Agreement Accounts Receivable With Credit Card Processing In Palm Beach

Description

Form popularity

FAQ

PCI compliance standards require merchants and other businesses to handle credit card information in a secure manner that helps reduce the likelihood that cardholders would have sensitive financial account information stolen.

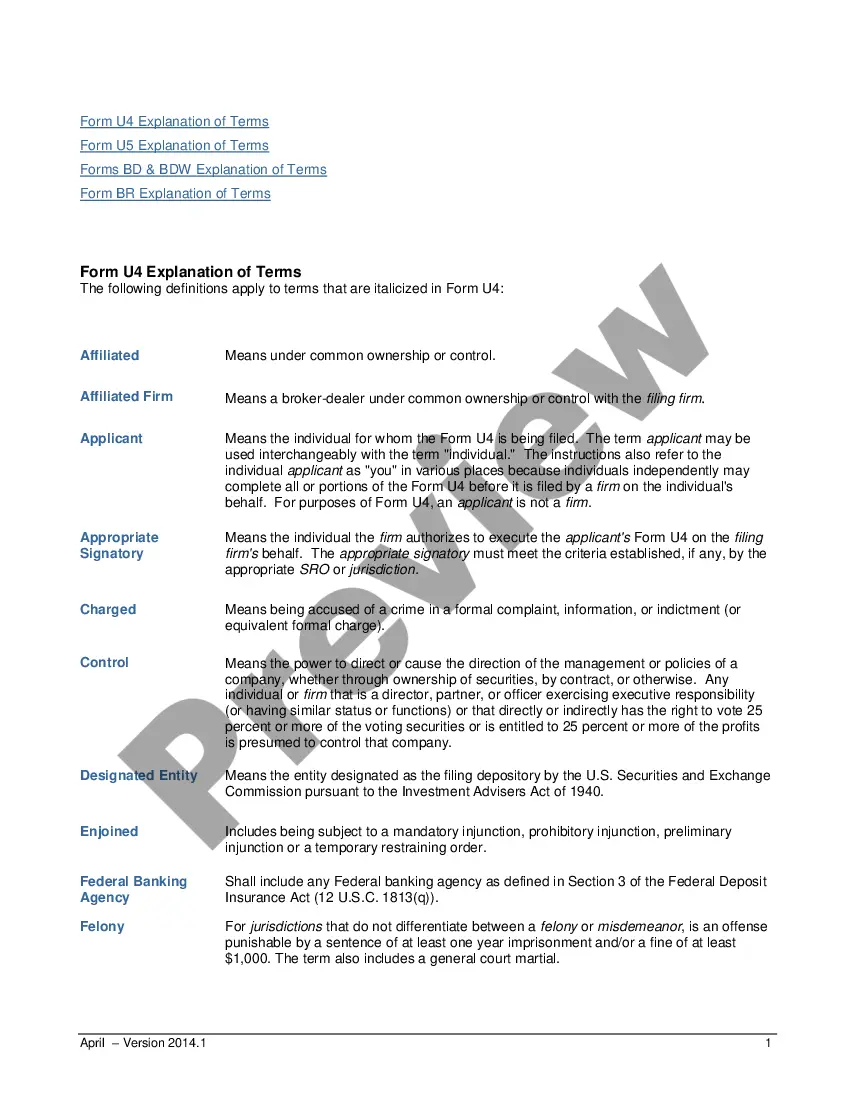

A cardholder agreement is a legal document outlining the terms under which a credit card is offered to a customer. Among other provisions, the cardholder agreement states the annual percentage rate (APR) of the card, as well as how the card's minimum payments are calculated.

Merchant Card Receivables: Amounts owed by banking companies for sales of goods, services, and/or special functions from credit companies. This account will be used for all credit card sales regardless of the credit card company involved.

A credit card's terms and conditions officially document the rules and guidelines of the agreement between a credit card issuer and a cardholder. Common terms and conditions include the fees, interest rate, and annual percentage rate carried by the credit card.

Cardholder Agreement – A cardholder agreement is a legal document which includes the terms of your credit card, including the Annual Percentage Rate (APR) of the card, how the credit card company calculates your minimum payments, what any fees are, and more.

Your credit card statement (available online or by mail) gives you a recap of your account activity. A credit card statement often includes categories like your available credit, amount due, due date, credit score, and transaction history.

Physical credit authorization forms have many security issues: They may get lost, stolen, or mishandled by employees. Having to type data manually may lead to errors and financial discrepancies. Physical forms are not encrypted, meaning anyone can read and understand the information.

While no license or permit is required to accept credit card payments from customers, there are a number of things you should be mindful of, particularly if your business has been incorporated with a name which is not the same as yours. The first thing you must do is establish a business bank account.