Form Assignment Accounts For Bank Loan In King

Description

Form popularity

FAQ

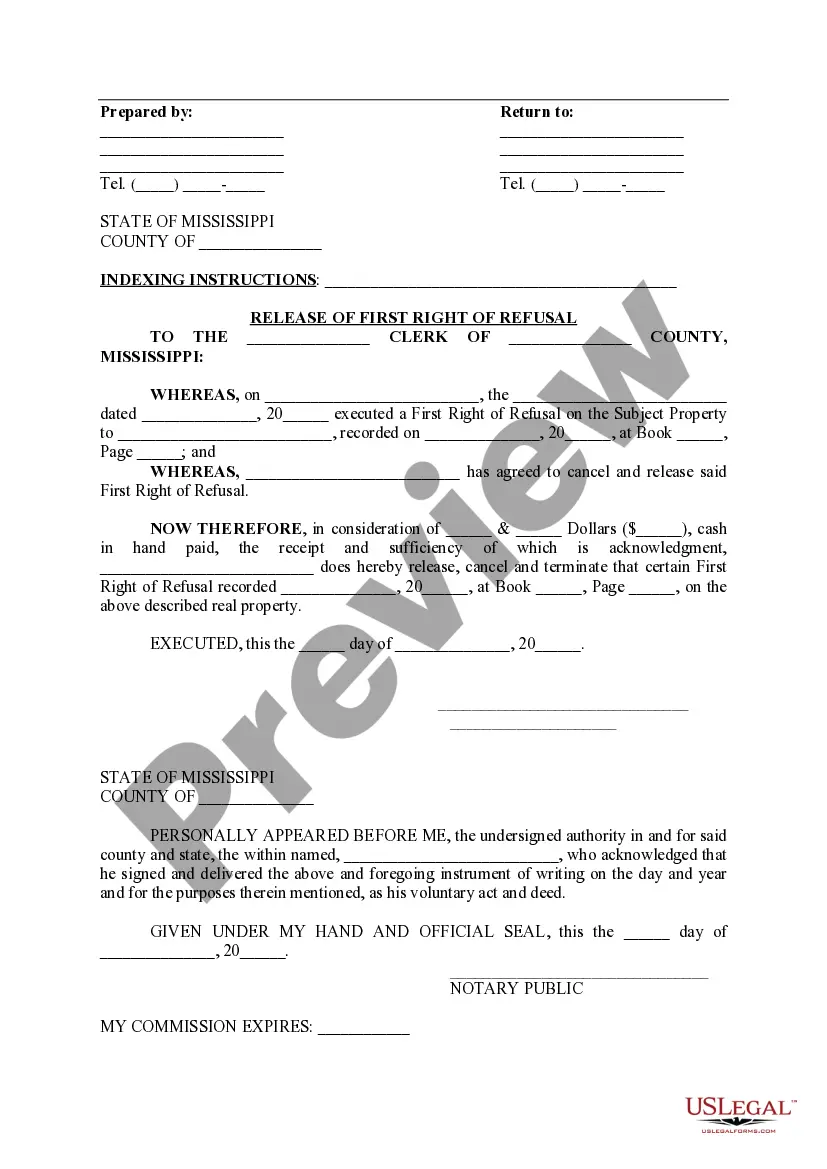

The assignment of loans essentially involves transferring rights and obligations from one party to another. Governed primarily by the Law of Property Act 1925, this act requires assignments to be in writing and signed by the assignor, ensuring the transfer is legally binding and enforceable.

Understanding an Assignment of Personal Property At its most basic, an assignment of personal property is a document or a portion of a document that assigns your interests in personal property to someone else. The assignment is often meant to take place at a point in the future, such as after you pass away.

The assignor must agree to assign their rights and duties under the contract to the assignee. The assignee must agree to accept, or "assume," those contractual rights and duties. The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

And public records. Let's get started Are banks required by law to provide small business loansMoreAnd public records. Let's get started Are banks required by law to provide small business loans banks are not legally obligated to provide small business loans.

Do student loans get deposited into your bank account? Typically, student loans do not get deposited in your bank account. Instead, the loans are disbursed directly to the school where it is applied to tuition payments and room and board.

Assignment is a transfer of rights or property from one party to another. Options assignments occur when option buyers exercise their rights to a position in a security. Other examples of assignments can be found in wages, mortgages, and leases.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically when the security interest attaches.

A lender can perfect a lien on a borrower's deposit account only by obtaining "control" over the account, which requires one of the following arrangements: (1) the borrower maintains its deposit account directly with the lender; (2) the lender becomes the actual owner of the borrower's deposit accounts with the ...