Factoring Agreement Meaning Forfaiting In Broward

Description

Form popularity

FAQ

Forfeited; forfeiting; forfeits. transitive verb. 1. : to lose or lose the right to especially by some error, offense, or crime.

Forfaiting is typically used for medium- to long-term financing solutions, while discounting is typically used for short-term financing solutions. Forfaiting is also typically used for high-value, capital goods transactions, while discounting can be used for a wider range of transactions.

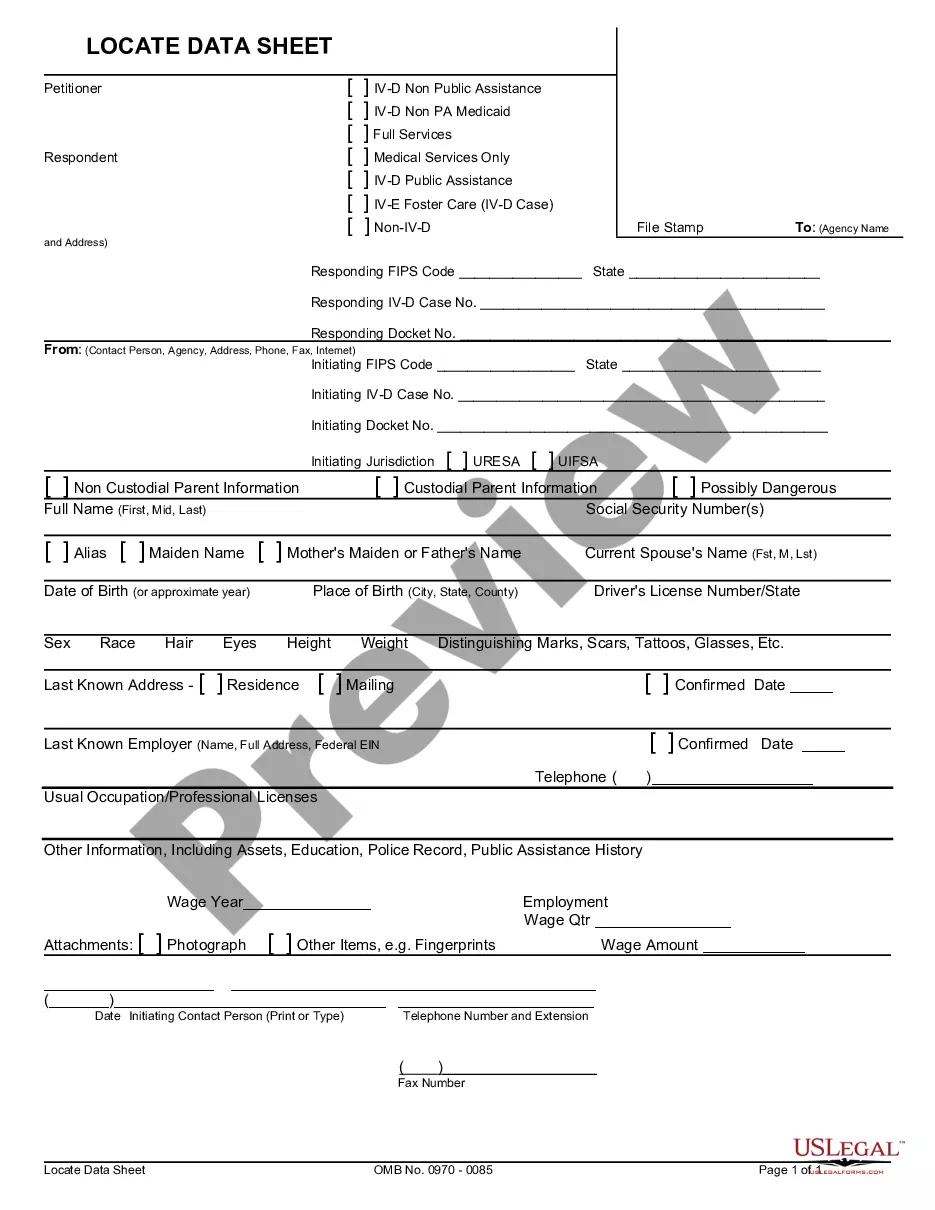

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

There are at least two parties to a contract, a promisor, and a promisee. A promisee is a party to which a promise is made and a promisor is a party which performs the promise. Three sections of the Indian Contract Act, 1872 define who performs a contract – Section 40, 41, and 42.

FACTORING IN A CONTINUING AGREEMENT - It is an arrangement where a financing entity purchases all of the accounts receivable of a certain entity.

Who Are the Parties to the Factoring Transaction? Factor: It is the financial institution that takes over the receivables by way of assignment. Seller Firm: It is the firm that becomes a creditor by selling goods or services. Borrower Firm: It is the firm that becomes indebted by purchasing goods or services.

A factoring agreement involves three key parties: The business selling its outstanding invoices or accounts receivable. The factor, which is the company providing factoring services. The company's client, responsible for making payments directly to the factor for the invoiced amount.

What is Process of Factoring? Factoring is a financial transaction in which a business sells its accounts receivable (invoices) to a third party, called a factor, at a discount.

Purpose: Factoring is typically used to obtain short-term financing, while forfaiting is used to manage long-term trade receivables. Types of assets: Factoring involves the sale of accounts receivable, while forfaiting involves the sale of trade receivables, such as promissory notes and bills of exchange.