Employee Form Fillable With Adobe Acrobat In Ohio

Description

Form popularity

FAQ

9 Form. One of the most important forms you have to give to a new hire that walks into your office is an 9 form. W4 Form. The next form you will have to give a new employee is the W4 form. W9 Form. New Hire Reporting. Ohio State ncome Tax. Unemployment nsurance. Workers' Compensation. Final Thoughts.

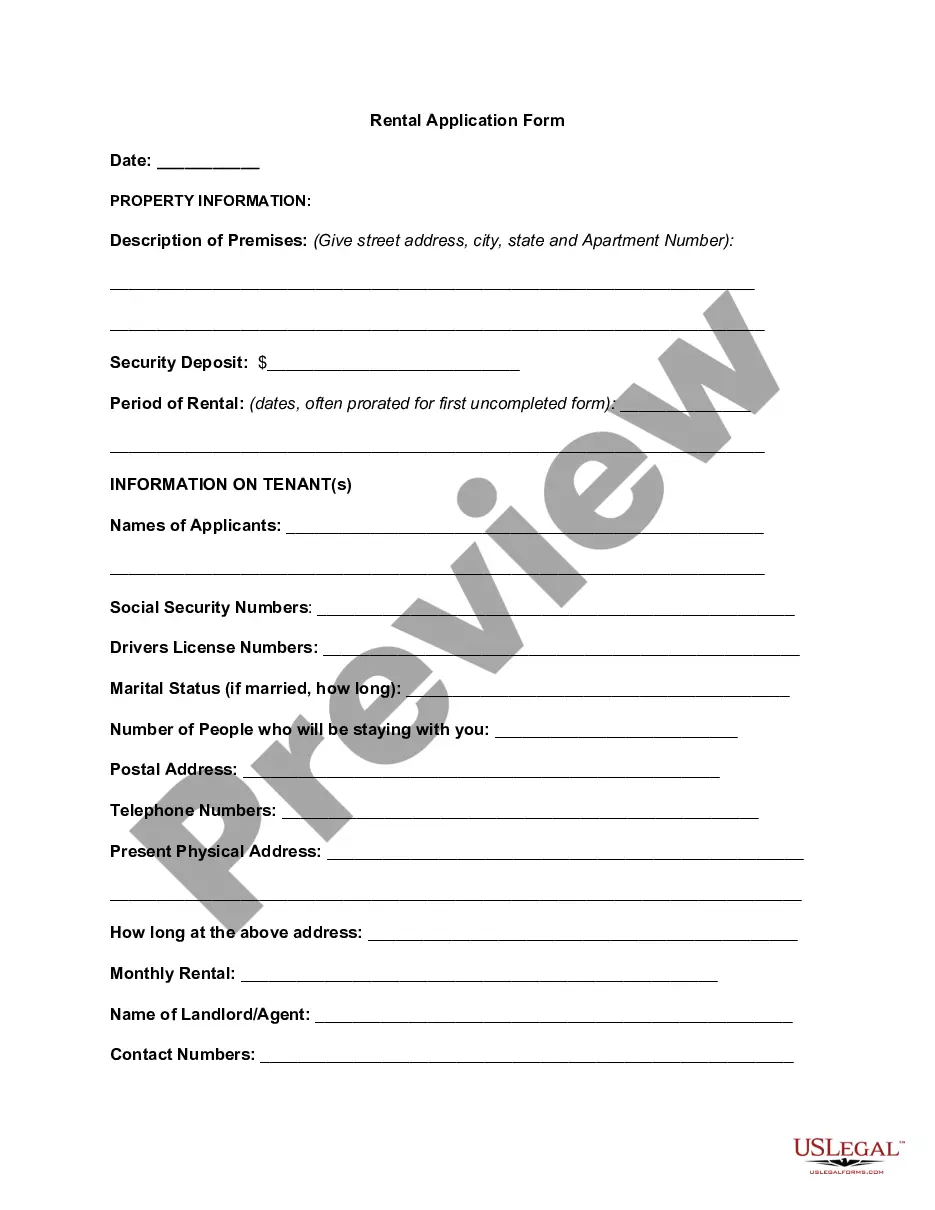

Make sure that the security settings allow form filling. (See File > Properties > Security.) Make sure that the PDF includes interactive, or fillable, form fields. Sometimes form creators forget to convert their PDFs to interactive forms, or they intentionally design a form you can only fill in by hand.

Please follow the steps outlined below to close your DC Unemployment account: Send a fax to (202) 698-5706 ATTN: STATUS with the following information: Business Name and Business Address. Employer ID Number.

Close an Unemployment Compensation Tax Account Deactivate your unemployment online in The SOURCE, Ohio's unemployment insurance tax system. If you have questions, contact the Ohio Department of Job and Family Services.

Employer Withholding Tax: This may also be done when filing the final return IT 941 electronically through the Ohio Business Gateway by selecting the box to Cancel Withholding Account. The last date of compensation must also be entered on the form.

You can fill out PDF forms in Google Drive on your Android device. On your Android device, open the Google Drive app. Tap the PDF that you want to fill out. At the bottom right, tap Edit. Form Filling . Enter your information in the PDF form. At the top right, tap Save. To save as a copy, click More.

To fill out a form that was emailed to you on a computer: Open the email and download the attachment. Fill out the PDF form using PDFgear online form filler. Resend the filled PDF form.