Factoring Agreement Sample Format In Suffolk

Description

Form popularity

FAQ

Acceptance of an offer: After one party makes an offer, it's up to the other party to accept it. If someone offers you $600 to walk their dogs, for example, you enter into a contractual agreement the moment you accept their offer in exchange for your services.

Use concrete words rather than industry jargon to keep the intent clear. A properly formatted contract will typically have copy that is left-aligned and single-spaced. If the contract is long or has multiple sections, a table of contents should be included to make it easier to review.

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

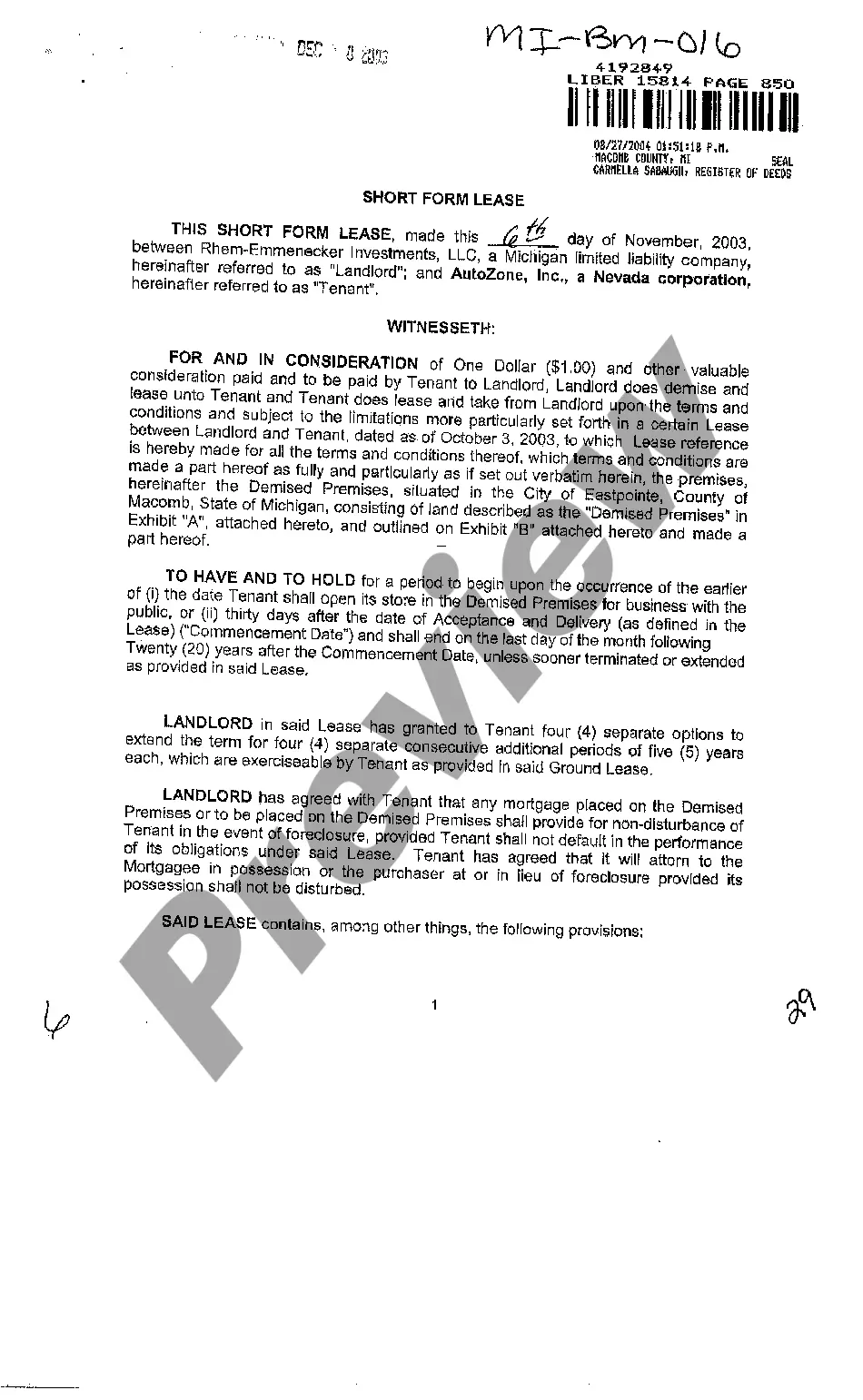

Invoice factoring is an agreement to assign your accounts receivable (A/R) to a factoring company. So the letter communicates that a third party (factoring company) is managing and collecting your A/R.

Invoice factoring can be a good option for business-to-business companies that need fast access to capital. It can also be a good choice for those who can't qualify for more traditional financing.

Get a Release Letter: Once all obligations are fulfilled, ask for a release letter from the factoring company. This document should state that you have fulfilled all contractual obligations and that the factoring company has no further claim on your invoices or receivables.

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

You can get out of a binding contract under certain circumstances. There are seven key ways you can get out of contracts: mutual consent, breach of contract, contract rescission, unconscionability, impossibility of performance, contract expiration, and voiding a contract.