Business Equity Agreement Forward In Queens

Description

Form popularity

FAQ

Both corporations and LLCs have owners, but in a limited liability company, the “members” own the assets of the business because of the investments they've made. In contrast, a corporation's owners own stock shares, but they do not own corporate assets.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

1 The SBA uses various standards for determining small business status based on numbers of employees, ranging from 50 to 1,500 depending on industry sector. In New York, Section 131 of the Economic Development Law defines a small business as one that has fewer than 100 employees and is independently owned and operated.

Is an LLC a corporation? An LLC is not a type of corporation. In fact, an LLC is a unique hybrid entity that combines the simplicity of a sole proprietorship with the liability protections offered by starting a corporation.

Is my LLC an S or C Corp? You can elect for an LLC to be taxed as an S Corp or a C Corp by filing the proper paperwork with the IRS. If you run an LLC, it's automatically taxed as a sole proprietorship or partnership, but you can elect to be taxed as a corporation instead.

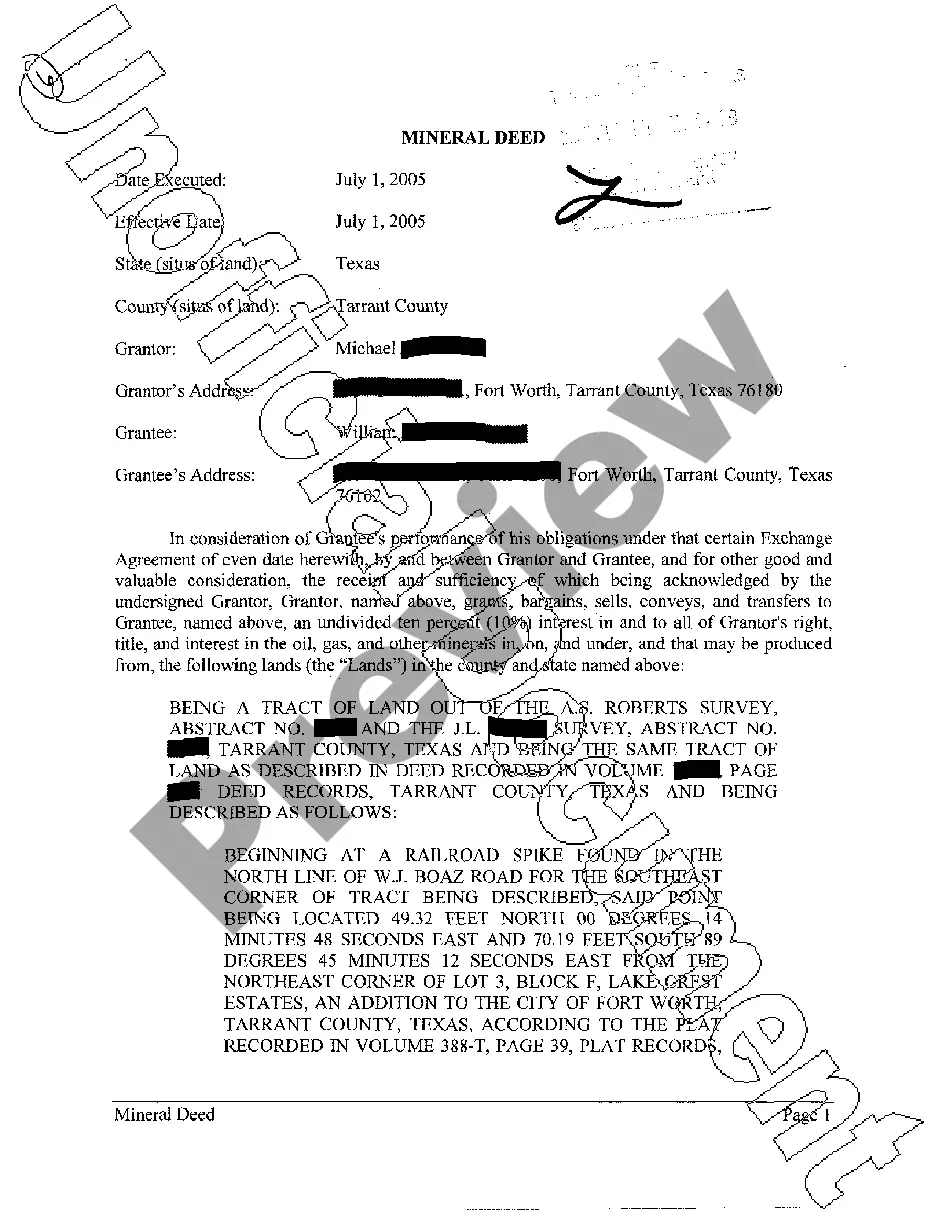

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

An equity agreement is like a partnership agreement between at least two people to run a venture jointly. An equity agreement binds each partner to each other and makes them personally liable for business debts.

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.