Factoring With Contract In Broward

Description

Form popularity

FAQ

6 best factoring companies AltLINE. Best for: General small businesses. FundThrough. Best for: Factoring invoices using accounting/invoicing software. RTS Financial. Best for: Trucking businesses. ECapital. Best for: Fast invoice factoring. Scale Funding. Best for: Flexible contracts. Riviera Finance.

RTS Financial: Best for trucking businesses. ECapital: Best for fast invoice factoring. Scale Funding: Best for flexible contracts. Riviera Finance: Best for non-recourse invoice factoring.

An invoice factoring company that has been in business longer has more experience and references to prove its worth. Working with a stable invoice financing company is important when it comes to helping your business grow. You need to work with a company with a reliable and robust track record in the finance industry.

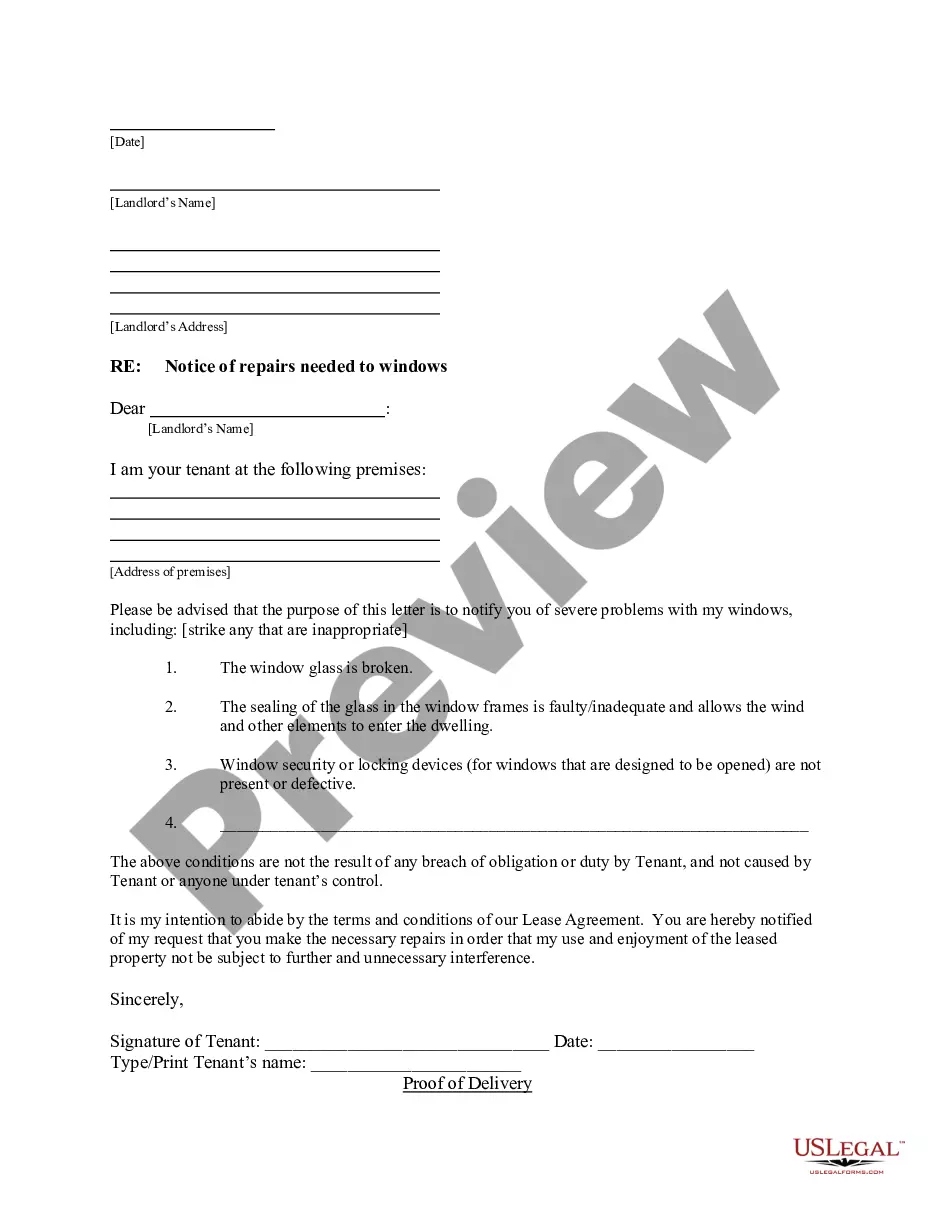

This will help you understand your rights and options. Contact the factoring company. Talk to the factoring company directly and explain the situation. Ask them why the release hasn't been issued yet and when you can expect it. Be polite and professional, but be firm in your request. Get everything in writing.

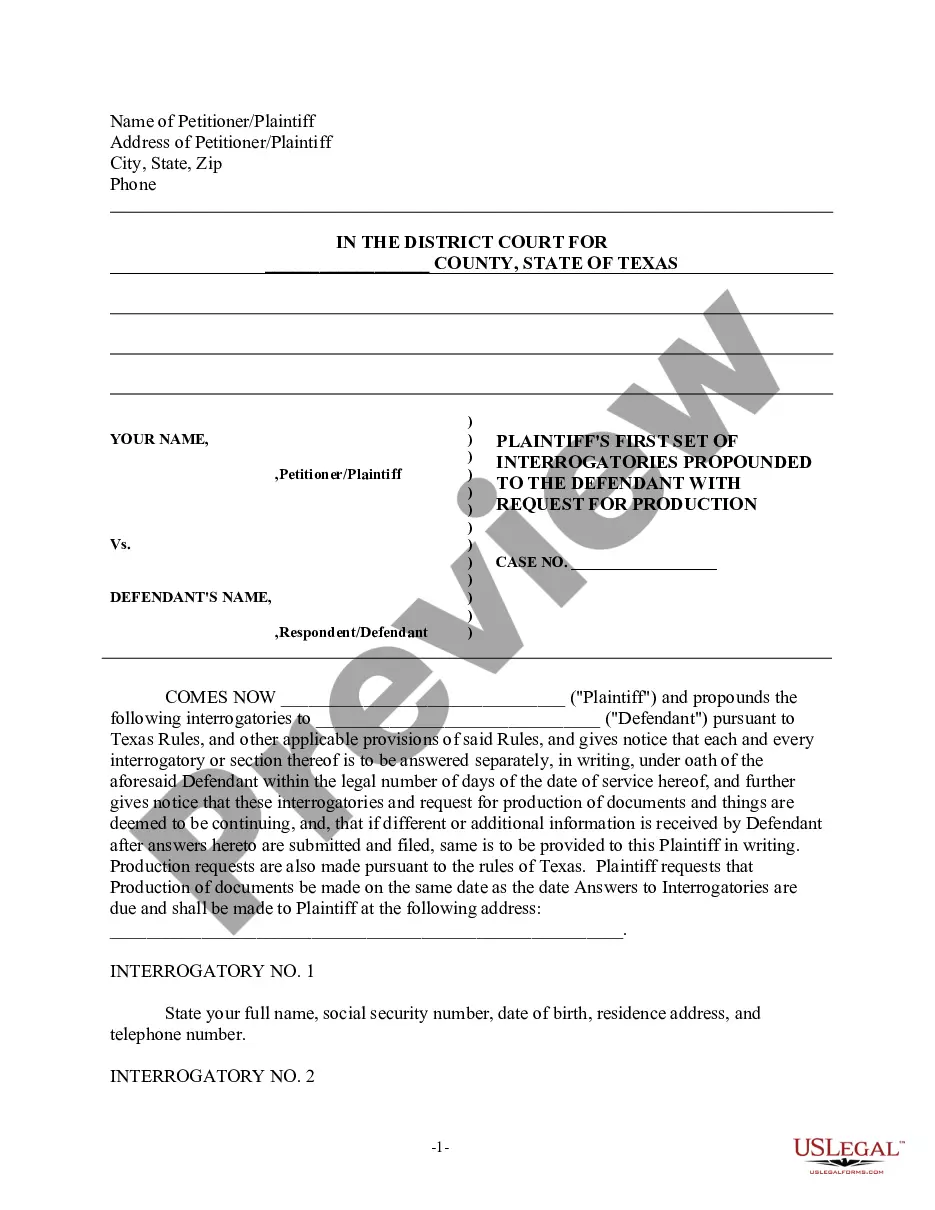

The IRS requires contractors to fill out a Form W-9, a request for a Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

Acceptance of an offer: After one party makes an offer, it's up to the other party to accept it. If someone offers you $600 to walk their dogs, for example, you enter into a contractual agreement the moment you accept their offer in exchange for your services.

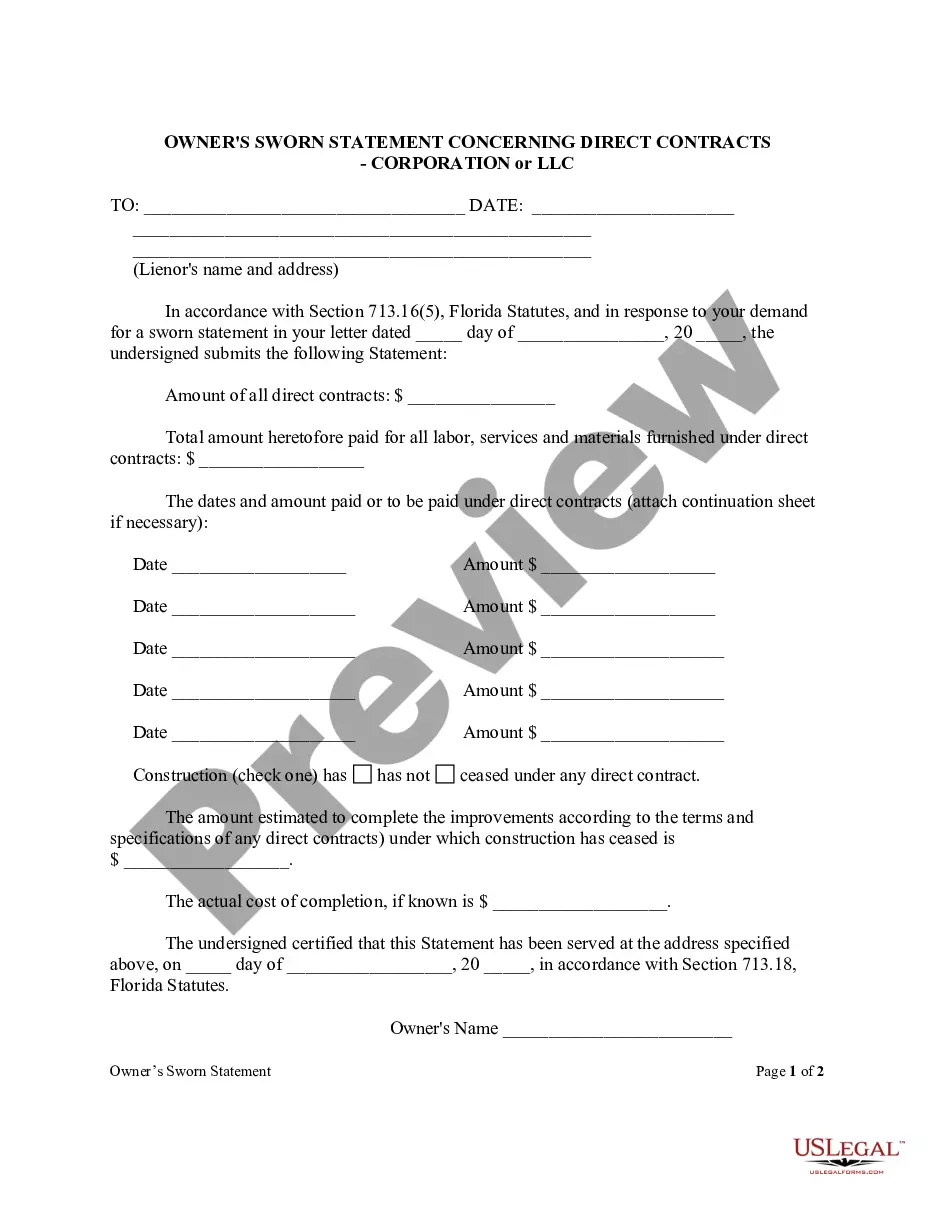

In order to qualify for factoring, your company will need to have the following items: Invoices to factor. Creditworthy clients. A completed factoring application – apply now. An accounts receivable aging report. A business bank account. A tax ID number. A form of personal identification.

In order to qualify for invoice factoring services, you need to provide proof that you have a legally documented business – which means you must have a copy of your Articles of Incorporation on hand. This proves the legitimacy of your business to the factoring company.