Employee Form Document Format In Nevada

Description

Form popularity

FAQ

The most common types of employment forms to complete are: W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form.

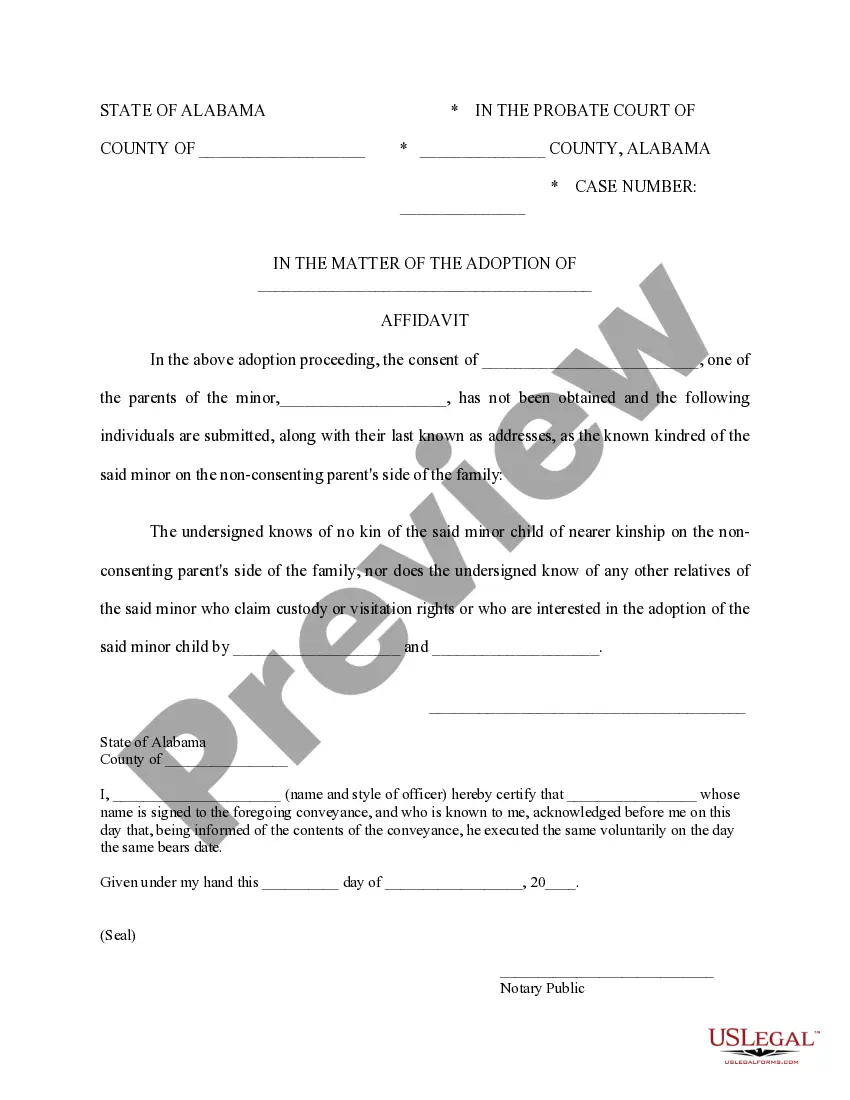

Employee's eligibility to work in the United States All U.S. employers must properly complete Form I-9 for every individual they hire for employment in the United States. This includes citizens and noncitizens. Both employees and employers (or authorized representatives of the employer) must complete the form.

Nevada Department of Employment, Training and Rehabilitation (DETR) State Unemployment Tax (UI) Go to DETR Employer Self Service (ESS) site. Click on “new user registration” on the top right corner. Under drop down, select employer. To complete the full registration process for a new Employer, Select no. Click “submit”

9 Verification Process Employers in Nevada are required to complete this form for every new hire to confirm their identity and work eligibility.

An I-9 Employment Eligibility Verification form that verifies your employee is legally allowed to work in the US. They will also need to provide you with one of these acceptable identification documents in ance with federal law. Both a W-2 and a W-4 tax form.

Certain businesses may be exempt from the State Business License requirement. All entities whether they receive a State Business License or Exemption are assigned a Nevada Business Identification Number. This number is important for being able to register with State and local agencies in Nevada.

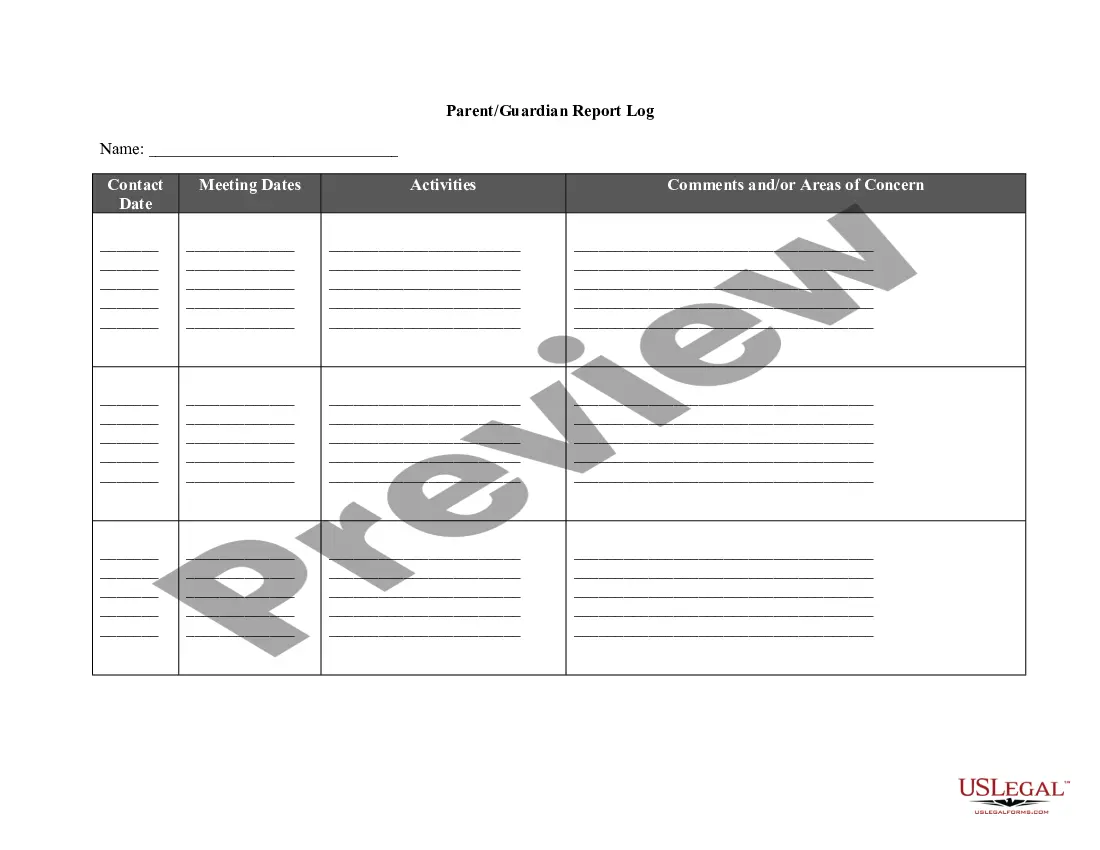

Document Retention Schedule Employee Records Records Relating to Promotion, Demotion or Discharge 7 years after termination Accident Reports and Worker's Compensation Records 5 years Salary Schedules 5 years Employment Applications 3 years4 more rows

Go to the UI. NV website and select “New User Registration” to register your business. You will receive your Unemployment ID Number Immediately once the online registration is completed, in 30 days if registering by mail. You will need to register with this department if you have employees that work in Nevada.

To get your Nevada Account Number and MBT Account Number, register online with the Nevada Department of Employment, Training and Rehabilitation (DETR). Once you complete registration, you will receive your nine-digit (X. XX) Nevada Account Number and your ten-digit (10XX) MBT Account Number.