Business Equity Agreement For Start In Minnesota

Description

Form popularity

FAQ

How to Add a Member to an LLC Step 1: Revisit your operating agreement. Step 2: Get approval from the other members. Step 3: Update your operating agreement to finalize the deal. Step 4: File an amendment to your Articles of Organization. Step 5: File tax documents.

Three of the most important ones are registering your business name, filing for trademarks, and separating your business finances from your personal finances.

Starting a business in Minnesota consists of three basic steps: Write a business plan. Choose a business type. Register your business.

Building a successful business requires optimal alignment of three key pieces – strategy, a growth system, and growth authority. By following these three steps, in the correct order, you can reach success in building your business.

The 3 Basic Ways to Get Into Your Own Business Start a business from scratch. A dude that built himself a 66,000 square foot house successfully started a business from scratch. Buy an existing business. If you decide to buy an existing business, the key word to remember here is patience. Invest in a franchise.

Business owners need to be armed with three important success factors. These success factors include business planning, financial knowledge, and a marketing approach. It is also essential to have knowledge about the industry you plan to delve into.

What is a small business? There is no ironclad definition of what constitutes a "small" business. The Small Business Administration defines a small business as anything with fewer than 500 employees, and a considerable amount of data collection and research uses this benchmark.

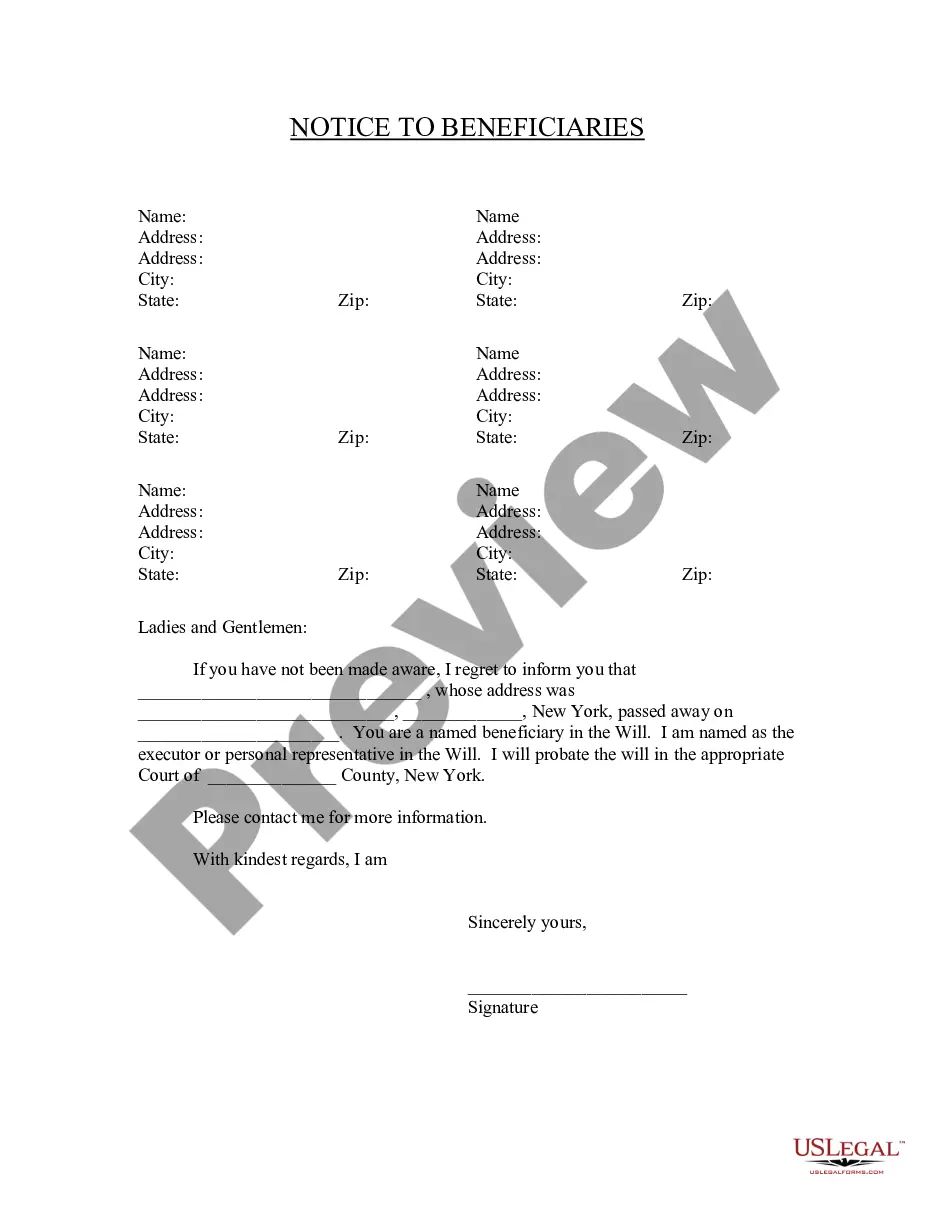

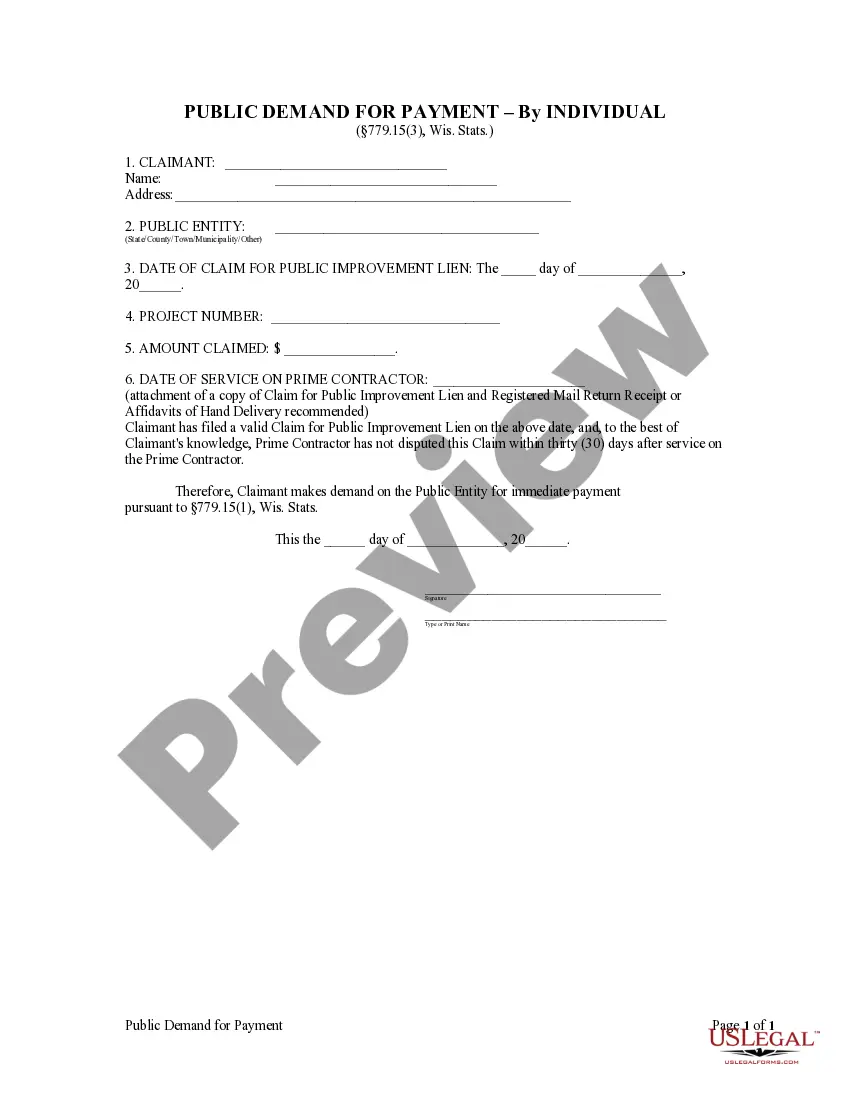

An equity agreement is like a partnership agreement between at least two people to run a venture jointly. An equity agreement binds each partner to each other and makes them personally liable for business debts.

For tax purposes, LLCs must apply for a federal Employer ID Number from the Internal Revenue Service (IRS), and a Minnesota Tax ID Number from the Minnesota Department of Revenue.

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).