Factoring Agreement Sample With Recourse In Bronx

Description

Form popularity

FAQ

Factoring Application Applications vary depending on the factor's needs, but most of them ask for things like business and personal phone numbers, email addresses, and business details. Applications also normally ask for your business' industry sector and your monthly invoicing volume.

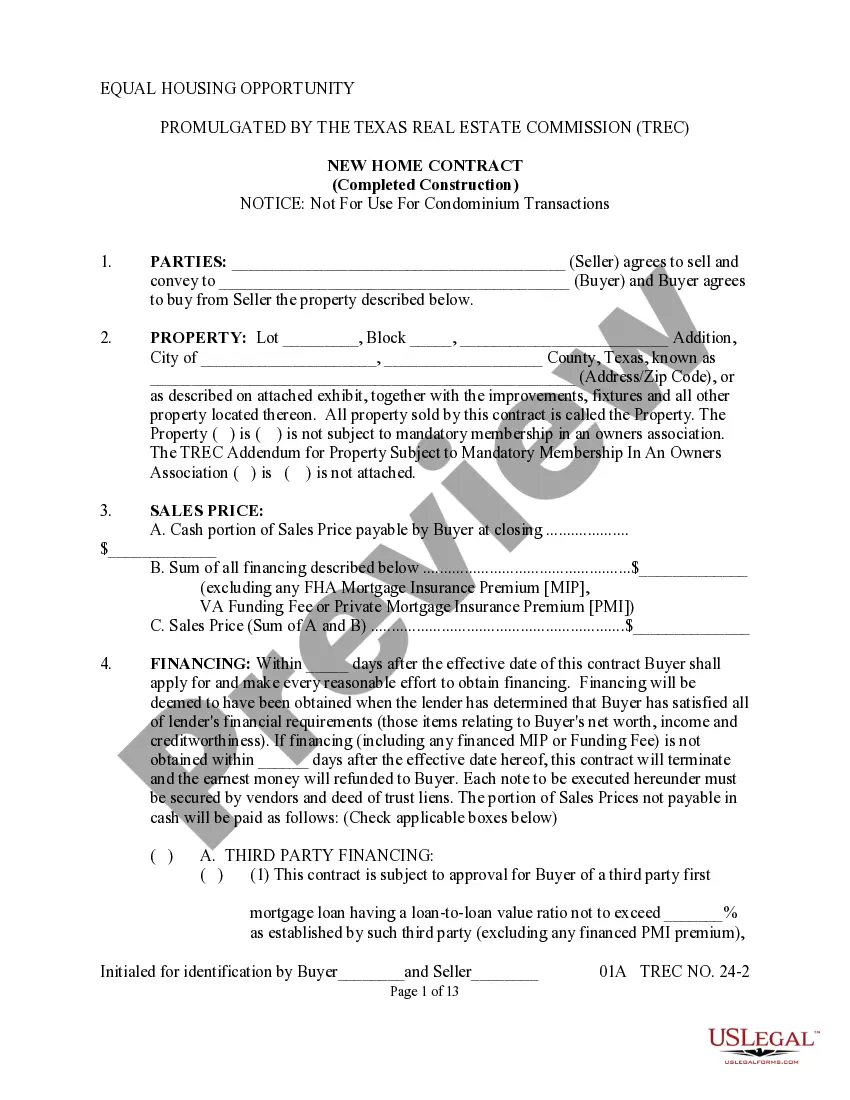

A factoring contract establishes the legal relationship between your business and the factor. It outlines the process for transferring invoices, clarifies who is responsible for collecting payments, and specifies whether the factor assumes the risk of bad debt.

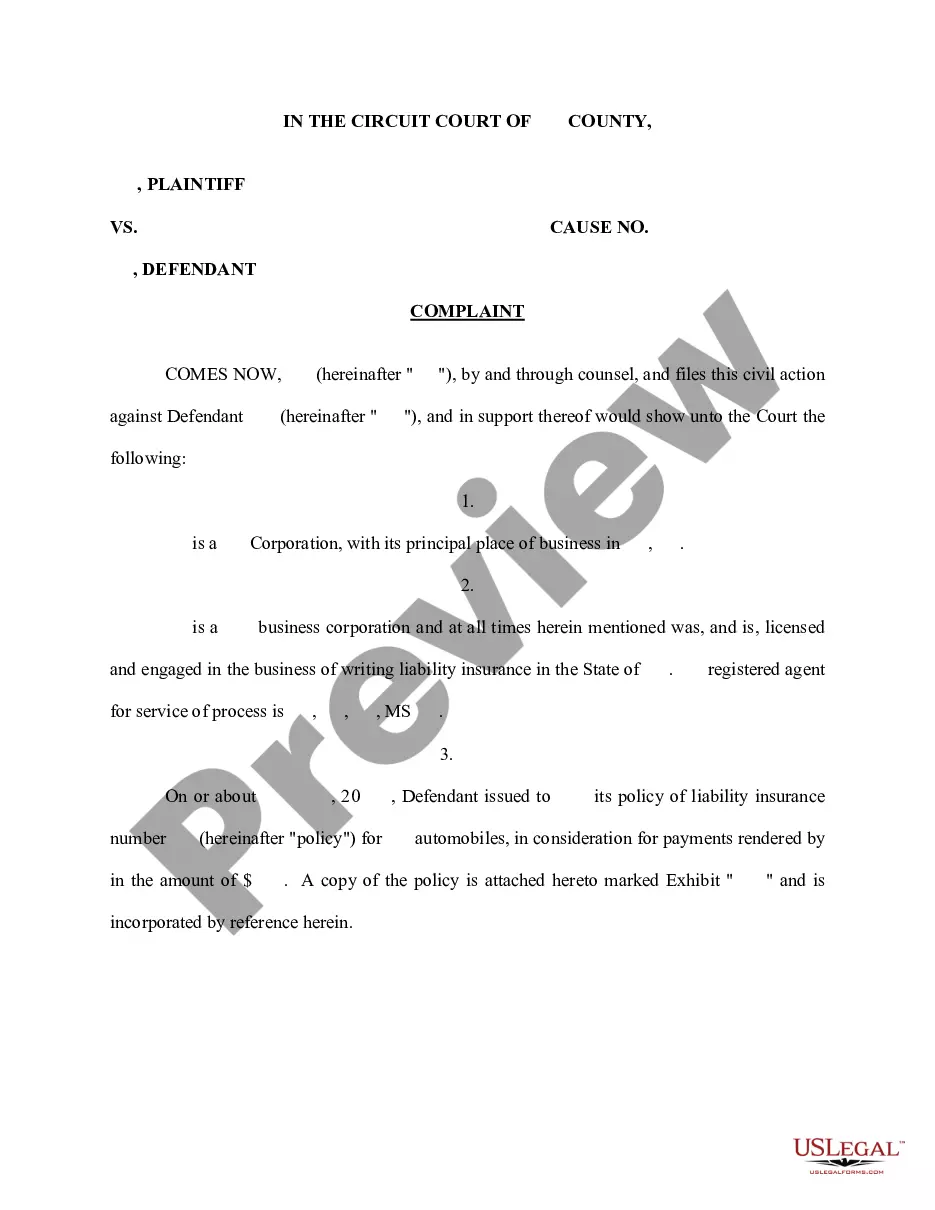

There are two types of debts: recourse and nonrecourse. A recourse debt holds the borrower personally liable. All other debt is considered nonrecourse. In general, recourse debt (loans) allows lenders to collect what is owed for the debt even after they've taken collateral (home, credit cards).