job Information: Title, department, supervisor, work location, start date, and salary. Emergency Contact Information: Name, address, and contact details of the emergency contact.

New hire paperwork in Washington includes tax documents, payroll information and the employment contract or agreement. As a best practice, provide your new employee with any documents or information about their role and your workplace policies as well as a point of contact for further questions.

This form should encompass areas such as personal information (name, address, date of birth), contact details, emergency contact information, employment history, educational background, and any relevant certifications or skills.

Employment Eligibility Verification (Form I-9) It has sections for employees and employers, with employees having to complete by the first day of work. Employers must physically examine the employee's identification documents and complete the form within three days after the employee starts work.

The federal Withholding Allowance Certificate, Form W-4, must be completed so that you know how much federal income tax to withhold from your new employee's wages. The importance of having each employee file a Form W-4 cannot be overstated, so make its completion a priority.

You must have a registered business to hire employees in Washington state. Businesses and domestic (household) employers must establish employer accounts to report employee hours and wages. To establish or reopen employer accounts, you must file a Business License Application with Business Licensing Service (BLS).