Equity Shares For Long Term In Nassau

Description

Form popularity

FAQ

What Is the 6-Year Rule for Capital Gains Tax? There is no 6-year rule for capital gains tax in the United States, but in Australia, taxpayers can claim a full capital gains exemption on their principal place of residence (PPOR) for up to 6 years on their tax return if they vacate and then rent out the home.

A few options to legally avoid paying capital gains tax on investment property include buying your property with a retirement account, converting the property from an investment property to a primary residence, utilizing tax harvesting, and using Section 1031 of the IRS code for deferring taxes.

7 ways to avoid capital gains tax on stocks for any investor Donate stock to charity. Hold stock shares for more than one year. Invest in retirement accounts. Pass it on in your estate plans. Sell stocks when you're in a lower tax bracket. Offset your capital gains with losses (aka tax-loss harvesting).

Long-term capital gains (LTCG) tax on shares applies to profits made from selling equity shares held for more than one year. Under the current tax regime, gains exceeding Rs. 1.25 lakh in a financial year are taxed at a rate of 12.5%. This change aims to provide a uniform tax structure for all financial assets.

By focusing on fundamentals like holding quality investments for the long term, doing thorough research rather than following tips, and maintaining discipline during market volatility, investors can build wealth steadily over time.

Who qualifies for 0% capital gains in 2025. Starting in 2025, single filers can qualify for the 0% long-term capital gains rate with taxable income of $48,350 or less, and married couples filing jointly are eligible with $96,700 or less. However, taxable income is significantly lower than your gross earnings.

“Buying and holding equities in the long run has helped investors historically,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “Investors also need to look at other factors, like how much short-term volatility in stock prices they're willing to tolerate.”

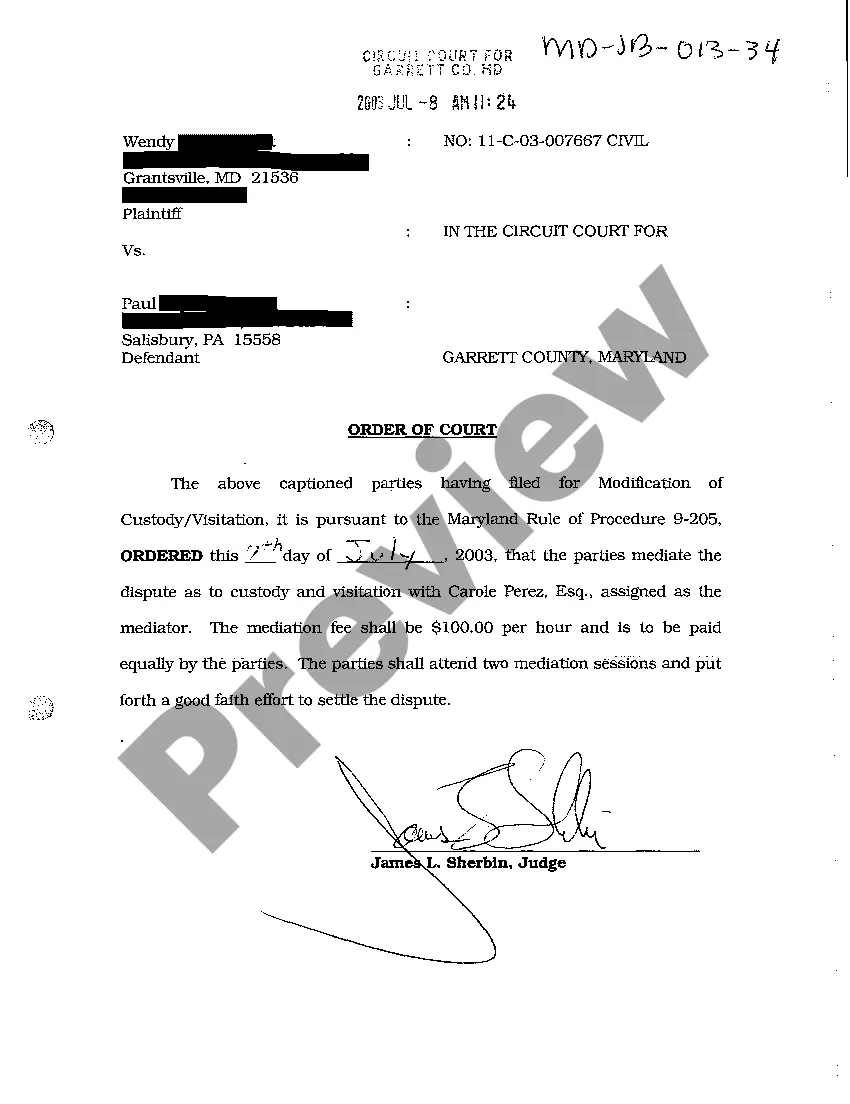

20% of Nassau Container Port port is owned by 11,000 members of the Bahamian public, 40% of the port is owned by the government of The Bahamas, and 40% is held by Arawak Cay Port Development Holdings Limited, a consortium of private investors from the shipping industry.

Investing in equity shares is a great idea. The reason is that an equity share indicates that you have a certain percentage of equity in the company. Thus, the returns you get are directly linked to the profits of the company. This makes it a great option as the opportunity to earn a good return is high.

Equity shares are a key source of long-term financing for companies, issued to the general public and non-redeemable. Shareholders of equity shares have voting rights, share in profits, and can claim assets, providing them with a stake in the company's success.