Financed House Lend For Sale In Phoenix

Description

Form popularity

FAQ

Is owner finance a good option? Owner finance can be a good option for borrowers who have very little credit score to seek housing loans from banks. However, one must be very careful while purchasing land with owner financing as failure to repay the debt amount can lead to loss of ownership and the entire amount.

Anyone who meets the legal requirements for adverse possession can claim property in Arizona. This includes individuals who have continuously and exclusively occupied the property for at least ten years, openly and without the true owner's permission, while also paying property taxes on the property during this period.

Best banks for land loans comparison BankStates where services are offered WaFD Bank Arizona, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington Atlantic Union Bank Indiana, Maryland, North Carolina, Virginia California Bank & Trust California Banner Bank California, Idaho, Oregon, Washington1 more row

Unlike improved property loans, land loans lack the security of a built structure, making them riskier investments. The following results from this: Lenders typically require higher down payments, often 20% to 50% of the land's value. Interest rates are usually higher than traditional mortgages.

Is owner finance a good option? Owner finance can be a good option for borrowers who have very little credit score to seek housing loans from banks. However, one must be very careful while purchasing land with owner financing as failure to repay the debt amount can lead to loss of ownership and the entire amount.

Sellers can capitalize on a range of benefits with owner financing, including increased buyer interest, regular income, financial flexibility, and the potential for higher sale prices, making it a strategic option in certain real estate transactions.

Other owner financing advantages include saving on closing costs, as there is no involvement from a lender, and there are potential capital gains tax savings over time. There can be a significant reduction in time to sell, as the sale of the property happens without any need for repairs.

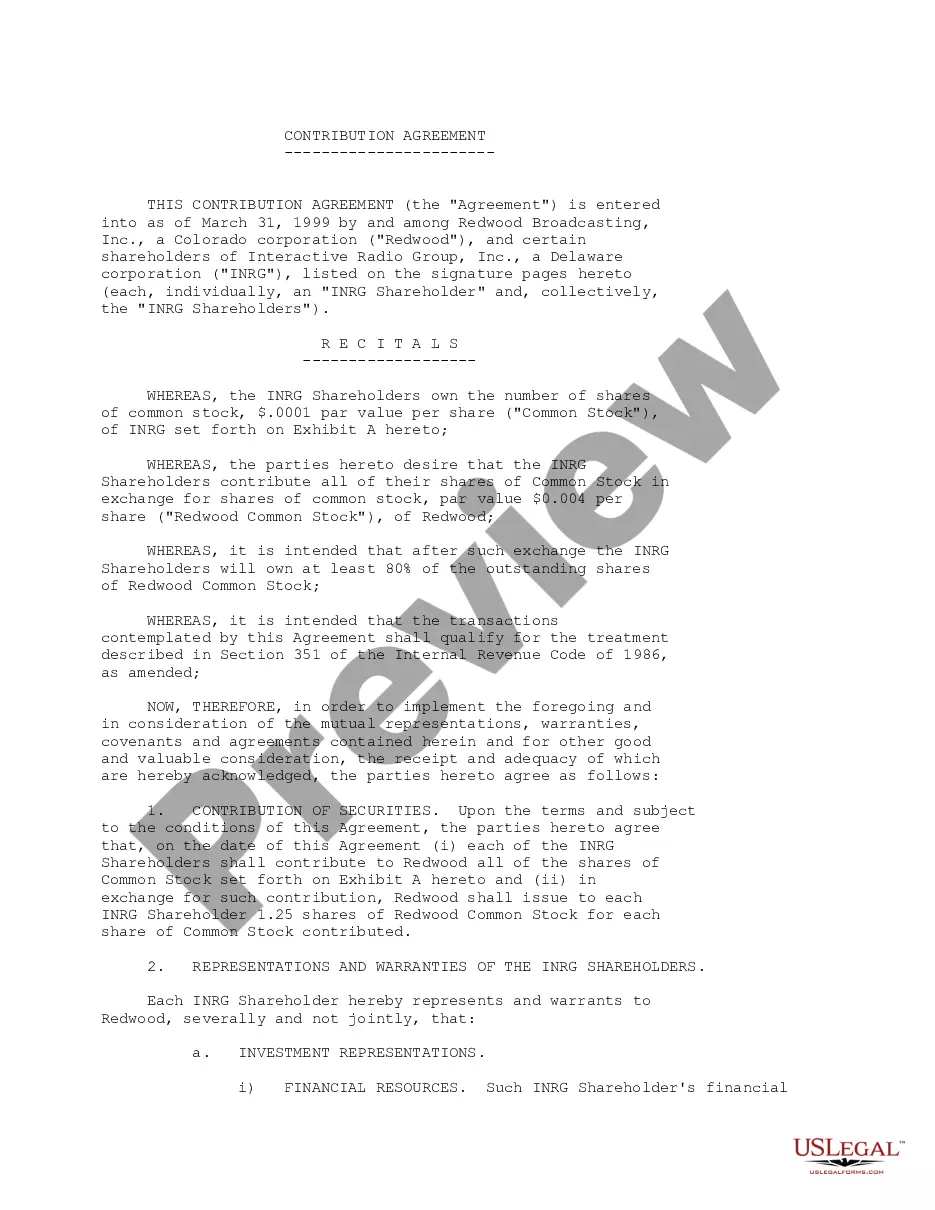

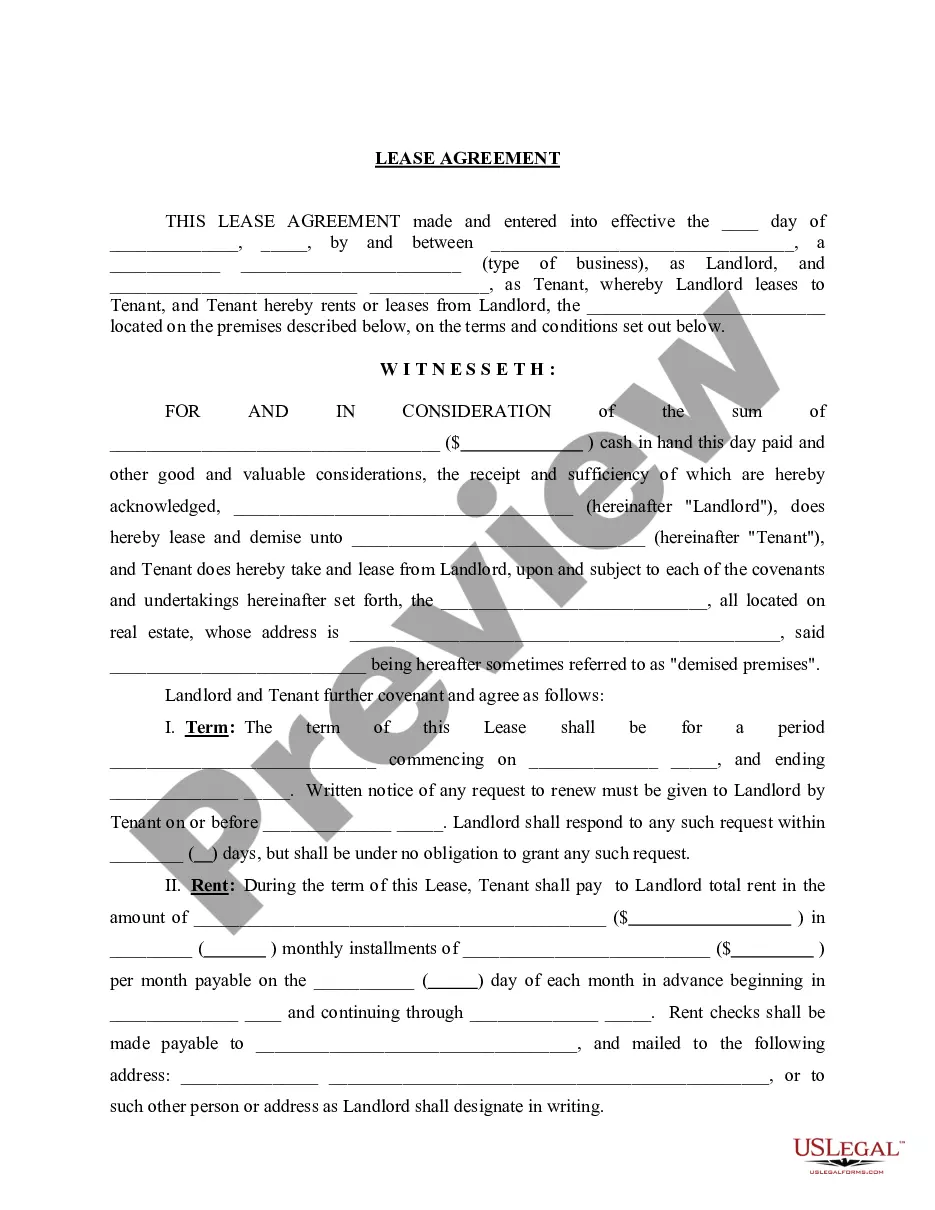

How Does Seller Financing Work? A bank isn't involved in a seller-financed sale; the buyer and seller make the arrangements themselves. They draw up a promissory note setting out the interest rate, the schedule of payments from buyer to seller, and the consequences should the buyer default on those obligations.

But what about Arizona land, how come you can get land as low as $2k-$3k or so. One of the biggest reasons for cheap land in Arizona is the foreclosure process in Arizona. There were so many developers in the pre-construction phase and these properties are just now being released to the public once again.