Agreement General Form With Collateral In Philadelphia

Description

Form popularity

FAQ

The Borrower-In-Custody (BIC) of collateral arrangement allows collateral to be maintained at the pledging institution rather than being delivered to the Federal Reserve Bank (FRB) or a third-party custodian. Typically, BIC arrangements are used to facilitate pledging large volumes of loans evidenced by instruments.

Most performing or investment-grade assets held by depository institutions are acceptable as collateral. Reserve Banks require a perfected security interest in all collateral pledged to secure Discount Window loans. Reserve Bank staff can offer guidance on other types of collateral that may be acceptable.

Contract financing is ideal for businesses that need to complete bigger projects to scale and grow, especially for those who do not have assets that would traditionally be used to secure funding. In this case, the contracted work serves as the collateral necessary to be approved for the funding.

Contract financing uses open contracts you have as collateral to approve you for funding. Those contracts also then determine the amount of funding you're approved for. It's similar to invoice factoring in that the advance is based on your customer's creditworthiness, not yours.

These agreements allow the secured party to perfect a security interest in collateral posted by the pledgor while ensuring that, in the event of the bankruptcy or insolvency of the secured party, such collateral will not become a part of the secured party's estate and will, to the extent owed to the pledgor, be ...

Non-Transferable Assets: Assets that are legally restricted from being transferred, such as government benefits, social security payments, or certain insurance policies, cannot be used as collateral since they cannot be seized or sold.

Suppose you agree to rent an apartment. The lease agreement you sign with the landlord is the main contract. However, your landlord promises to fix the toilet drainage. Therefore, this is the collateral contract.

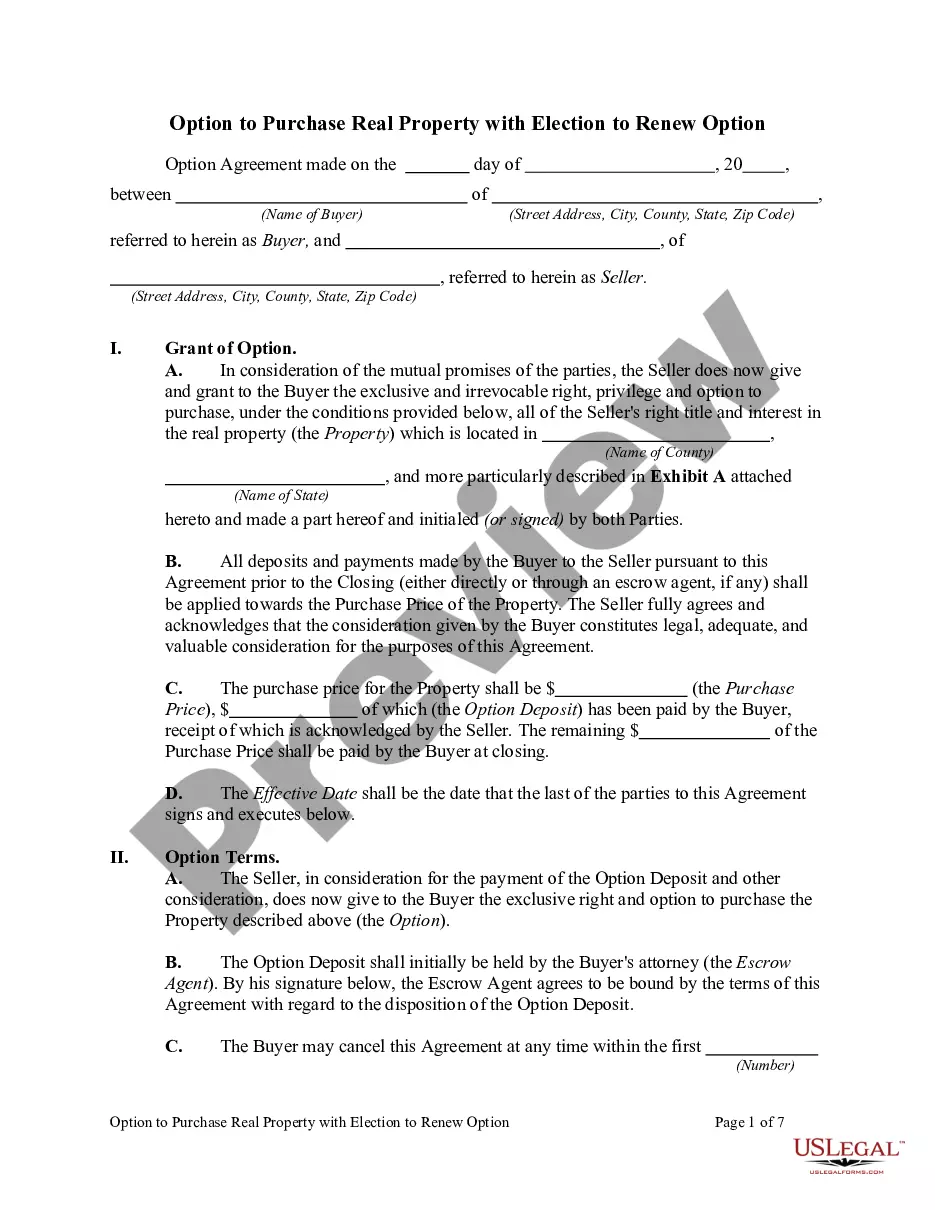

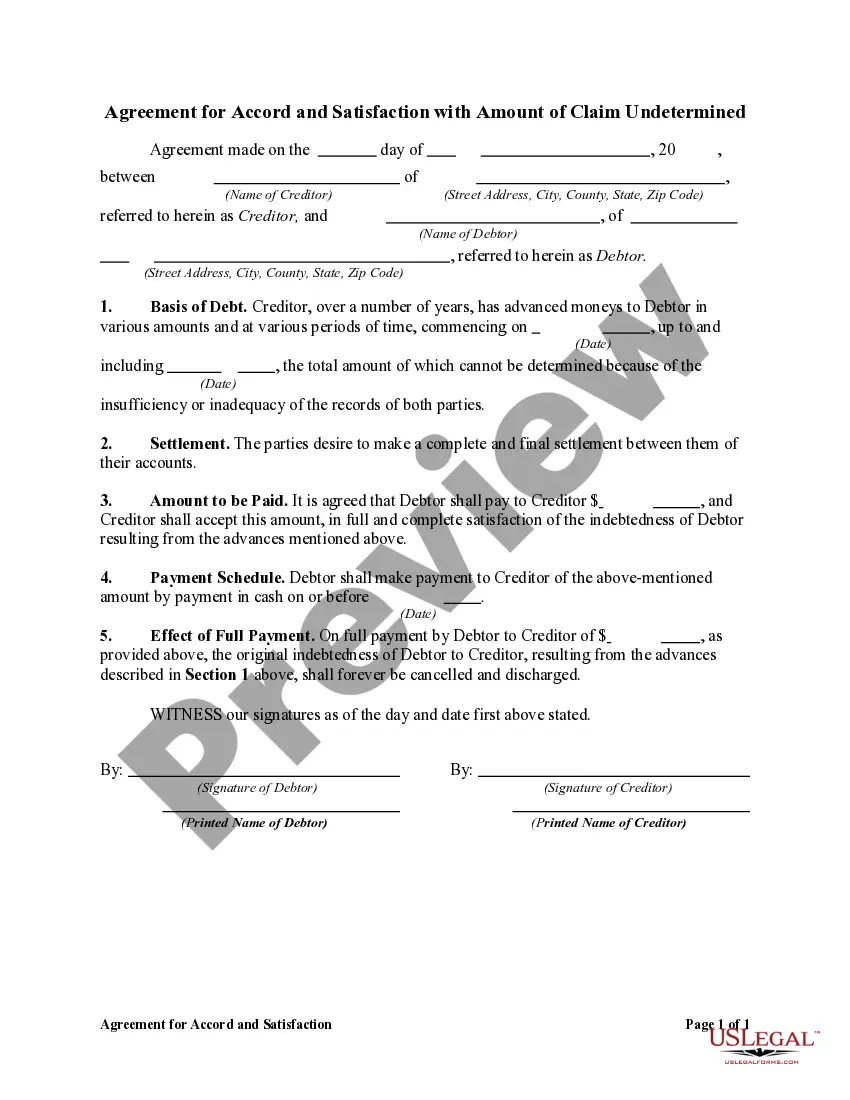

A Security Agreement, also known as a Collateral Agreement or Pledge Agreement, gives to a lender or other party a security interest in property that a debtor or obligor owns.

The Federal Reserve determines the collateral value of pledged loans as the product of their fair market value estimate and a margin designed to protect the Federal Reserve from financial loss.

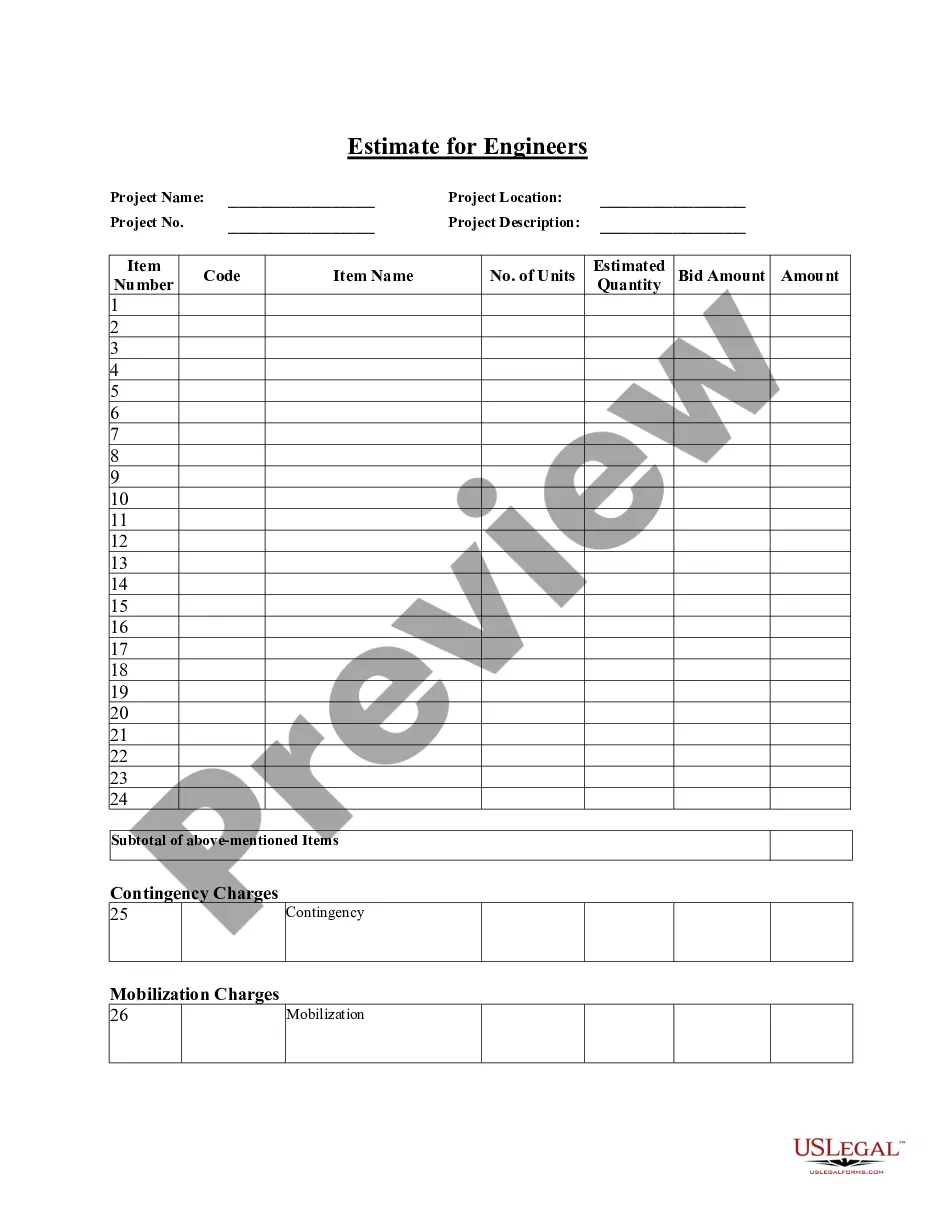

Treasury Collateral Management & Monitoring - Forms. TCMM.