Contract For Equity In Riverside

Description

Form popularity

FAQ

Consider attending industry events, joining professional organizations, and reaching out to professionals in the field to build your network. Research firms: Research private equity firms that align with your interests and goals, and consider reaching out to them directly to express your interest in working with them.

A Guide to Private Equity Deal Sourcing Hire an In-House Deal Origination Team. Manage Relationships at Scale. Identify Your Attractive Deal Signals. Assign Scores to Your Opportunities. Engage Early and Act Quickly. Develop a Strong Brand Presence. Key Takeaway.

Consider attending industry events, joining professional organizations, and reaching out to professionals in the field to build your network. Research firms: Research private equity firms that align with your interests and goals, and consider reaching out to them directly to express your interest in working with them.

Six Things to Know When Negotiating with a Private Equity Don't negotiate only with one private equity firm. Use a M&A advisor. Clean the mess. Be realistic with the business plan. Prepare for a cut after the due diligence. Conduct your own due diligence of the private equity.

Experience as a law intern in the alternative investment industry is highly recommended for entry-level positions. You'll need five to ten years of mergers and acquisitions experience to work as a chief legal officer in the PE industry.

Private equity firms usually look for entry-level associates with at least two years of experience within the banking industry. Investment bankers usually follow the PE firm career path as their next job and typically have a bachelor's degree in finance, accounting, economics, and other related fields.

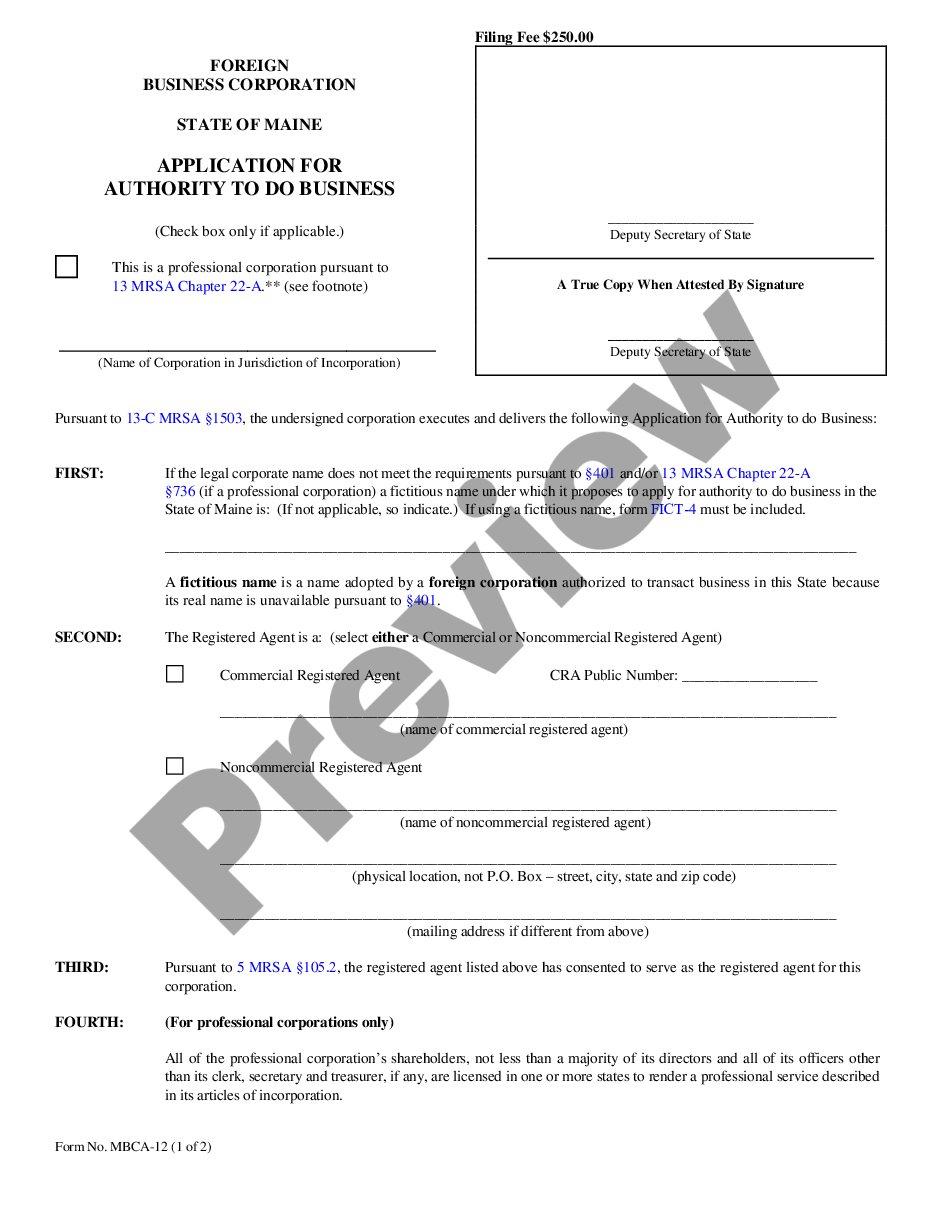

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

The Riverside Company is a global private equity firm focused on making control and non-control investments in growing businesses valued at up to US$400 million. Since its founding in 1988, Riverside has invested in more than 480 transactions and has an international portfolio including more than 80 companies.