Factoring Agreement Document For Business In Travis

Description

Form popularity

FAQ

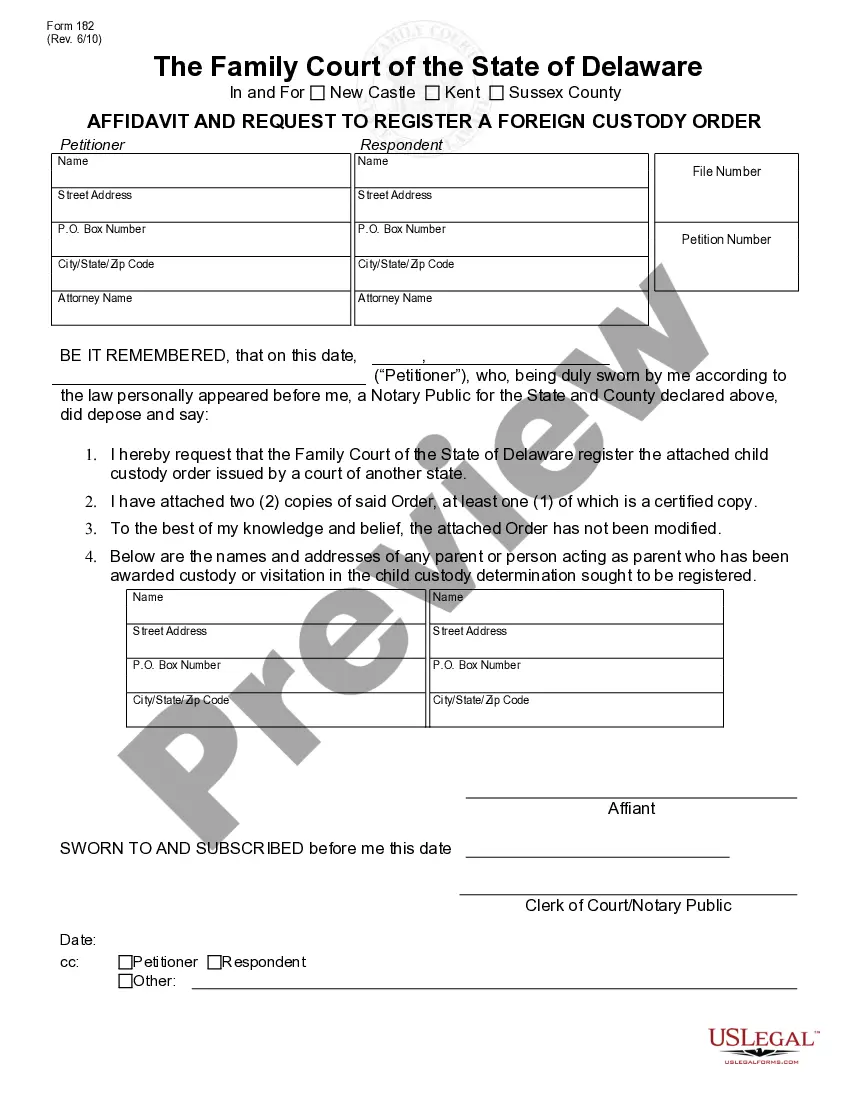

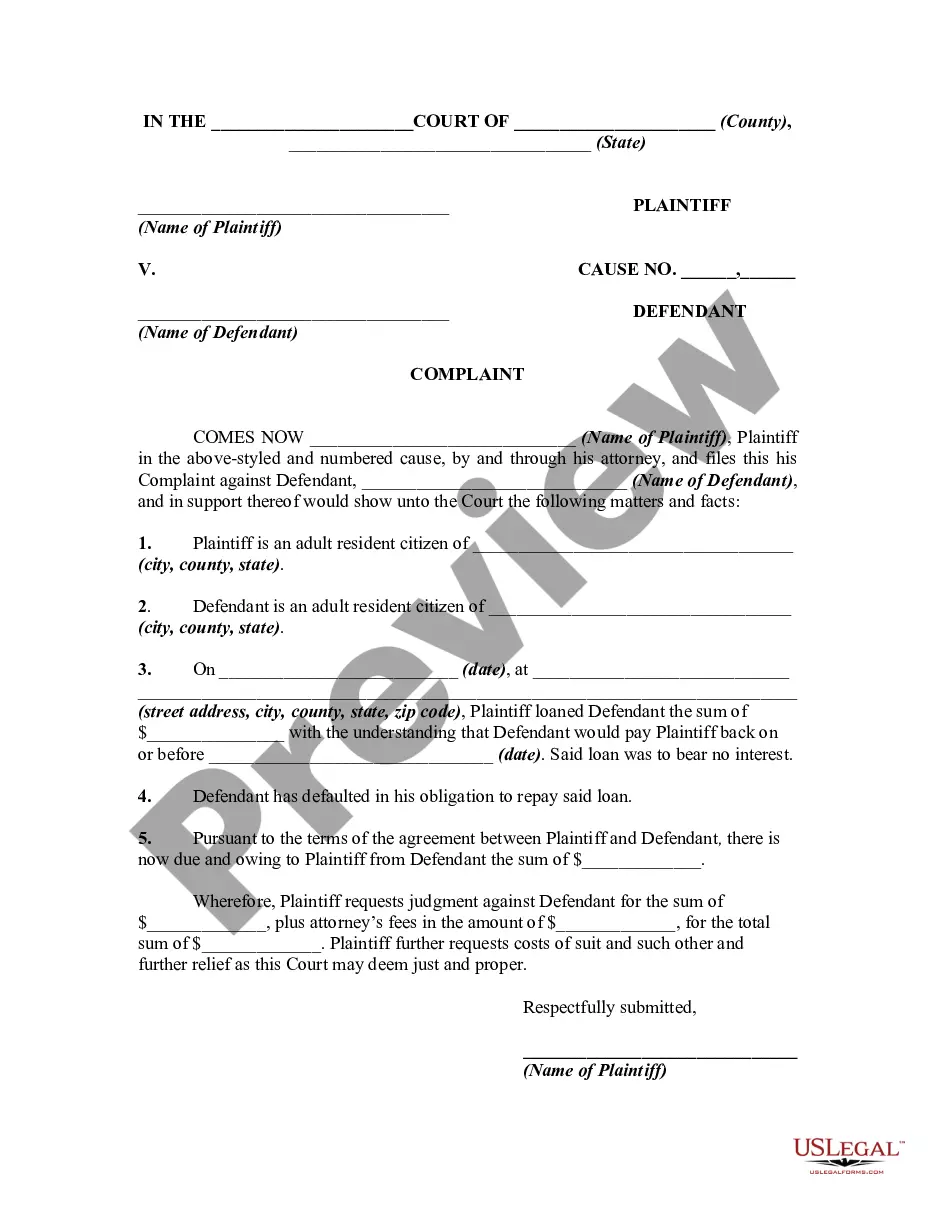

Contracts only need (1) a meeting of the minds as to the terms, and (2) exchange of goods and/or services which each party considers to have some non-zero value (called ``consideration''). So, yes, you can write a contract for yourself. You don't need an attorney.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

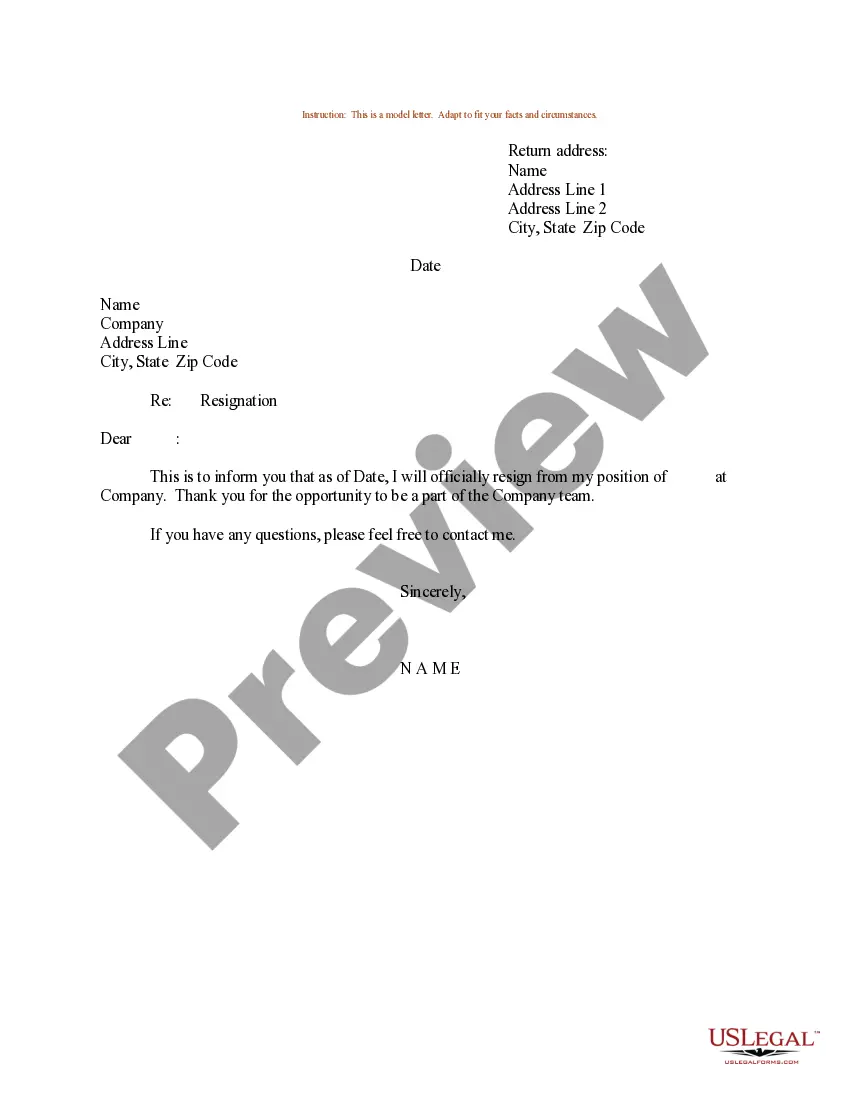

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

Another document required for factoring is an accounts receivable aging report. This report lists out unpaid invoices, credit memos, and notes by date. Accounts receivable aging reports may also be referred to as a schedule of accounts receivable or just a schedule.

How to write an effective business contract agreement #1 Incorporate details about relevant stakeholders. #2 Define the purpose of the contract. #3 Include key terms and conditions. #4 Outline the responsibilities of all parties. #5 Review and edit. #6 Provide enough space for signatures and dates.