Factoring Agreement Online Formula In Oakland

Description

Form popularity

FAQ

There are three parties directly involved in a transaction involving a factor: The first party is the company selling its accounts receivables. The second party is the factor that purchases the receivables.

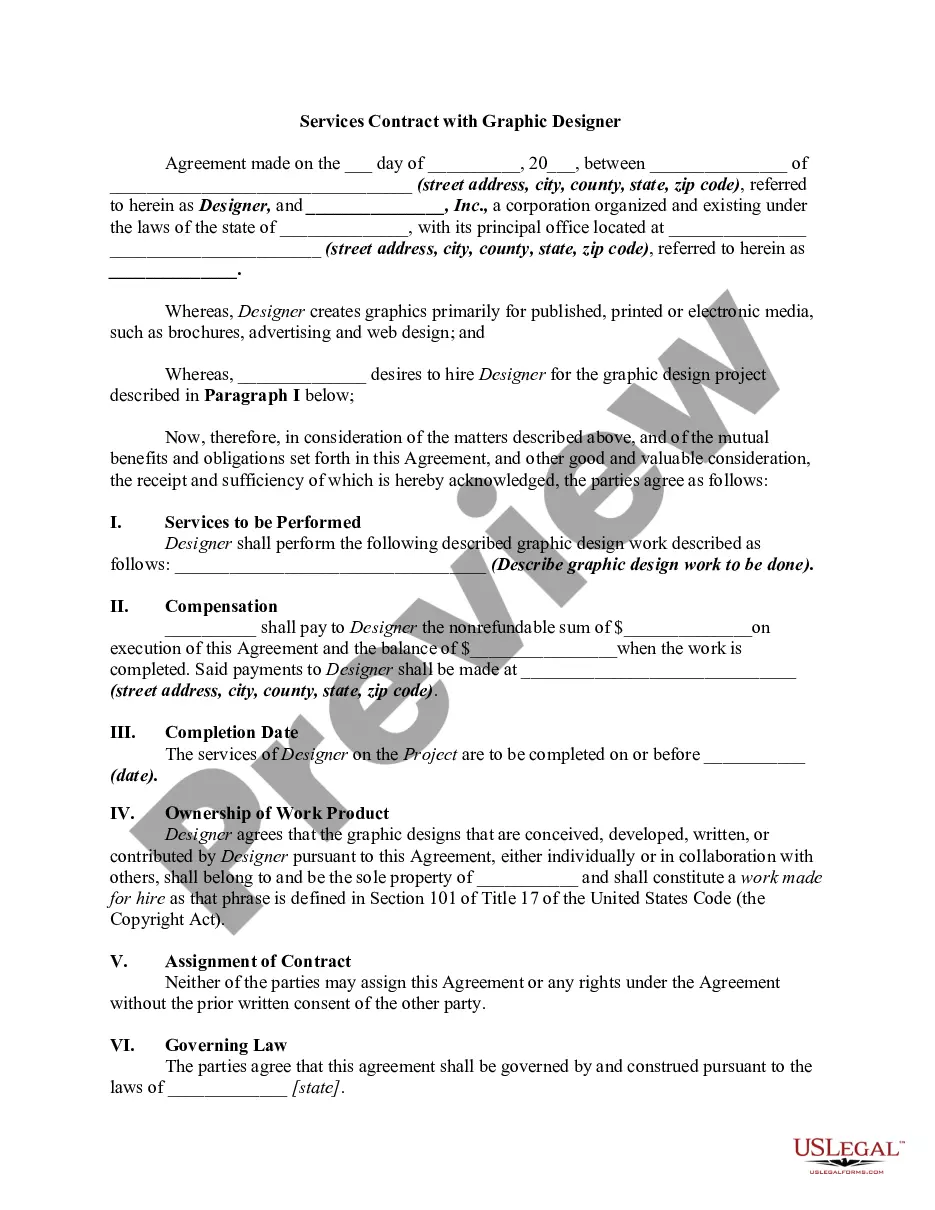

The parties to the agreement are the parties that assume the obligations, responsibilities, and benefits of a legally valid agreement. The contract parties are identified in the contract, which includes their names, addresses, and contact information.

This is the most common system of international factoring and involves four parties i.e., Exporter, Importer, Export Factor in exporter's country and Import Factor in Importer's country.

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

In order for the injured worker to qualify for this benefit, the injured employee must have sustained permanent disability, the injured employee must not have been able to return to work within 60 days after temporary disability ended, and the employer must have failed to timely offer modified or alternative work.

Average Workers' Comp Payouts by Injury Type 55% range between $2,000 and $20,000. 13% fall between $20,001 and $40,000. 12% are within $40,001 and $60,000. 8% range from $60,001 to $100,000.

How to Start Factoring: The Process Explained Complete the application process. First, you'll get your account setup. Submit invoices to factor. Now you're approved and ready to send your invoices to the factor. The factor collects from your customers. The factor releases the reserve.

Invoice factoring can be a good option for business-to-business companies that need fast access to capital. It can also be a good choice for those who can't qualify for more traditional financing.

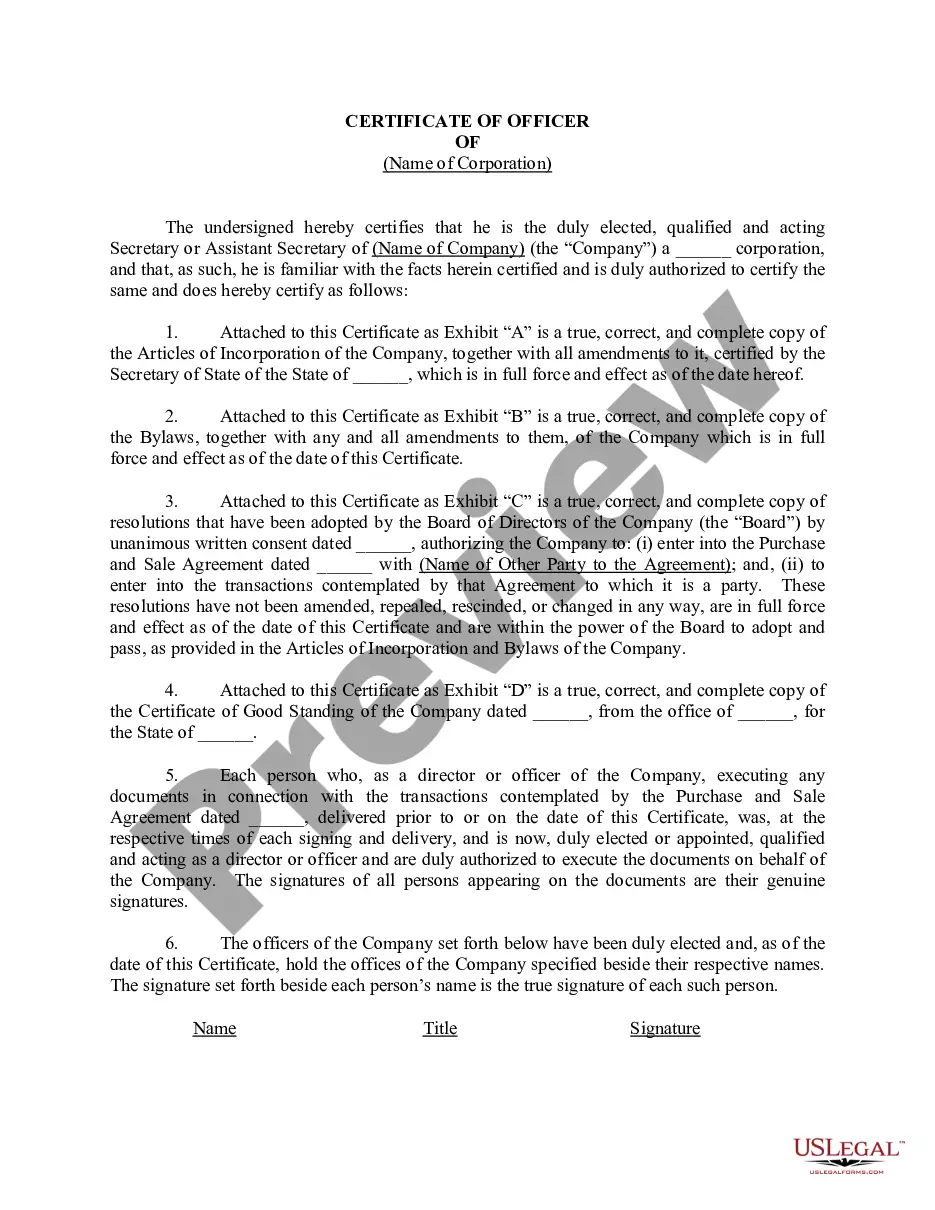

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)