Shared Equity Agreements For Sale In Texas

Description

Form popularity

FAQ

Home equity sharing agreements involve selling a percentage of your home's value or appreciation to an investor in exchange for a lump sum upfront. The agreement typically is settled, with the homeowner paying back the investor, after the home is sold or at the end of a 10- to 30-year period.

A HEA might make more sense if you need a lump sum now, prefer not to take on monthly debt, or have limited income or credit history. Both can be smart ways to tap into your home's equity. Just make sure to read the fine print, weigh the long-term costs, and choose the option that best aligns with your plans.

Home equity sharing agreements involve selling a percentage of your home's value or appreciation to an investor in exchange for a lump sum upfront. The agreement typically is settled, with the homeowner paying back the investor, after the home is sold or at the end of a 10- to 30-year period.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

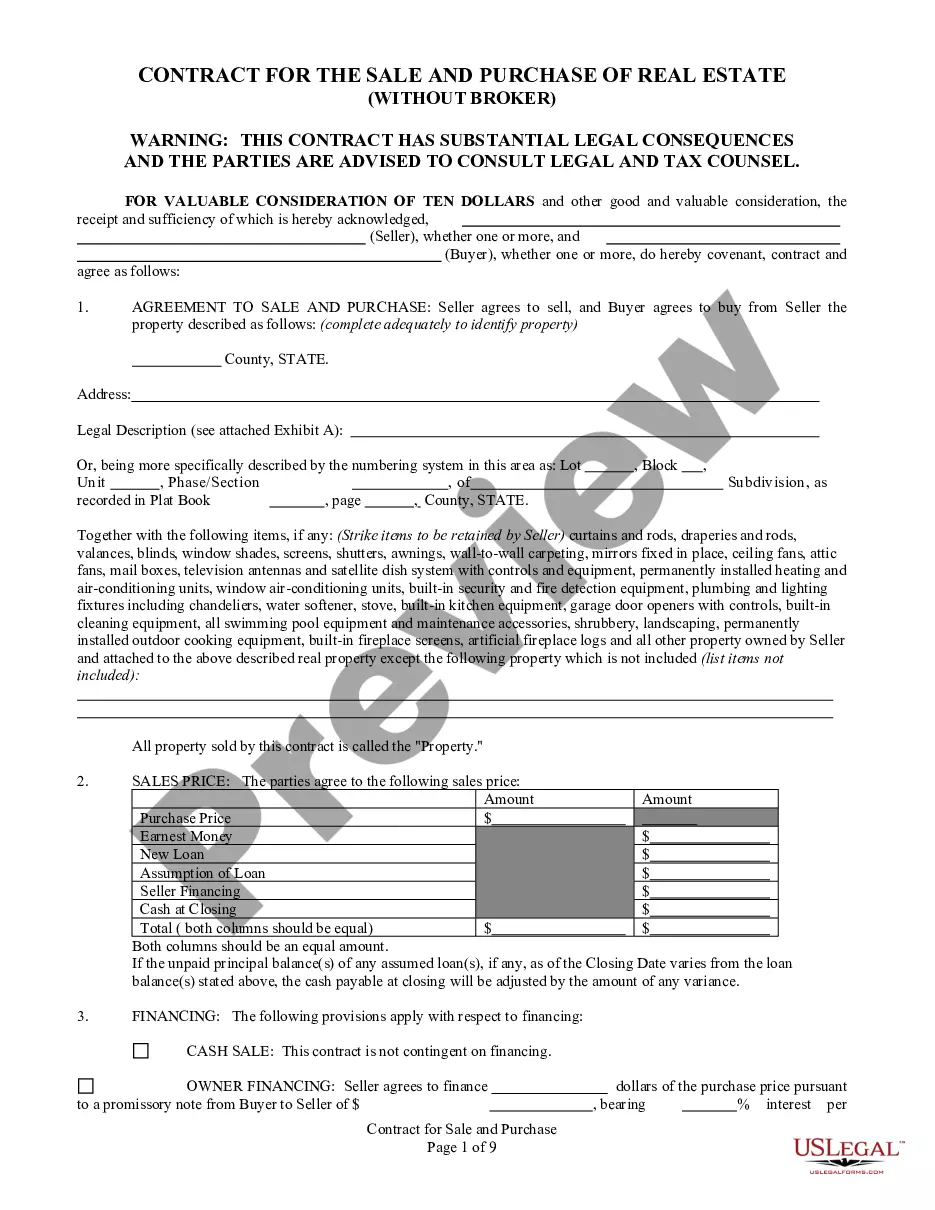

Equity sharing owners share the initial costs of buying the property, including down payment and closing costs. These costs are called “Initial Capital Contributions”. The owners also share the costs of major repairs and improvements and these are called “Additional Capital Contributions”.

Point: Best for investment property owners With Point's HEI program, you can get up to 20% of your home's value in a lump sum within just a few weeks, thanks to its particularly quick and easy qualification and funding process.

State Laws on Home Equity Loans in Texas The state was the last in the U.S. to allow home equity loans—they became legal in 1997—and they are regulated under a Texas Constitution statute known as Section 50.

Texas Home Equity Affidavit and Agreement (First Lien) - Fannie Mae/Freddie Mac UNIFORM INSTRUMENT Form 3185. The affidavit must be recorded together with the Security Instrument and any applicable riders.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Location. Your property must be located in a state served by Unlock: Arizona, California, Florida, Michigan, New Jersey, North Carolina, Oregon, Pennsylvania, South Carolina, Tennessee, Utah, Virginia or Washington state.