Factoring Agreement Online With English Subtitles In Alameda

Description

Form popularity

FAQ

To be deductible, factoring fees must meet the IRS criteria of being ordinary and necessary expenses for the business. If the fees are deemed excessive or unnecessary, they may not be fully deductible.

Leaving Your Current Factor You need to consider the fees associated with switching before committing to the change. Once you've decided to leave your current factor, you will need to give notice. All factoring companies require written notice to terminate the contract.

How To Get Out Of Factoring Check your factoring contract. Get some guidance. Identify your problems with factoring. Consider product migration. Plan any product migration. Take over the credit control function. Calculate the residual funding gap. Plan your funding migration.

Here are the common steps for switching factoring companies. Find a new factor. Create a game plan. Submit termination notice & confirm buyout eligibility date. Begin Buyout Process. Begin Invoice Audit & Budget for 3-5 Days of Holding Invoices. Sign Buyout Agreement & Upload New Invoices.

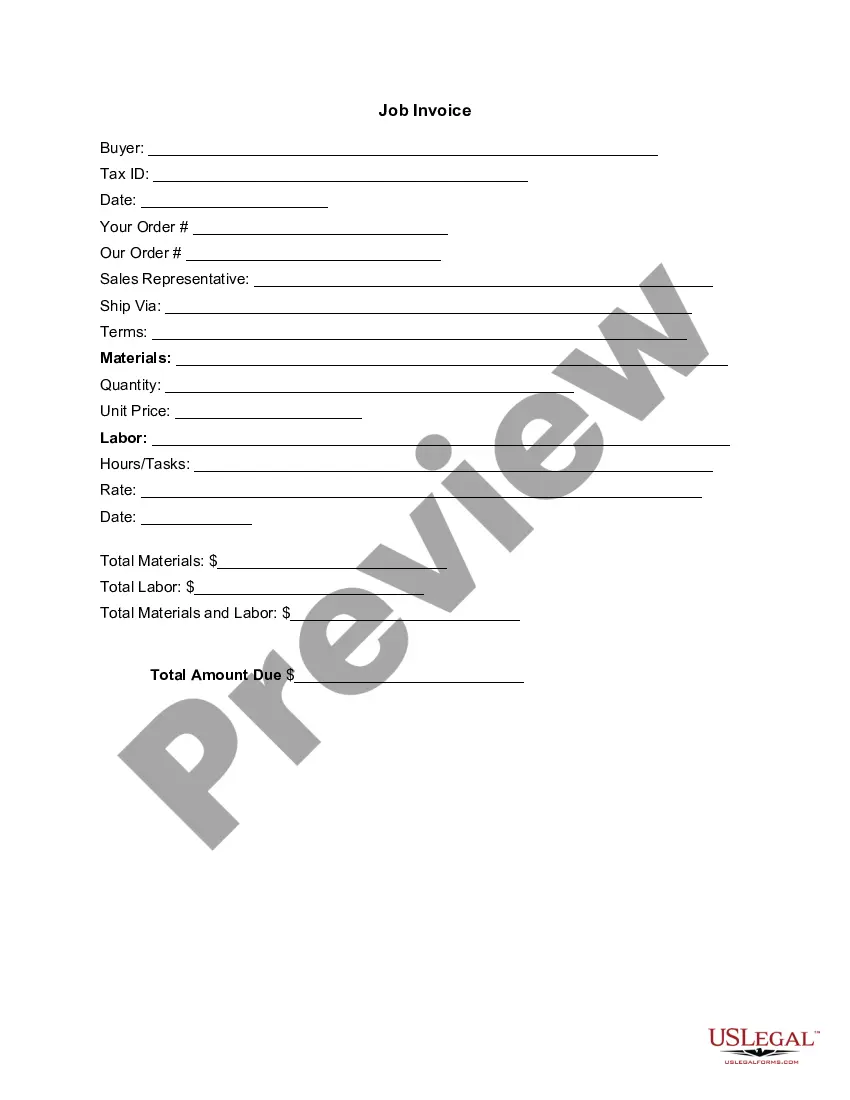

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

What is Process of Factoring? Factoring is a financial transaction in which a business sells its accounts receivable (invoices) to a third party, called a factor, at a discount.