Agreement Form Assignment Purchase With Credit Card In Minnesota

Description

Form popularity

FAQ

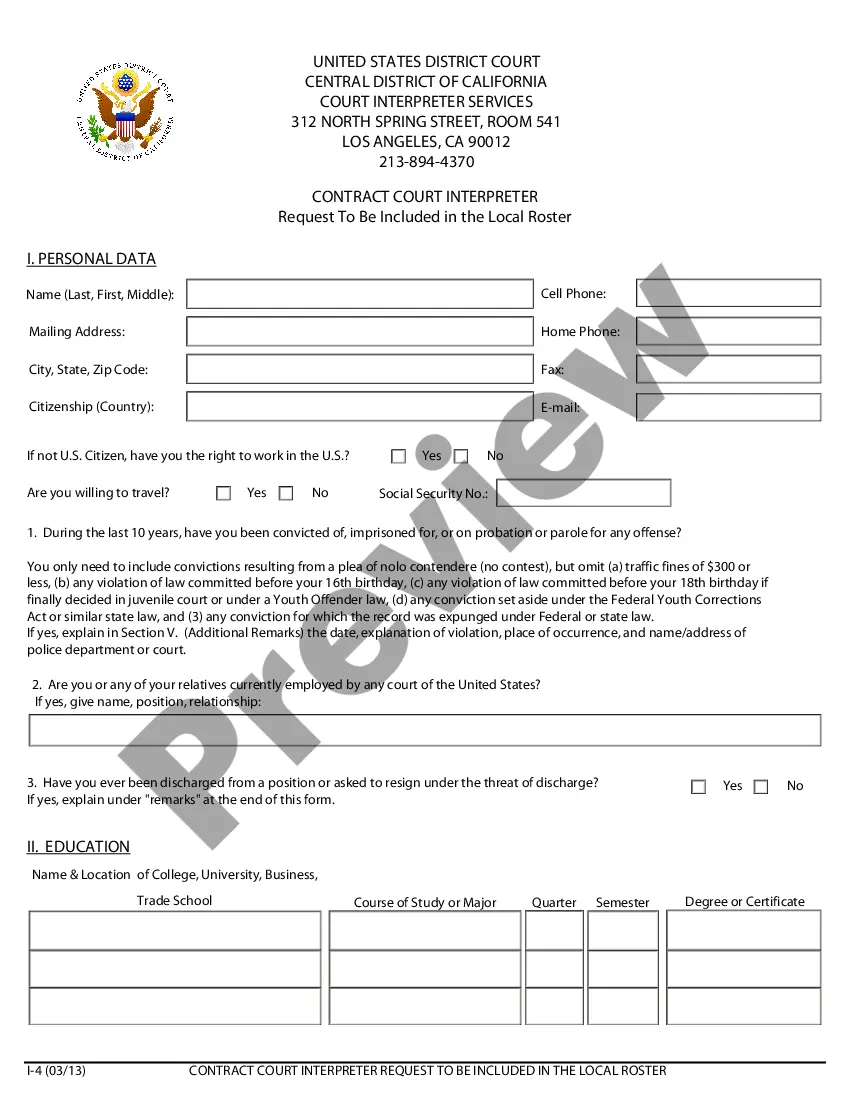

How to write a letter of agreement Title the document. Add the title at the top of the document. List your personal information. Include the date. Add the recipient's personal information. Address the recipient. Write an introduction paragraph. Write your body. Conclude the letter.

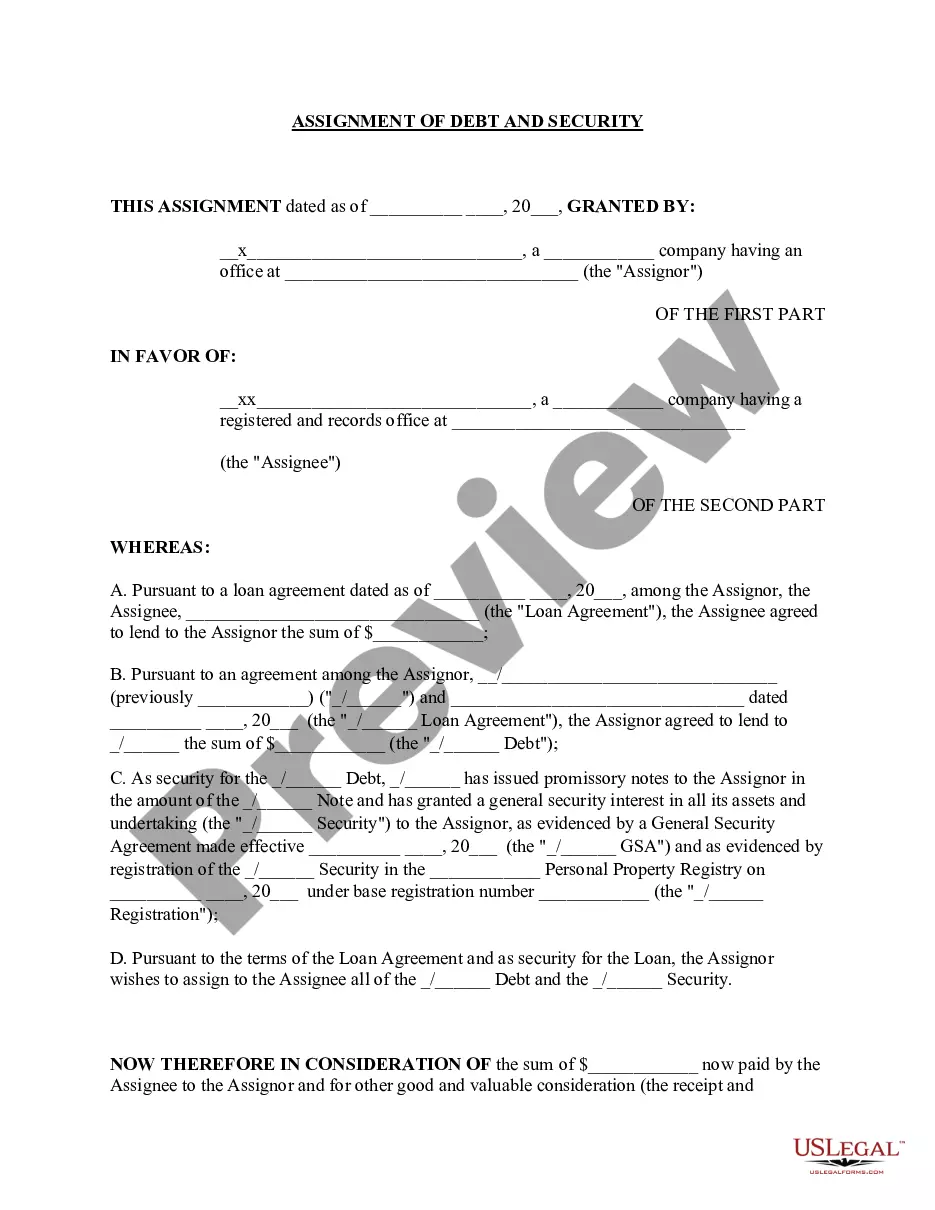

Also, to enhance its enforceability, it is advisable to have the assignment agreement witnessed or notarized, depending on the jurisdiction's legal requirements. Additionally, maintaining a record of the executed contract is essential for future reference and as evidence of the assignment.

Some credit cards include language that the card is not considered valid until signed, and merchants can require signatures, if they choose. But an EMV chip is far more effective than a signature in helping merchants fight credit card fraud.

Yes, you need to sign a credit agreement for it to be valid.

Cardmembers have the option to sign the back of their credit cards. Most credit card networks no longer require credit card signatures. This is mainly because of modern credit card security advancements.

However, Minnesota does have a Three-Day Cooling-Off Law (more formally known as the Home Solicitation Sales Act) for home solicitation sales. The law applies to the rental, lease or sale of goods or services for household or personal use, and also property improvements.

When a transaction is covered by the Three-Day Cooling-Off Law, you have three business days to cancel the contract.

Include the names of the grantor. And Grant T. As well as a description of the property. BeingMoreInclude the names of the grantor. And Grant T. As well as a description of the property. Being transferred once the form is completed it must be signed by the grantor in the presence of a notary.

Once the seller provides proper notice, the three business days' right to cancel begins to run. The Three-Day Cooling-Off Law does not apply when you buy a vehicle.