Equity Agreement Form Contract With Nike In Palm Beach

Description

Form popularity

FAQ

Nike's total equity last quarter was 14.037 billion. Nike's total equity for fiscal years ending May 2020 to 2024 averaged 12.907 billion. Nike's operated at median total equity of 14.004 billion from fiscal years ending May 2020 to 2024.

NIKE share holder equity for 2022 was $15.281B, a 19.69% increase from 2021.

Nike total equity 2020-2024 The total equity of Nike with headquarters in the United States amounted to 14.43 billion U.S. dollars in 2024. The reported fiscal year ends on May 31. Compared to the earliest depicted value from 2020 this is a total increase by approximately 6.37 billion U.S. dollars.

Brand equity is a multidimensional concept that allows consumers' to evaluate a brand and determine its perceived benefits. Nike has successfully created a strong brand by fulfilling the pillars of brand equity, which include: brand loyalty, brand awareness, brand associations and perceived quality.

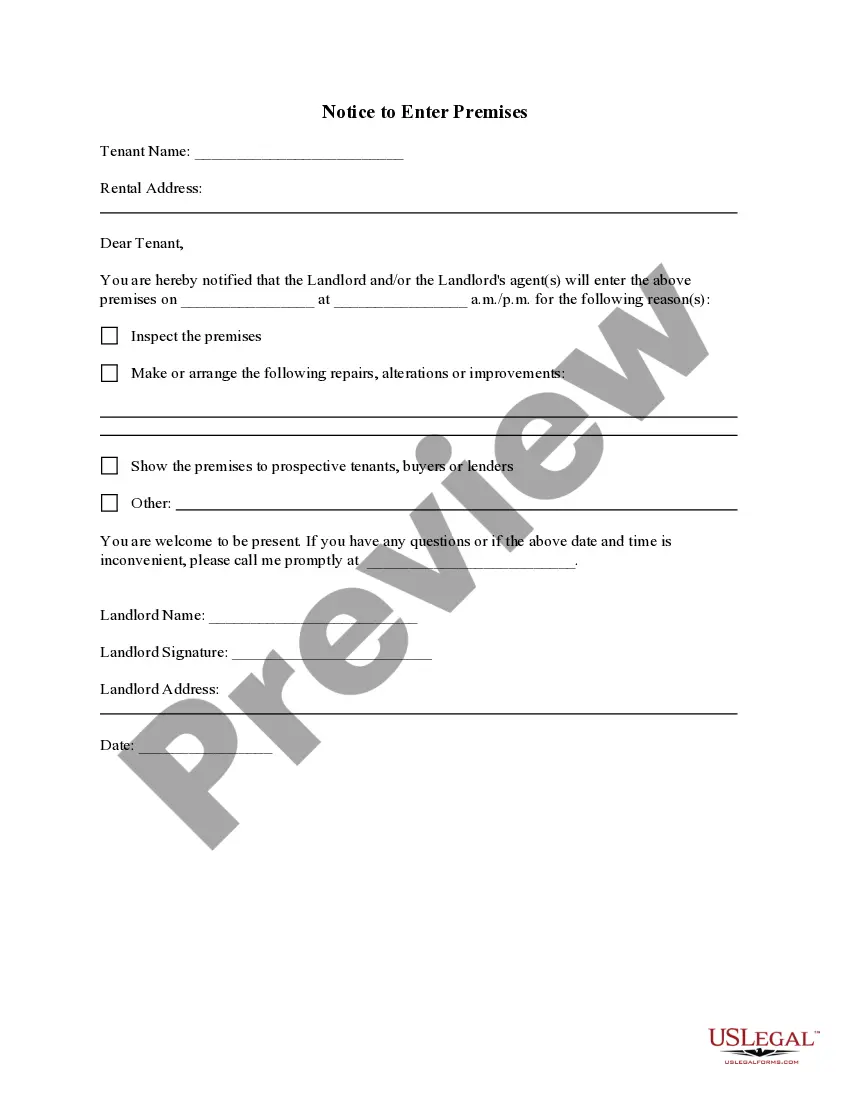

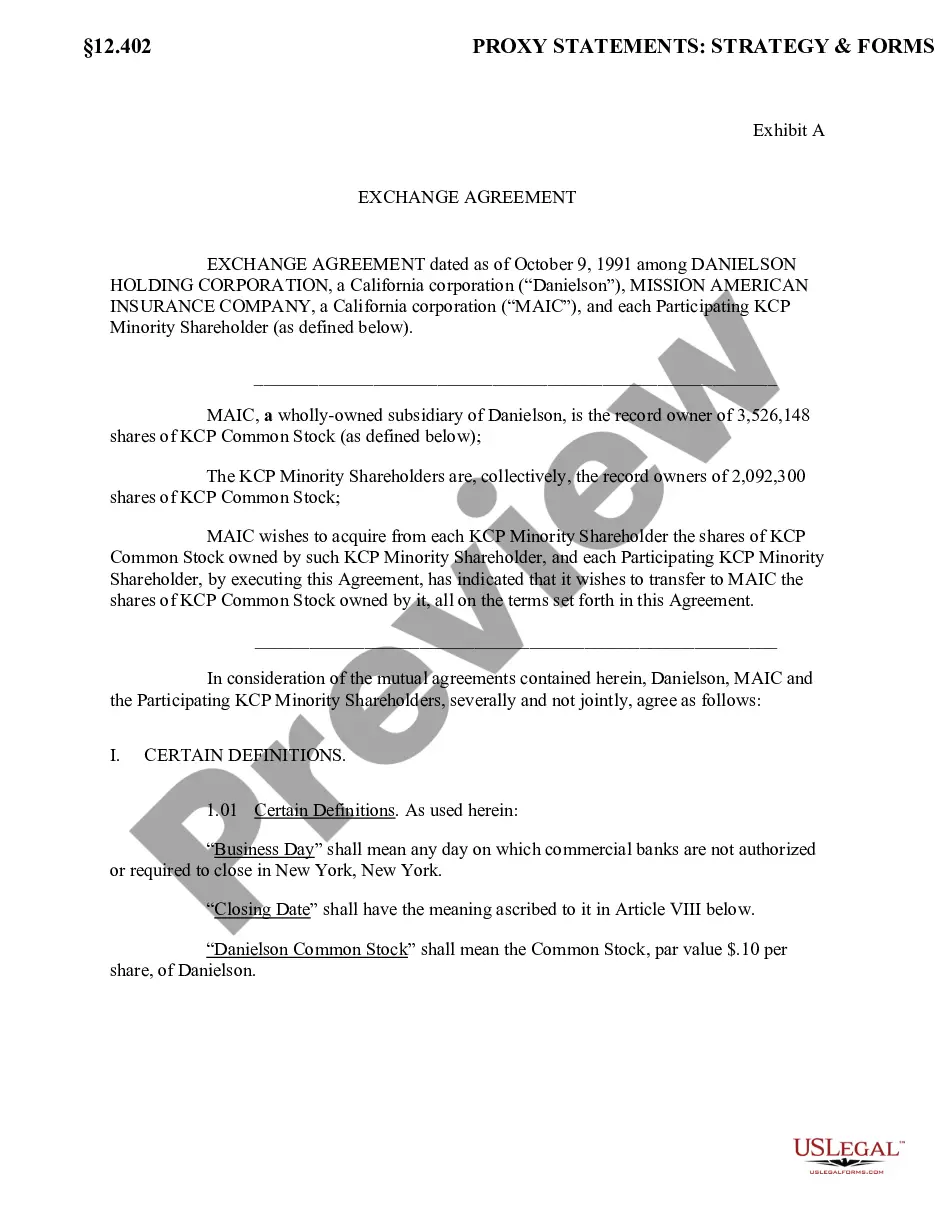

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

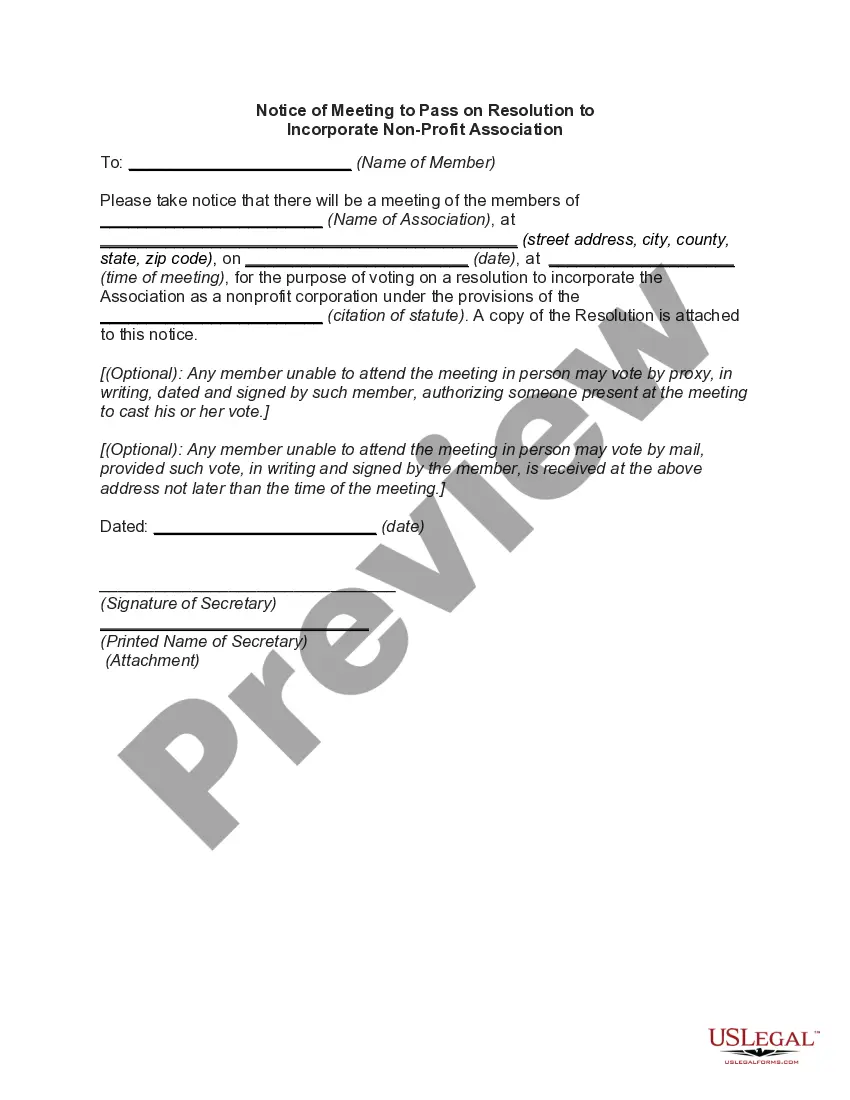

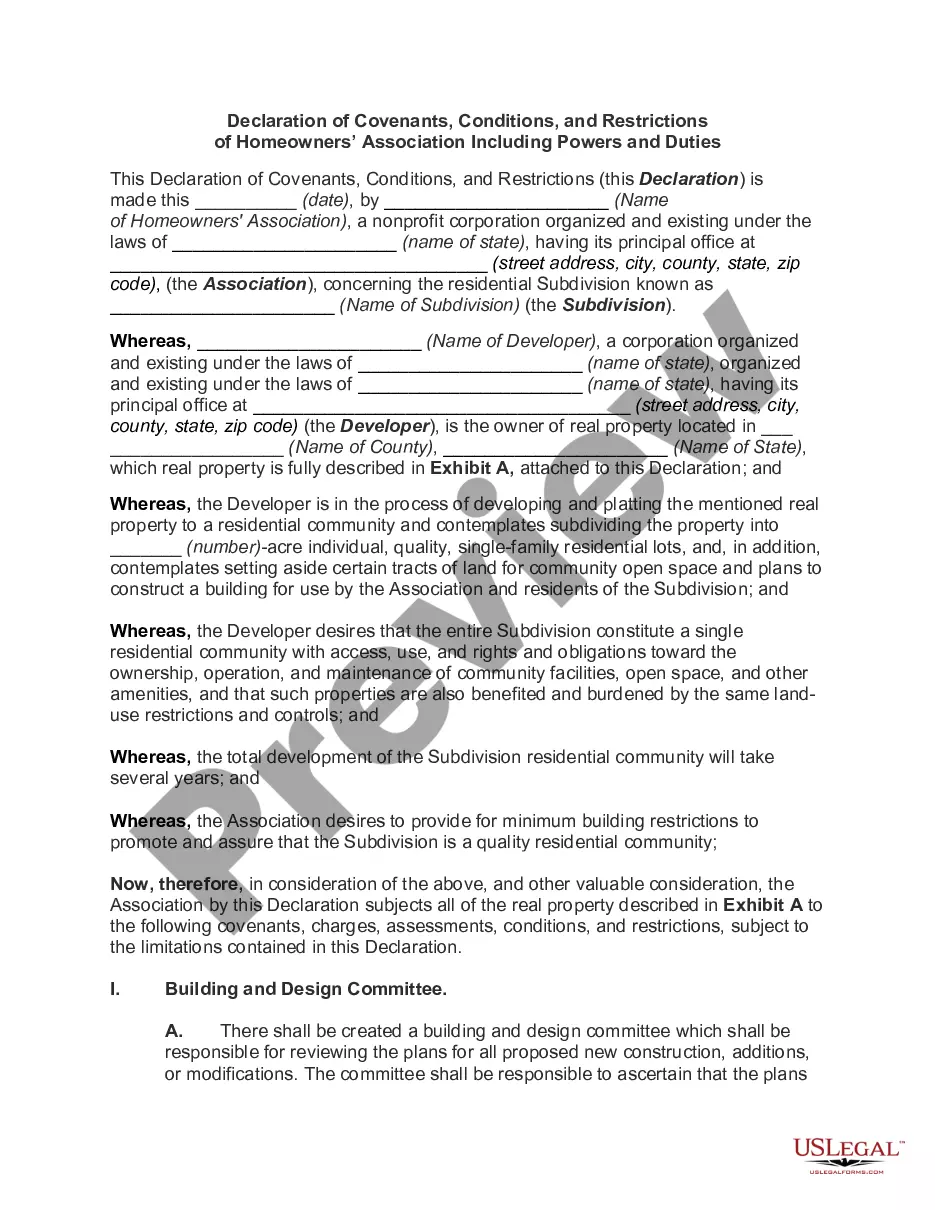

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.