Form Assignment Accounts Receivable For Your Business In Bexar

Description

Form popularity

FAQ

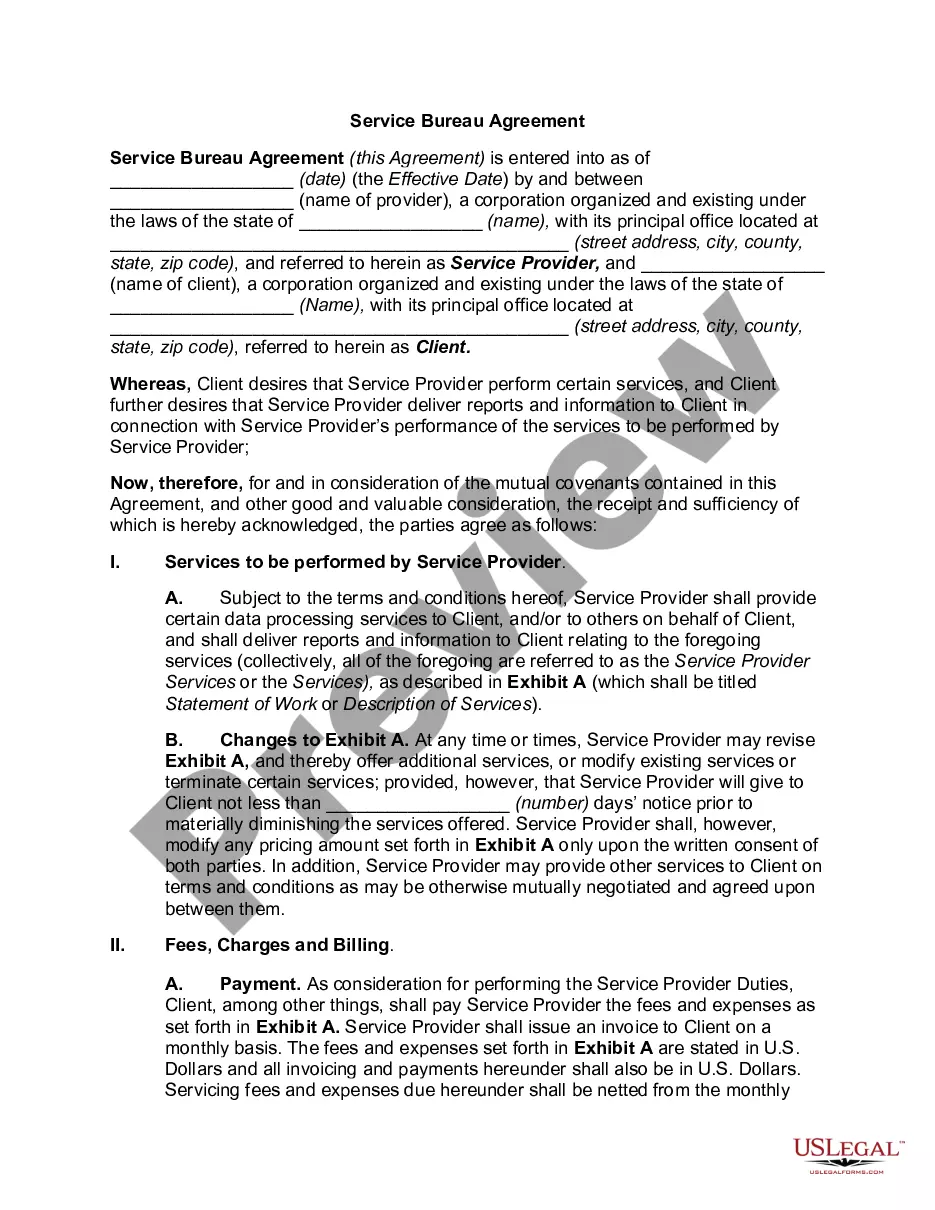

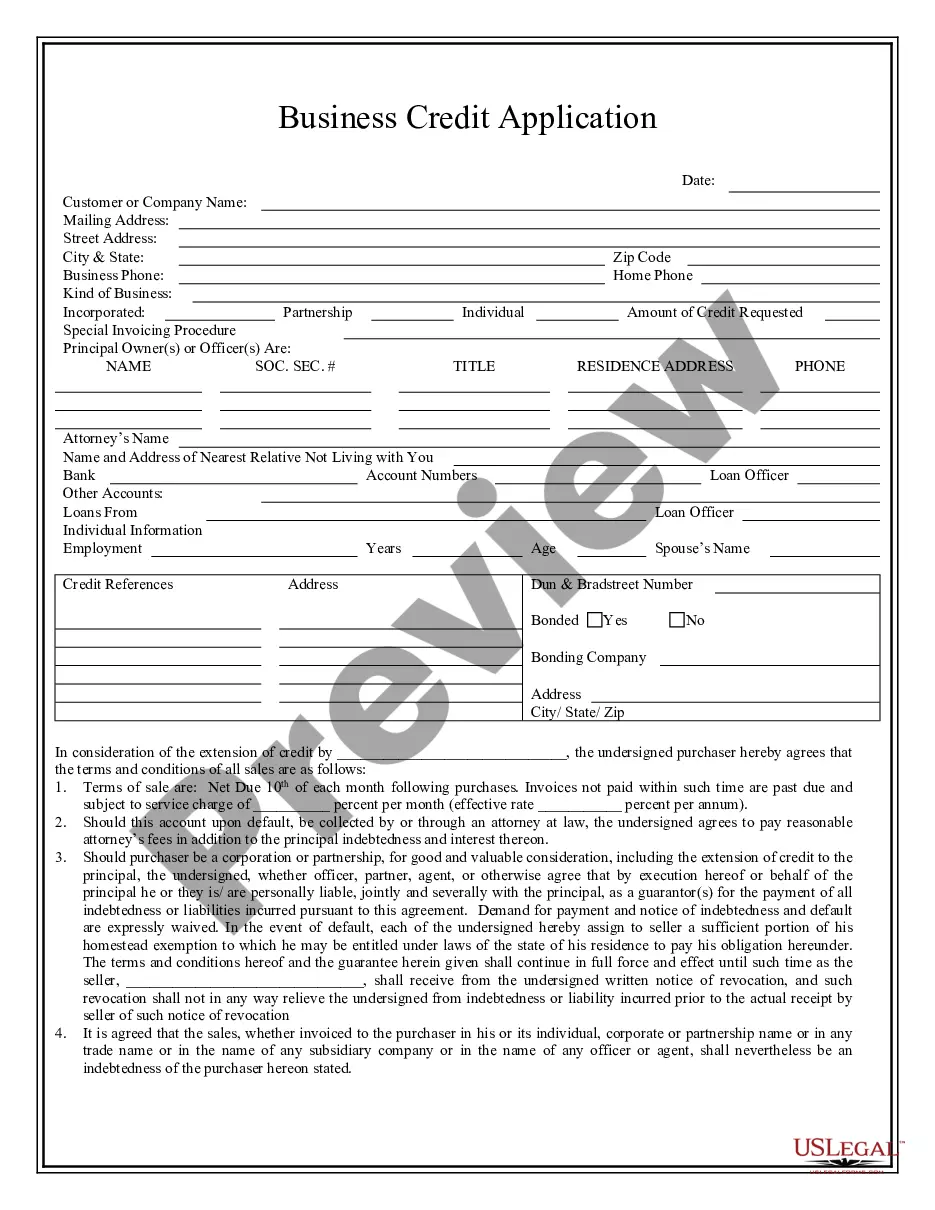

With factoring, the factor takes control of bill collection and assumes the credit risk for customer non-payment. In contrast, with the assignment of receivables, the business retains control of its customer relationships and the collection process, bearing all of the credit risk.

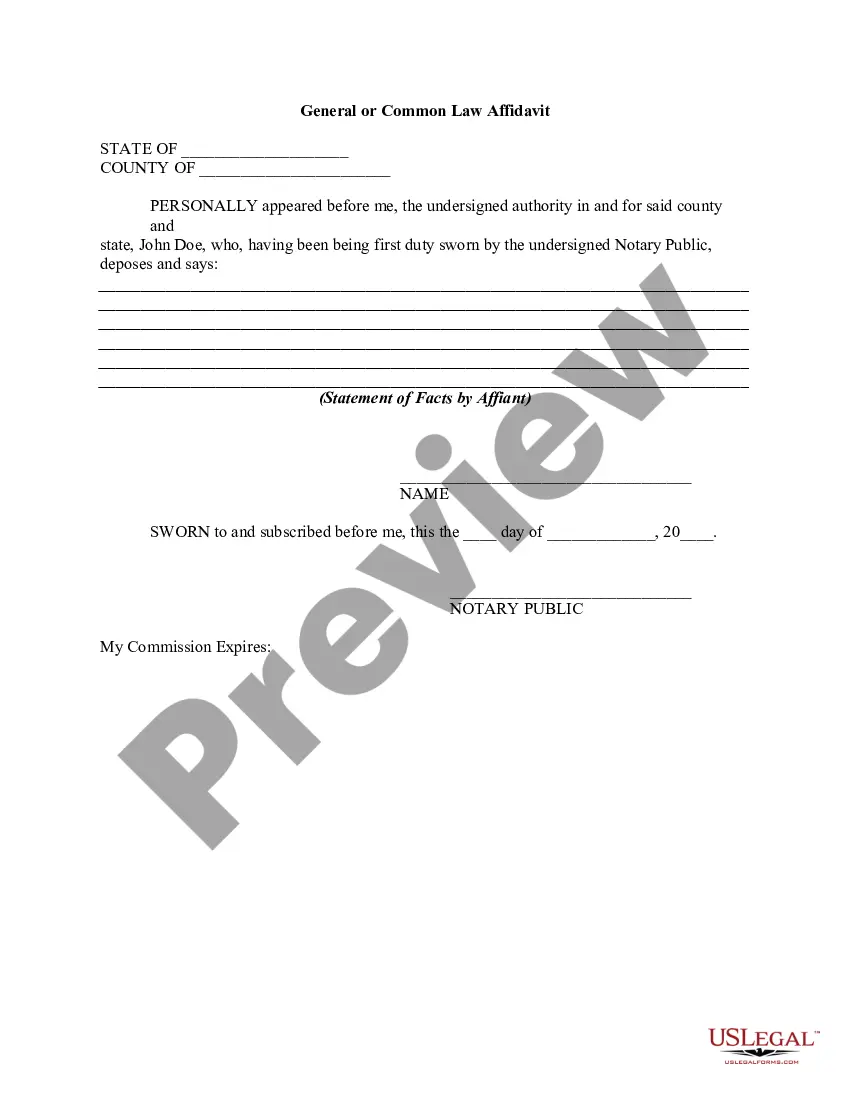

How do I register my business name or get an Assumed Name: Doing Business As (DBA)? Visit the Bexar County Clerk's office at the Bexar County Paul Elizondo Tower, next to the Courthouse to register the business name, 1st floor 101 W. Nueva (Notary public onsite) Call them at (210) 335-2223 or visit them on the web.

The Writ of Possession allows for the possession of the property, after a deputy has posted written notice notifying the tenant a writ has been issued. By law, we are required to give a minimum of 24 hours notice before enforcing the writ.

Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables. This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.

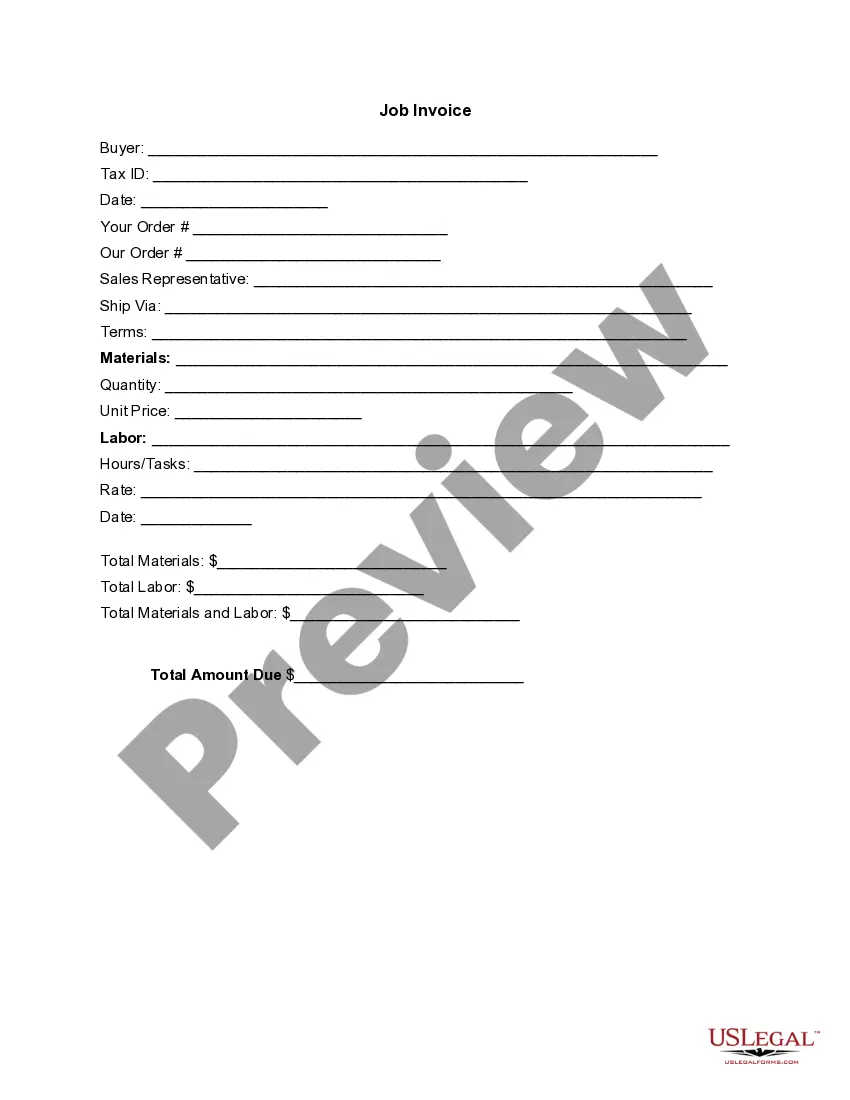

You can also calculate average accounts receivable by adding up the beginning and ending amount of your accounts receivable over a period of time and dividing by two.

Accounts receivable on a balance sheet are accounted for as a current asset representing amounts owed by customers for goods or services provided on credit, with their net realizable value reflecting the anticipated collectible amount.

To create a journal entry for accounts receivable, you can follow these steps: Record the details of each transaction. To create an accounts receivable journal entry, you enter the details of each financial transaction. Record the debit amount. Record the credit amount.

To report accounts receivable, gather information about outstanding amounts owed by customers, create an accounts receivable ledger, categorize the accounts by age, prepare a report that summarizes the outstanding amounts, analyze the report, and take action to collect payments and manage the balance.

The 10-Step Accounts Receivable Process Develop a Credit Application Process. Create a Collection Plan. Compliance with Consumer Credit Laws. Send Out Invoices. Choose an Accounts Receivable Management System. Track the Collection Process. Log All Charges and Expenses in Real-time. Incentivize Early Payment Discounts.