Factoring Agreement Document For Business In Palm Beach

Description

Form popularity

FAQ

A factoring agreement involves three key parties: The business selling its outstanding invoices or accounts receivable. The factor, which is the company providing factoring services. The company's client, responsible for making payments directly to the factor for the invoiced amount.

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

The factoring agreement will also include representations that each factored account is bona fide and represents indebtedness incurred by the customer for goods actually sold and delivered to the customer; that there are no setoffs, offsets, or counterclaims against the account; that the account does not represent a ...

The parties to the agreement are the parties that assume the obligations, responsibilities, and benefits of a legally valid agreement. The contract parties are identified in the contract, which includes their names, addresses, and contact information.

Who Are the Parties to the Factoring Transaction? Factor: It is the financial institution that takes over the receivables by way of assignment. Seller Firm: It is the firm that becomes a creditor by selling goods or services. Borrower Firm: It is the firm that becomes indebted by purchasing goods or services.

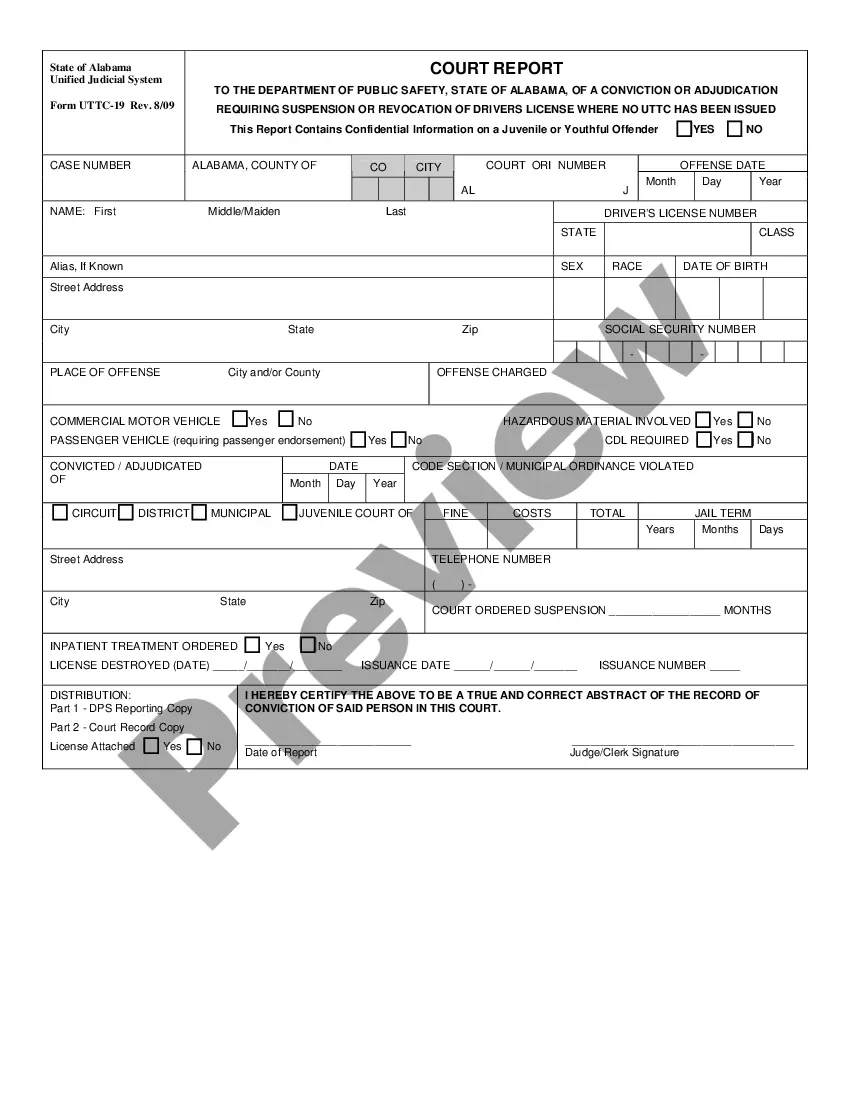

Another document required for factoring is an accounts receivable aging report. This report lists out unpaid invoices, credit memos, and notes by date. Accounts receivable aging reports may also be referred to as a schedule of accounts receivable or just a schedule.

The Most Common Invoice Factoring Requirements A factoring application. An accounts receivable aging report. A copy of your Articles of Incorporation. Invoices to factor. Credit-worthy clients. A business bank account. A tax ID number. A form of personal identification.

Factoring companies will typically run a background check. While less-than-perfect backgrounds can be approved for factoring, certain violent or financial crimes may be disqualifying.