Factoring Agreement Editable Formula In Philadelphia

Category:

State:

Multi-State

County:

Philadelphia

Control #:

US-00037DR

Format:

Word;

Rich Text

Instant download

Description

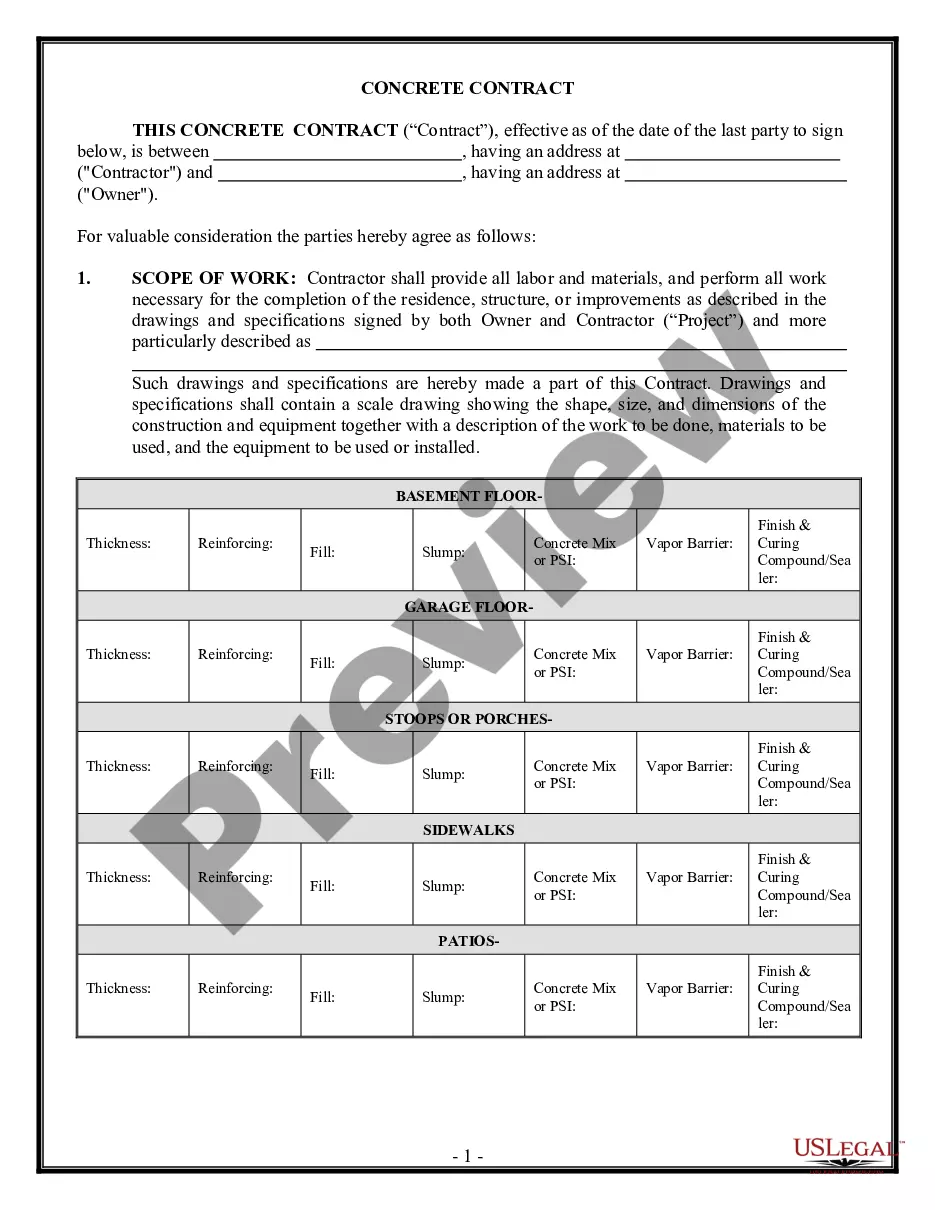

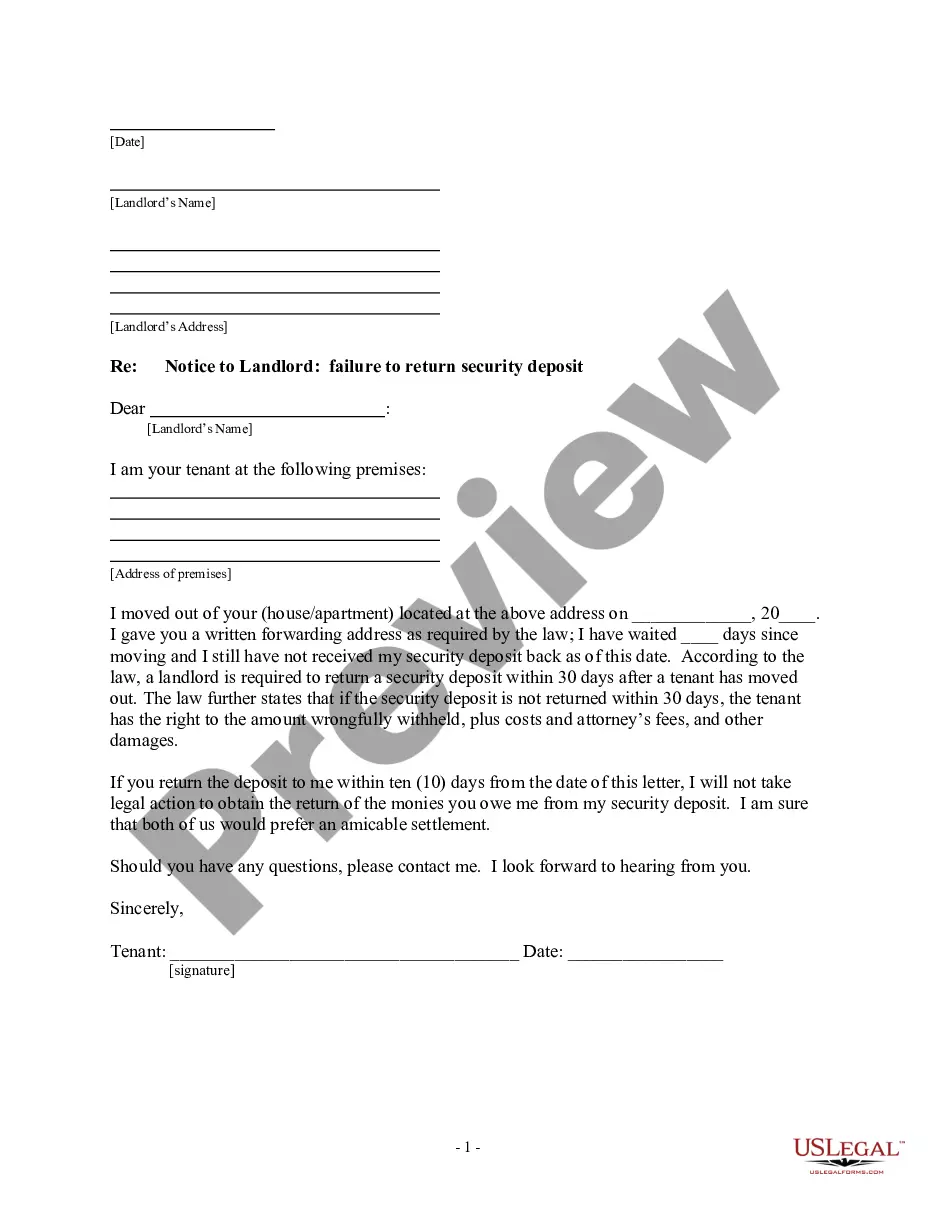

The Factoring Agreement editable formula in Philadelphia provides a structured legal framework for businesses looking to sell their accounts receivable to a factor. This form establishes a relationship between the Factor and the Client, where the Client assigns their accounts receivable to the Factor in exchange for immediate funds. Key features include sections on the assignment of receivables, the rights and responsibilities of both parties, credit approvals, and the calculation of the purchase price. Users are advised to fill in specific details such as names, addresses, and percentages related to commissions and fees, ensuring clarity and compliance. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants in facilitating quick liquidity for businesses. It is designed to be straightforward, with clear instructions for filling out and editing, catering to those with varying levels of legal knowledge. The versatility of the form makes it applicable in various scenarios, from small businesses seeking financial support to larger corporations optimizing their cash flow.

Free preview

Form popularity

FAQ

To be deductible, factoring fees must meet the IRS criteria of being ordinary and necessary expenses for the business. If the fees are deemed excessive or unnecessary, they may not be fully deductible.

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)

Average factoring costs fall between 1% and 5% depending on the factors above. Volume plays a huge part in calculating factoring rates.