Form Assignment Accounts For Sale In Texas

Description

Form popularity

FAQ

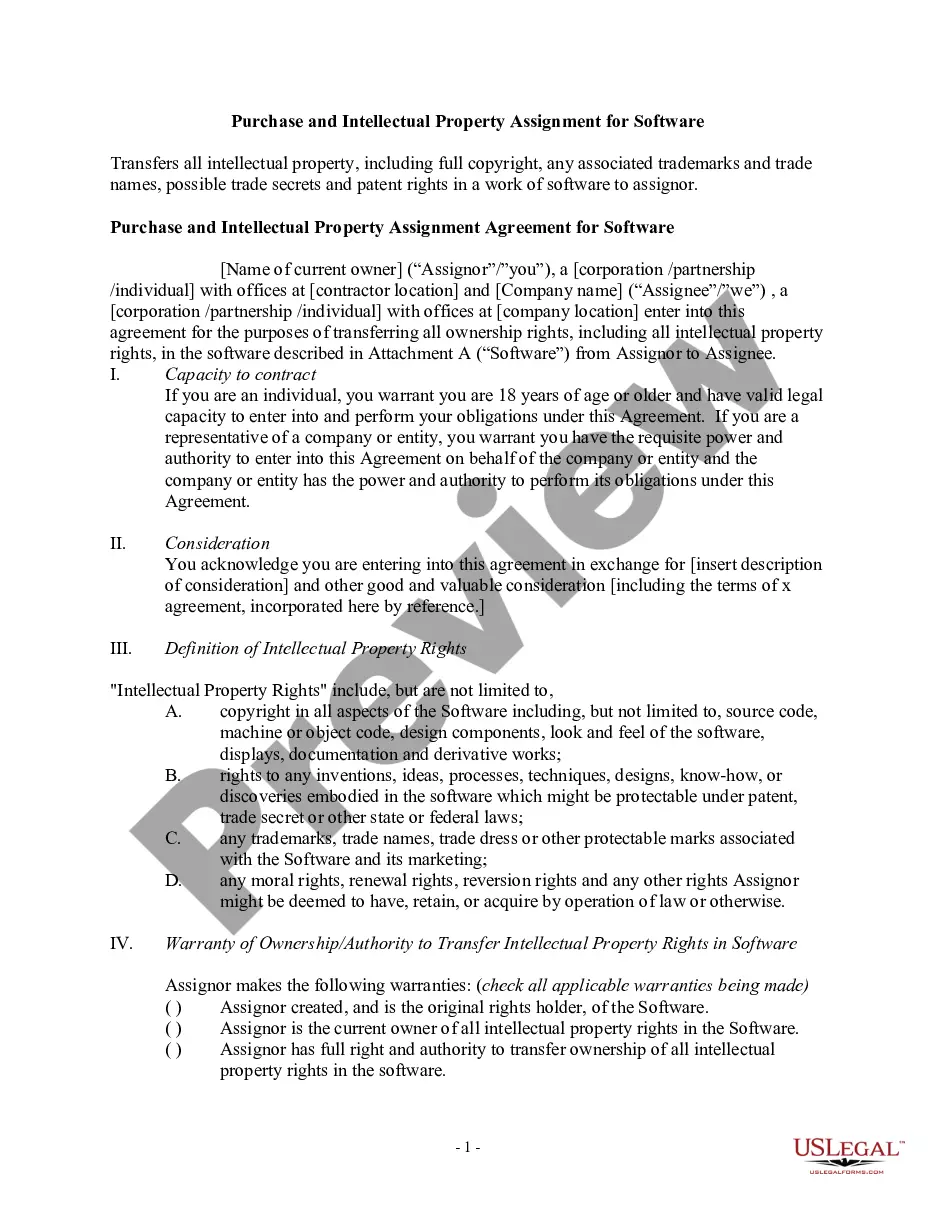

Contract Assignment. (a) A contract assignment must be made as part of an ownership change, a change in tax status, or a transfer from one legal entity to another through a legal process. No assignment is effective until approved, in writing, by the Texas Department of Human Services (DHS).

The assignor must agree to assign their rights and duties under the contract to the assignee. The assignee must agree to accept, or "assume," those contractual rights and duties. The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

Texas sellers must collect sales tax on taxable items, including shipping and delivery charges, sold online in Texas. Texas sellers are engaged in business if they have a physical Texas location or make online sales in Texas.

If you do not have your Webfile number, you can contact us at (800) 442-3453 24 hours a day, 7 days a week.

You will need to apply using form AP-201, Texas Application (PDF). Email the application to sales.applications@cpa.texas or fax the application to 512-936-0010. To complete the application, you will need the following documentation: Sole owner's Social Security number.

You must obtain a Texas sales and use tax permit if you are an individual, partnership, corporation or other legal entity engaged in business in Texas and you: Sell tangible personal property in Texas; Lease or rent tangible personal property in Texas; Sell taxable services in Texas; or.

(2) The resale certificate must show the signature and address of the purchaser, the date of the sale, the state in which the purchaser intends to resell the item, the sales tax permit number or the registration number assigned to the purchaser by the state in which the purchaser is authorized to do business or a ...

A seller's permit is required for digital goods in Texas as the state considers electronic items to be taxable. Regarding online sales, Texas residents who “sell more than two taxable items in a 12-month period and ship or deliver those items to customers in Texas" must have Texas seller's permits.

In general, business owners do not need a State of Texas business license to operate their online business. As previously mentioned, however, an owner may be required to get a permit or license depending on the type of business being operated and the kinds of products and/or services being sold.

A taxable item that is purchased for resale is exempt from sales or use tax if the seller accepts a properly completed Form 01-339, Texas Sales and Use Tax Resale Certificate (PDF), instead of collecting the sales tax due.