Equity Share Purchase Format In Ohio

Description

Form popularity

FAQ

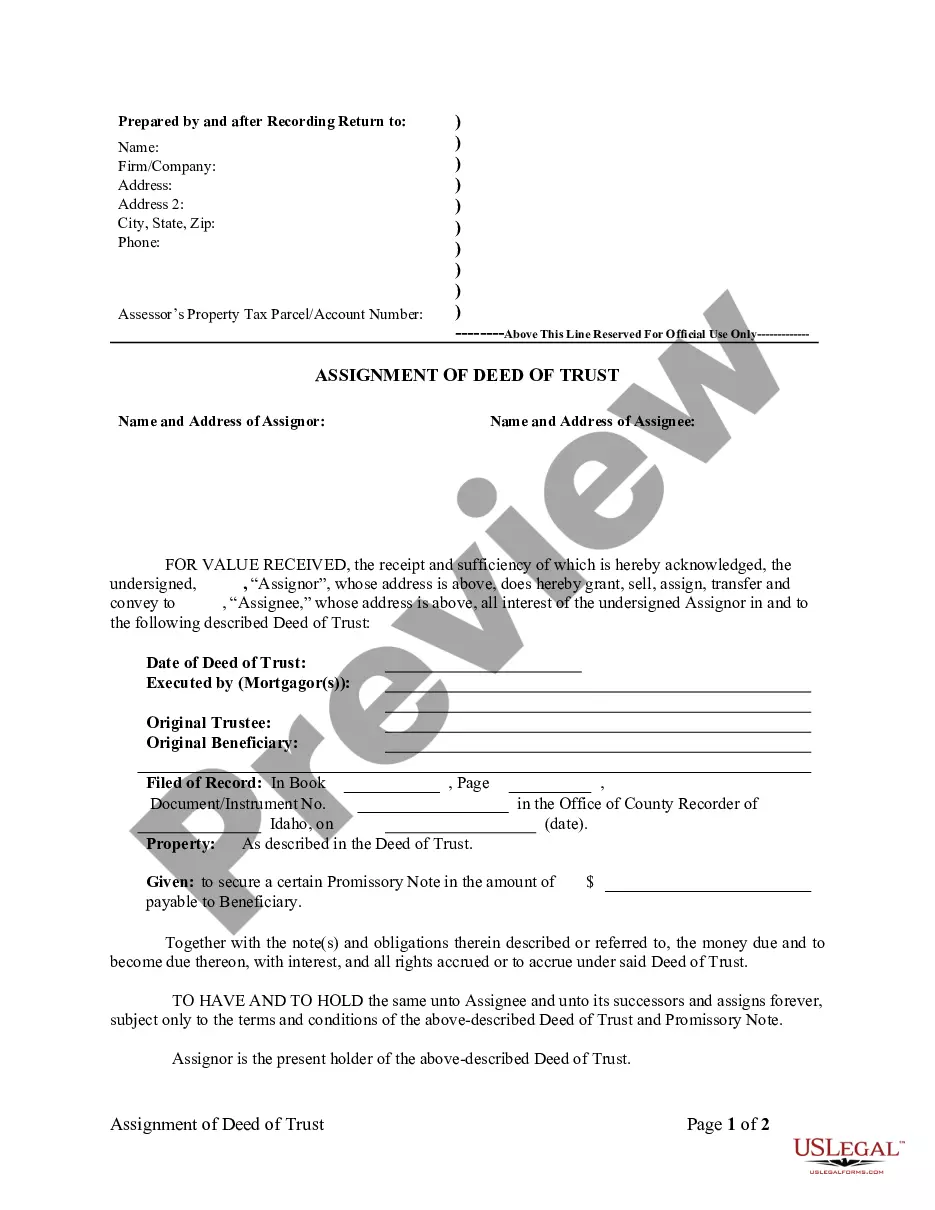

There may be times when you want to change the share structure of your company; either by adding a new shareholder or by changing the existing proportion of shares between shareholders. A share transfer is the process of transferring existing shares from one person to another; either by sale or gift.

To withdraw or cancel your foreign Ohio Corporation in Ohio, you must provide the completed Certificate of Surrender of Foreign Licensed Corporation form to the Secretary of State by mail or in person. You don't have to have original signatures on the certificate. Make checks for fees payable to “Secretary of State.”

Under Ohio's Nonprofit Corporation Law ("NCL"), your nonprofit's voting members must authorize dissolution by voting to adopt a resolution to dissolve. In many states, it is possible to authorize dissolution by a vote of a nonprofit's directors.

To dissolve your corporation in Ohio, you must provide the completed Certificate of Dissolution by Shareholders, Directors, or Incorporators form (561) to Ohio's Secretary of State (SOS) by mail or in person. The certificate itself is not too complicated and instructions are included at the end of Form 561.

What are the steps for changing an LLC name in Ohio? Check if your new LLC name is available. File the Amendment form (and wait for approval) Update the IRS. Update the Ohio Department of Taxation. Update financial institutions (credit card companies, banks) Update business licenses.

It is possible to electronically file (“e-file”) certain divorce documents online in Ohio. However, you and your spouse need to physically appear in court for any divorce or dissolution in Ohio.

The biggest difference is that an SPA is the sale of all shares, and an APA is the sale of selected assets. Therefore, they are both different transactions and have different procedures. 2. With a SPA, all shareholders in the company must be consulted and agree to sell their shares in the company.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. Step 2: Identify the interests of shareholders. Step 3: Identify shareholder value. Step 4: Identify who will make decisions - shareholders or directors. Step 5: Decide how voting power of shareholders should add up.

When you buy common stocks, you're actually buying a small part of the company that issued it. As an owner, you could be entitled to certain benefits, like voting rights and shares of the company's profits. And if the company does well, and the value of the stock goes up, you'll be able to sell your stock for a profit.