Form Assignment Accounts Receivable For Your Business In King

Description

Form popularity

FAQ

Where Do I Find a Company's Accounts Receivable? Accounts receivable are recorded on a company's balance sheet. Because they represent funds owed to the company (and that are likely to be received), they are booked as an asset.

AI is making a big difference in accounts payable (AP) and accounts receivable (AR) by improving efficiency, accuracy, and decision-making. It handles tasks like smart invoice processing, automated approvals, and predictive analytics. This means your financial operations run smoother, and your business can grow faster.

How to Implement AR Automation Step 1: Consult with all stakeholders. Step 2: Clearly explain the goals of the switch. Step 3: Integrate accounting software. Step 4: Automate payment reminders. Step 5: Select and connect payment options. Step 6: Reconcile and report.

A basic schedule of accounts receivable consists of at least three columns. These columns include the name of the account or customer with an outstanding balance, the balance total and the current balance or amount the customer still owes.

What is the 10 rule for accounts receivable? The 10 Rule for accounts receivable suggests that businesses should aim to collect at least 10% of their outstanding receivables each month.

You can find your accounts receivable balance under the 'current assets' section on your balance sheet or general ledger. Accounts receivable are classified as an asset because they provide value to your company.

Accounts receivable (AR) refers to the system of tracking, following through, and recording payments owed to your business for services or products already delivered. Accounts receivable automation (or AR automation) applies digital technology to the low-value, manual tasks that comprise accounts receivable.

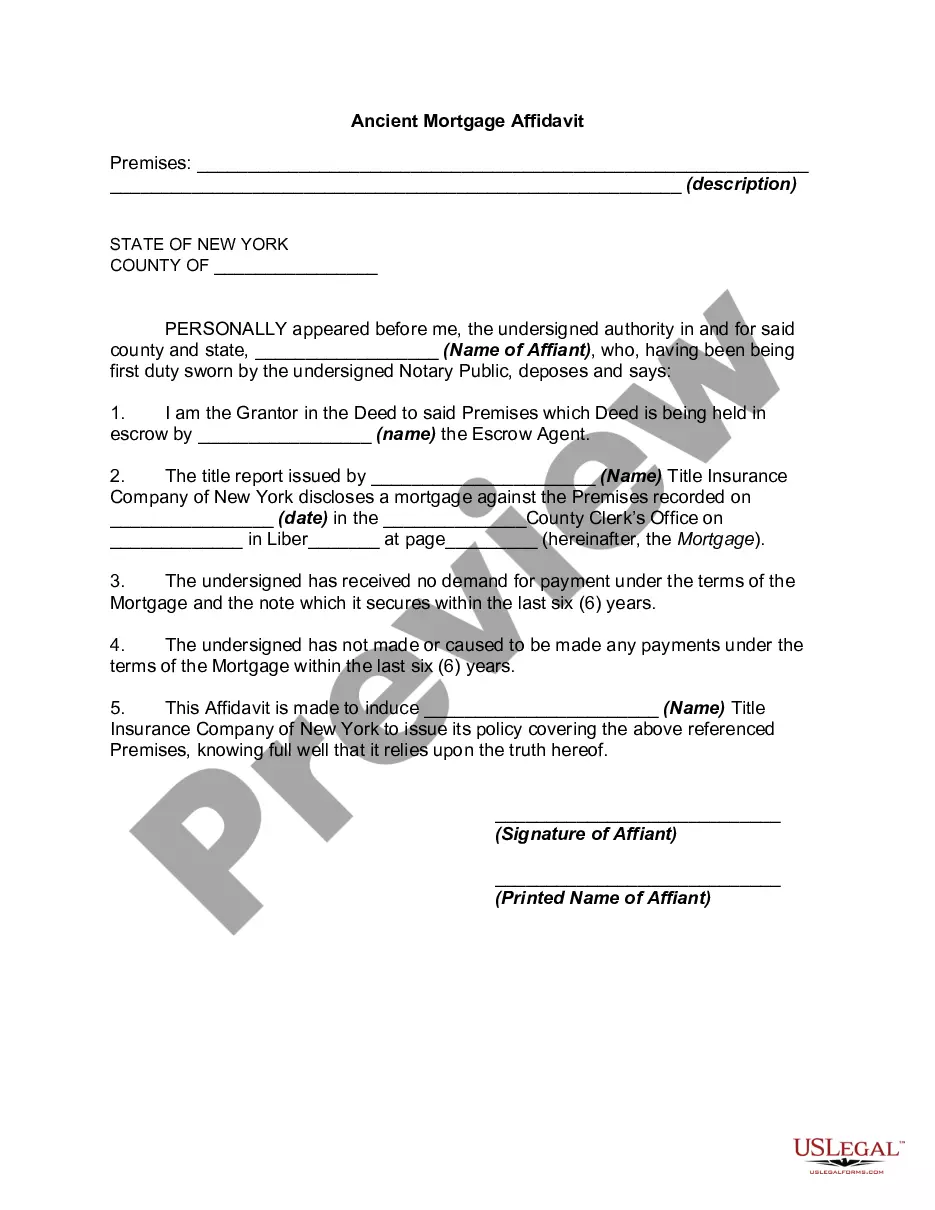

In contracts to which the Regulations apply, a term has "no effect to the extent that it prohibits or imposes a condition or other restriction on the assignment of a receivable by a party to the contract”. In other words, any prohibitions or restrictions on the assignment of receivables will be legally ineffective.

The mere exchange of consents between the assignor and the assignee is sufficient to give rise to the contract for the assignment of the receivable, the consent of the debtor not being necessary for its performance.

Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables. This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.