Equity Forward Contract In Salt Lake

Description

Form popularity

FAQ

A forward rate agreement (FRA) is a forward contract on interest rates. The FRA's fixed interest rate is determined such that the initial value of the FRA is zero. Receive-fixed (Short): NA × {FRA0 – Lm tm}/1 + Dmtm.

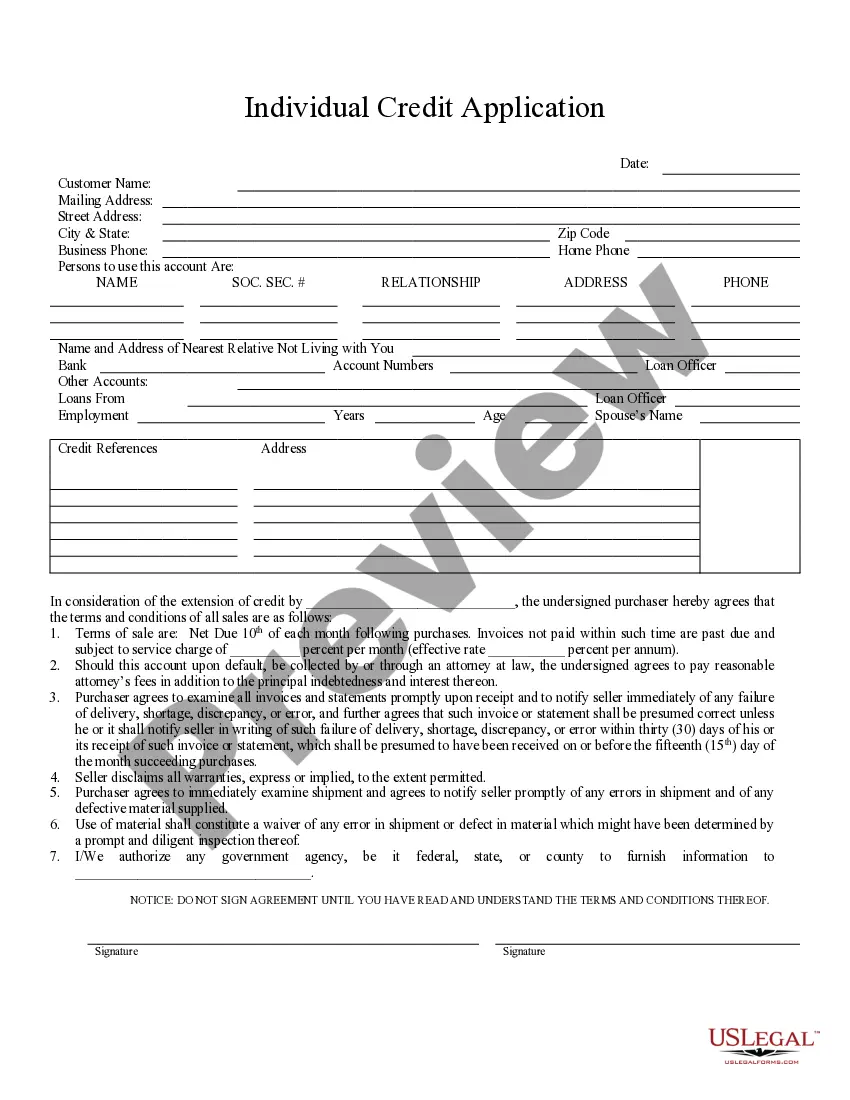

Record a forward contract on the contract date on the balance sheet from the seller's perspective. On the liability side of the equation, you would credit the Asset Obligation for the spot rate. Then, on the asset side of the equation, you would debit the Asset Receivable for the forward rate.

Record a forward contract on the contract date on the balance sheet from the seller's perspective. On the liability side of the equation, you would credit the Asset Obligation for the spot rate. Then, on the asset side of the equation, you would debit the Asset Receivable for the forward rate.

The forwards vs. futures distinction lies in their trading methods, as forwards are traded over the counter while futures are traded on an exchange. Futures contracts are traded on exchanges and are standardized and regulated.

Forward Contracts can broadly be classified as 'Fixed Date Forward Contracts' and 'Option Forward Contracts'. In Fixed Date Forward Contracts, the buying/selling of foreign exchange takes place at a specified future date i.e. a fixed maturity date.

Equity Contract means a contract which is valued on the basis of the value of underlying equities or equity indices and includes related derivative contracts.