Employee Form Fillable For 2023 In San Diego

Description

Form popularity

FAQ

If you were under 65 at the end of 2023 If your filing status is:File a tax return if your gross income is: Single $13,850 or more Head of household $20,800 or more Married filing jointly $27,700 or more (both spouses under 65) $29,200 or more (one spouse under 65) Married filing separately $5 or more1 more row

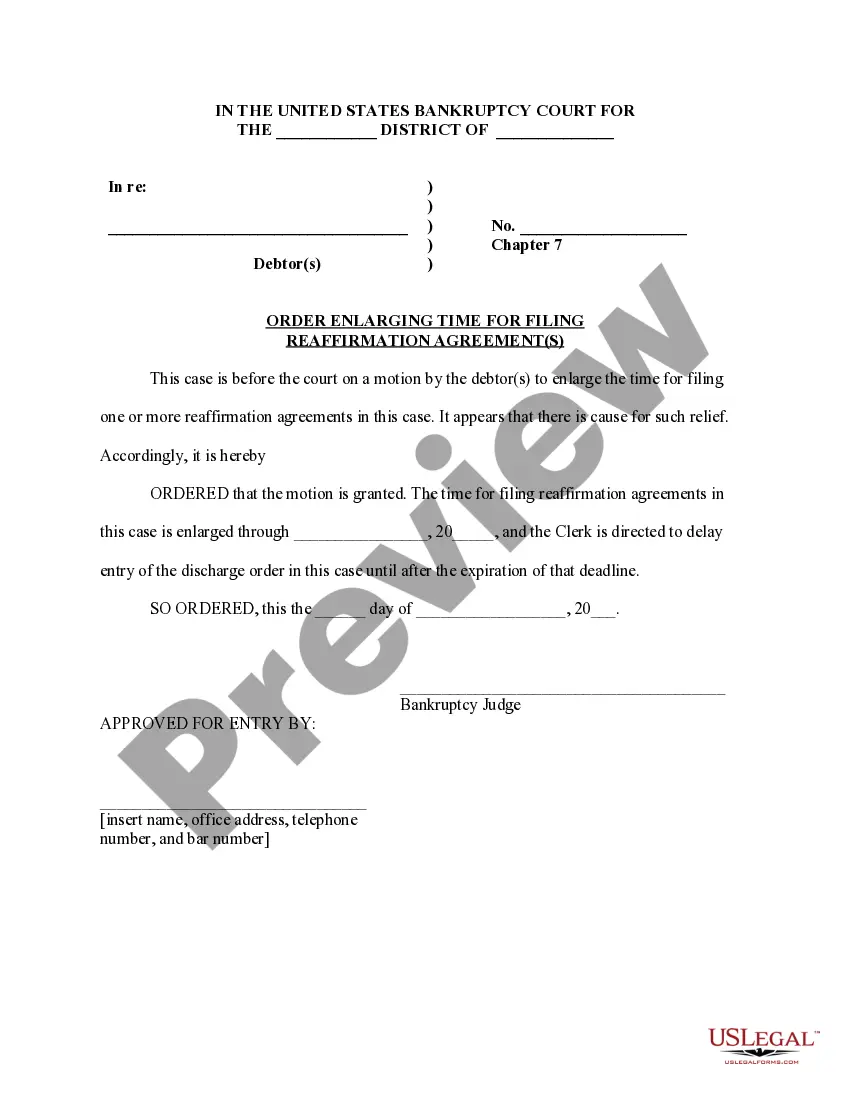

The IRS has released: The 2023 Form 941, Employer's Quarterly Federal Tax Return, and its instructions. The instructions for Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors. Schedule R, Allocation Schedule for Aggregate Form 941 Filers, and its instructions.

Tax time is here – the Internal Revenue Service (IRS) began accepting 2023 tax returns on Monday, Jan. 29, 2024.

The IRS Document Upload Tool is a secure, easy and fast way to send information to the IRS. You can use the tool to: Upload scans, photos, or digital copies of documents as JPGs, PNGs or PDFs. Get confirmation that we received your documents.

Forms W-2 (including Forms W-2AS, W-2GU, and W-2VI) redesigned. Beginning with the tax year 2023 forms (filed in tax year 2024), you may complete and print Copies 1, B, C, 2 (if applicable), and D (if applicable) of Forms W-2, W-2AS, W-2GU, and W-2VI on IRS to provide to the respective recipient.

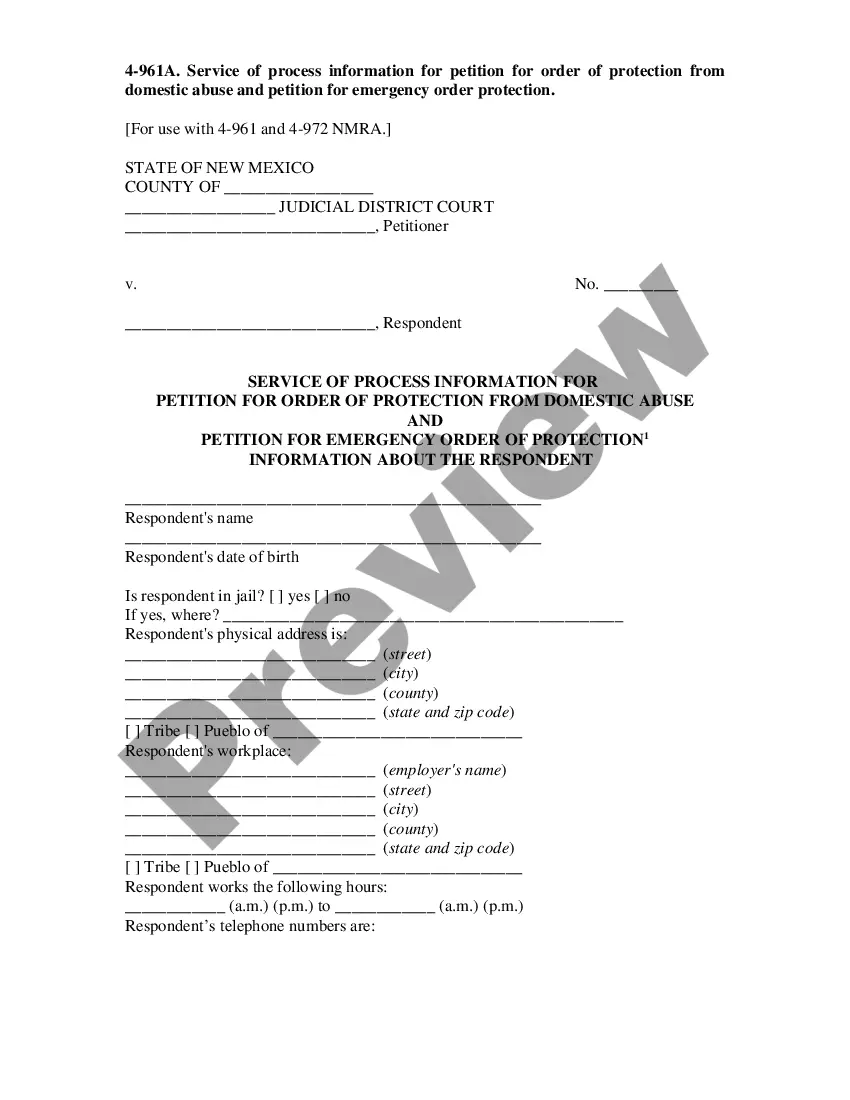

This form should encompass areas such as personal information (name, address, date of birth), contact details, emergency contact information, employment history, educational background, and any relevant certifications or skills.

The most common types of employment forms to complete are: W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form.

Use e-Services for Business to submit a Report of New Employee(s) (DE 34). It's fast, easy, and secure. Submit a paper report of new employees by mail or fax using one of the following options: Download a fill-in DE 34 form.

All U.S. employers must properly complete Form I-9 for every individual they hire for employment in the United States. This includes citizens and noncitizens.

LISTEN TO OUR CALIFORNIA SALARY LAWS PODCAST YearMinimum Salary for Exempt White-Collar Workers at Employers with 26 or more employeesMinimum Salary for Exempt White-Collar Workers at Employers with 25 or fewer employees 2021 $58,240 $54,080 2022 $62,400 $58,240 2023 $64,480 $64,480 2024 $66,560 $66,560