Equity Forward Contract In San Bernardino

Description

Form popularity

FAQ

For example, a December 2022 corn futures contract traded on the CME Group represents 5,000 bushels of the grain (trading in dollars per bushel) to be delivered by a certain date in December 2022. Crude oil futures represent 1,000 barrels of oil and are quoted in dollars and cents per barrel.

In other words, a forward contract ensures that a future transaction is carried out at an agreed term by the two parties from the past. Therefore, a forward contract is a contract to A) deliver a commodity to a buyer in the future.

Suppose that a client has entered into an equity forward contract with a bank. The client (long side) agrees to buy 400 shares of a publicly listed company for US$ 100 per share from the bank (short side) on a specified expiration date one year in the future.

Let's consider an example to understand how a Forward Rate Agreement works. Suppose Party A enters into a 6-month FRA with Party B. The notional amount is $1 million, and the reference interest rate is 5%. The forward rate agreed upon is 6%.

The forwards vs. futures distinction lies in their trading methods, as forwards are traded over the counter while futures are traded on an exchange. Futures contracts are traded on exchanges and are standardized and regulated.

Forward Contracts can broadly be classified as 'Fixed Date Forward Contracts' and 'Option Forward Contracts'. In Fixed Date Forward Contracts, the buying/selling of foreign exchange takes place at a specified future date i.e. a fixed maturity date.

Equity Contract means a contract which is valued on the basis of the value of underlying equities or equity indices and includes related derivative contracts.

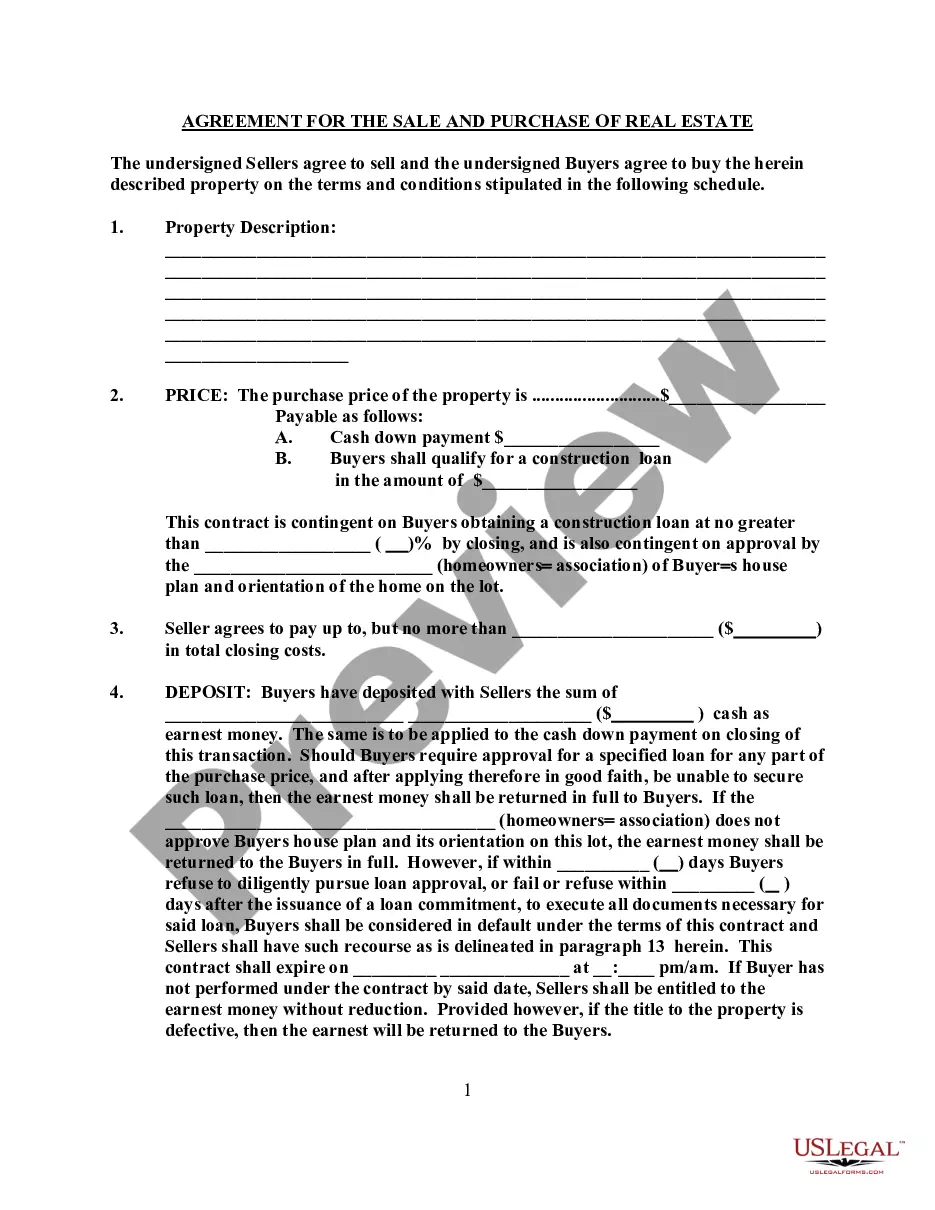

The Documentary Transfer Tax (DTT) imposes a tax on each deed, instrument, or writing by which any lands, tenements, or any other realty sold, shall be granted, transferred, or otherwise conveyed to another person. The State Revenue and Taxation Code 11902 - 11934 governs this tax.

In most California counties, the seller typically pays for the transfer tax. But this can be negotiated between both parties and specified within the contract. RETTs are imposed by state and local governments in many parts of the United States, including California.