Form Assignment Accounts Receivable With Balance Sheet In Illinois

Description

Form popularity

FAQ

To report accounts receivable effectively on the balance sheet: Break down accounts receivable into categories, such as “trade accounts receivable” and “other receivables.” Clearly indicate the aging of accounts receivable to show how much is current, 30, 60, or 90+ days overdue.

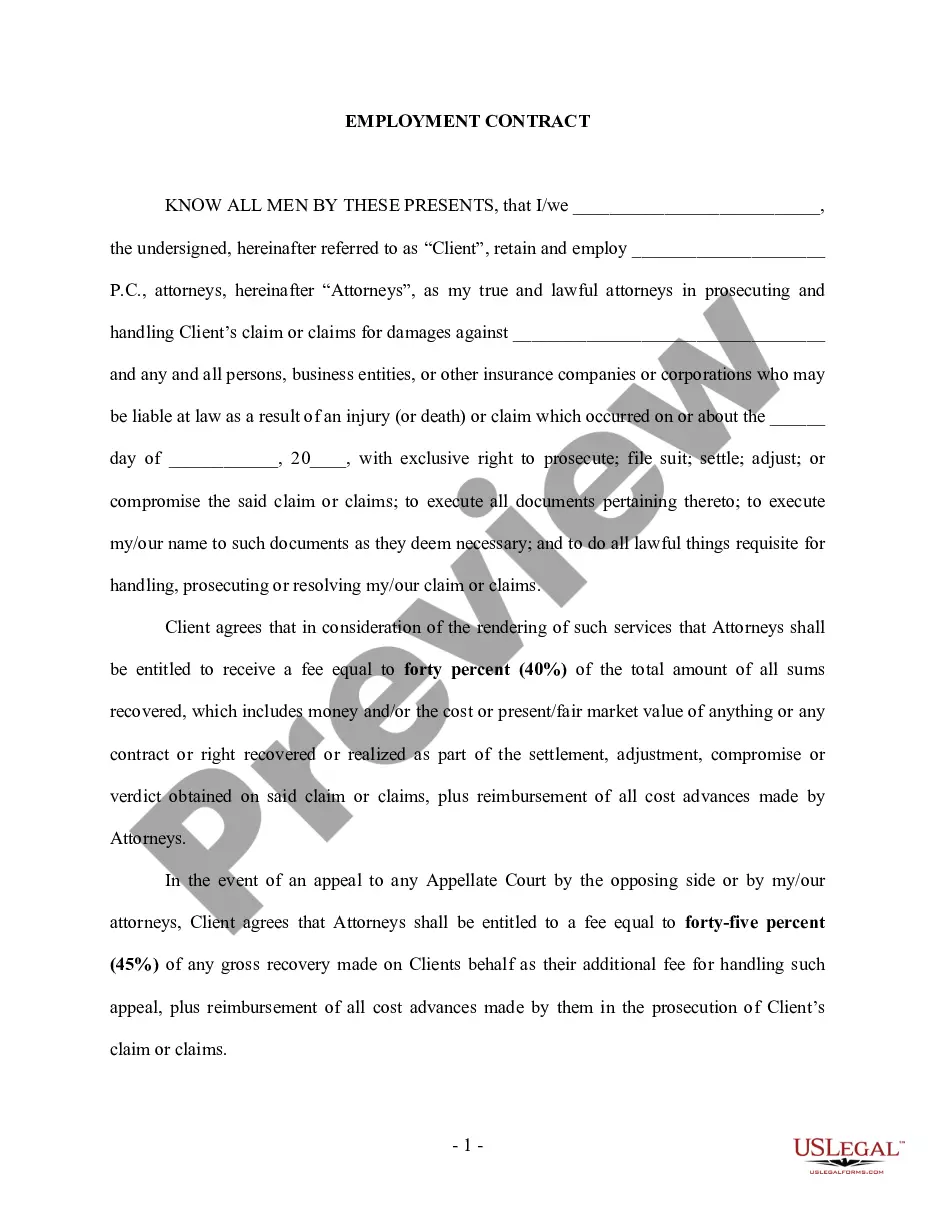

For example, if A contracts with B to teach B guitar for $50, A can assign this contract to C. That is, this assignment is both: (1) an assignment of A's rights under the contract to the $50; and (2) a delegation of A's duty to teach guitar to C.

Assignment in the context of a receivable means the transfer of rights related to it to another person or entity. For this purpose, an appropriate contract is usually concluded (although this is not a necessary condition).

An account receivable is recorded as a debit in the assets section of a balance sheet. It is typically a short-term asset—short-term because normally it's going to be realized within a year.”

Assignment of receivables would mean sale of the lease rentals, not the asset. In that case, the leased asset still remains the property of the assignor – that is, the assignor has retained the residual interest in the asset. However, it would be different if the lessor sells the asset that has been leased out.

Average accounts receivable is calculated as the sum of starting and ending receivables over a set period of time (generally monthly, quarterly or annually), divided by two.

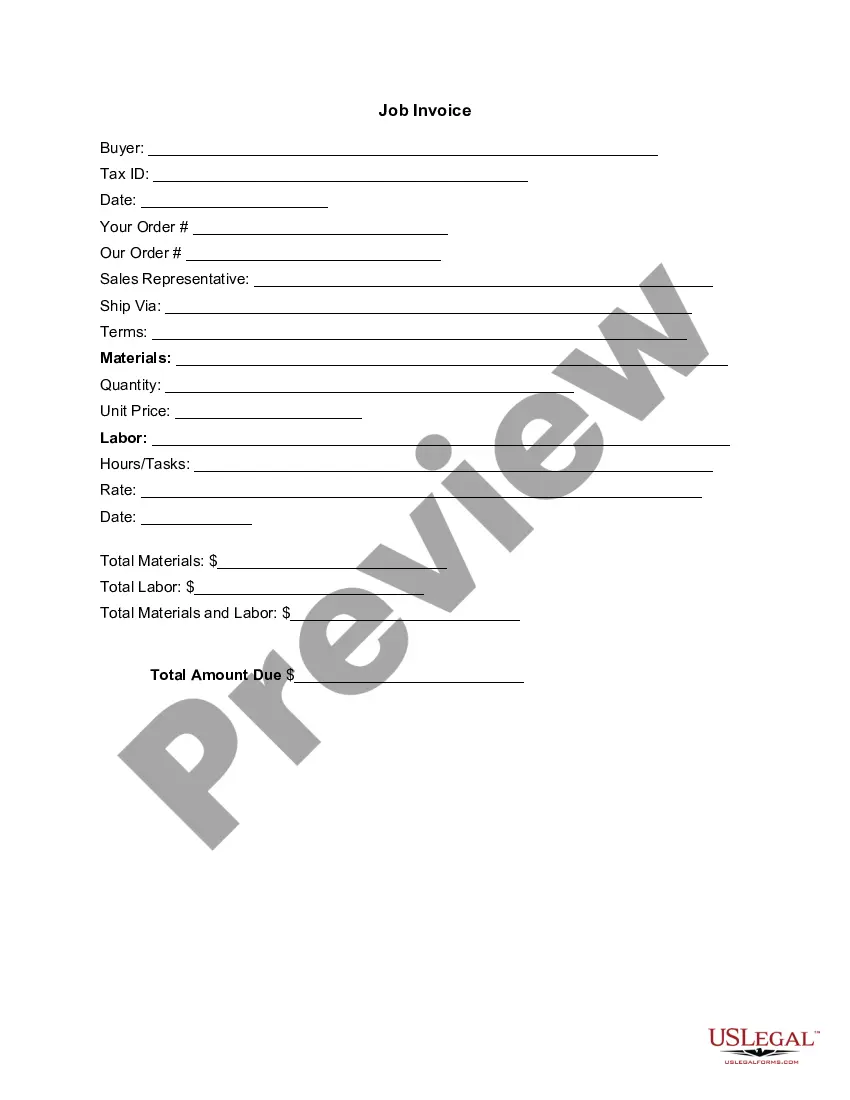

Follow these steps to calculate accounts receivable: Add up all charges. You'll want to add up all the amounts that customers owe the company for products and services that the company has already delivered to the customer. Find the average. Calculate net credit sales. Divide net credit sales by average accounts receivable.

Gross accounts receivable represents the total amount of outstanding invoices or the sum owed by customers. It's perhaps the easiest to calculate, too - you simply add up all the outstanding invoices at a given time!

To report accounts receivable effectively on the balance sheet: Break down accounts receivable into categories, such as “trade accounts receivable” and “other receivables.” Clearly indicate the aging of accounts receivable to show how much is current, 30, 60, or 90+ days overdue.