Agreement Accounts Receivable With Balance Sheet Example In Oakland

Description

Form popularity

FAQ

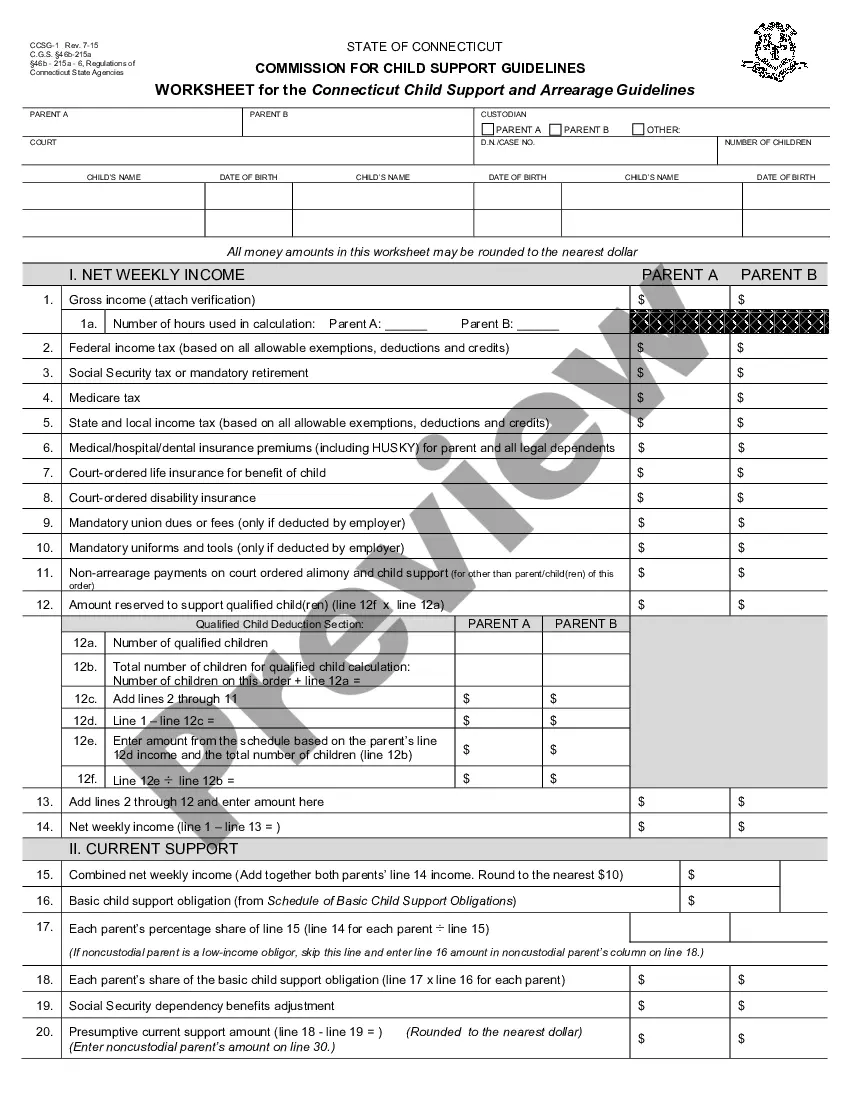

An account receivable is recorded as a debit in the assets section of a balance sheet.

To report accounts receivable effectively on the balance sheet: Break down accounts receivable into categories, such as “trade accounts receivable” and “other receivables.” Clearly indicate the aging of accounts receivable to show how much is current, 30, 60, or 90+ days overdue.

Accounts Receivables are current assets on the balance sheet and are to be reported at net realizable value.

To forecast accounts receivable, divide DSO by 365 for a daily collection rate. Multiply this rate by your sales forecast to estimate future accounts receivable. This method helps predict the amount you can expect to receive over a specific period.

Accounts receivable are listed under the current assets section of the balance sheet and typically fluctuate in value from month to month as the company makes new sales and collects payments from customers.

The amount that is receivable will be recorded as a debit to the assets. These entries balance each other out.

What is the 10 rule for accounts receivable? The 10 Rule for accounts receivable suggests that businesses should aim to collect at least 10% of their outstanding receivables each month.

Generally, receivables are divided into three types: trade accounts receivable, notes receivable, and other accounts receivable.

For example, a software company that provides a monthly service might invoice its clients at the end of the month, leading to an accounts receivable entry until the invoice is settled.

Accounts receivable are listed under the current assets section of the balance sheet and typically fluctuate in value from month to month as the company makes new sales and collects payments from customers.