Equity Agreement Statement With 20 In San Antonio

Description

Form popularity

FAQ

Property Tax Rate M&O: 33.009 cents. Debt Service: 21.150 cents. Total tax rate: 54.159 cents.

Texas Property Tax Rates CountyMedian Home ValueAverage Effective Property Tax Rate Bexar $171,200 2.35% Blanco $261,300 1.05% Borden $156,300 0.50% Bosque $135,500 1.05%89 more rows

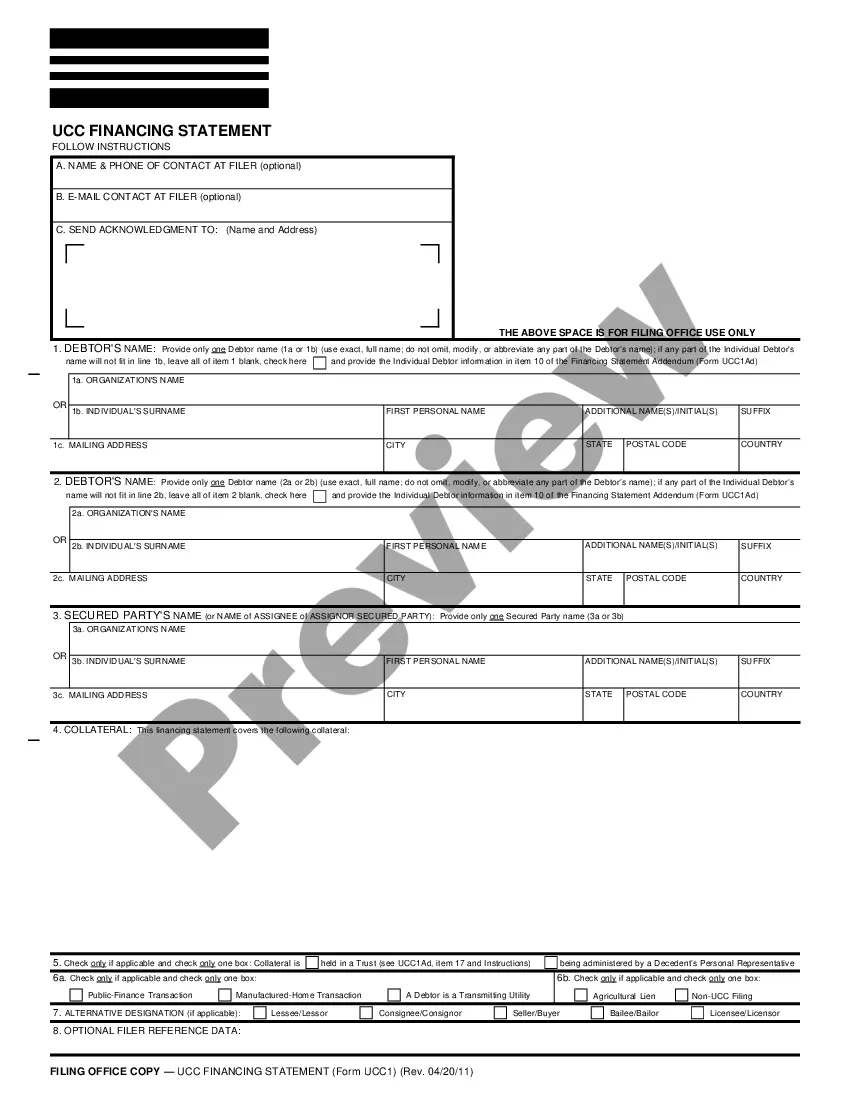

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Ing to the Comptroller, there is no provision for the cessation of property taxes at any stage. However, there is a Texas property tax exemption for people over the age of 65, which offers temporary tax relief for seniors. At the age of 65, seniors can apply for an exemption from Texas property taxes.

San Antonio sales tax details The minimum combined 2025 sales tax rate for San Antonio, Texas is 8.25%. This is the total of state, county, and city sales tax rates. The Texas sales tax rate is currently 6.25%. The San Antonio sales tax rate is 1.25%.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.