Equity Share Purchase With Bitcoin In Maryland

Description

Form popularity

FAQ

A 20% equity stake means you own 20% of a company. This means you have a right to 20% of the company's profits and assets. If the company were to be sold, you would be entitled to 20% of the proceeds.

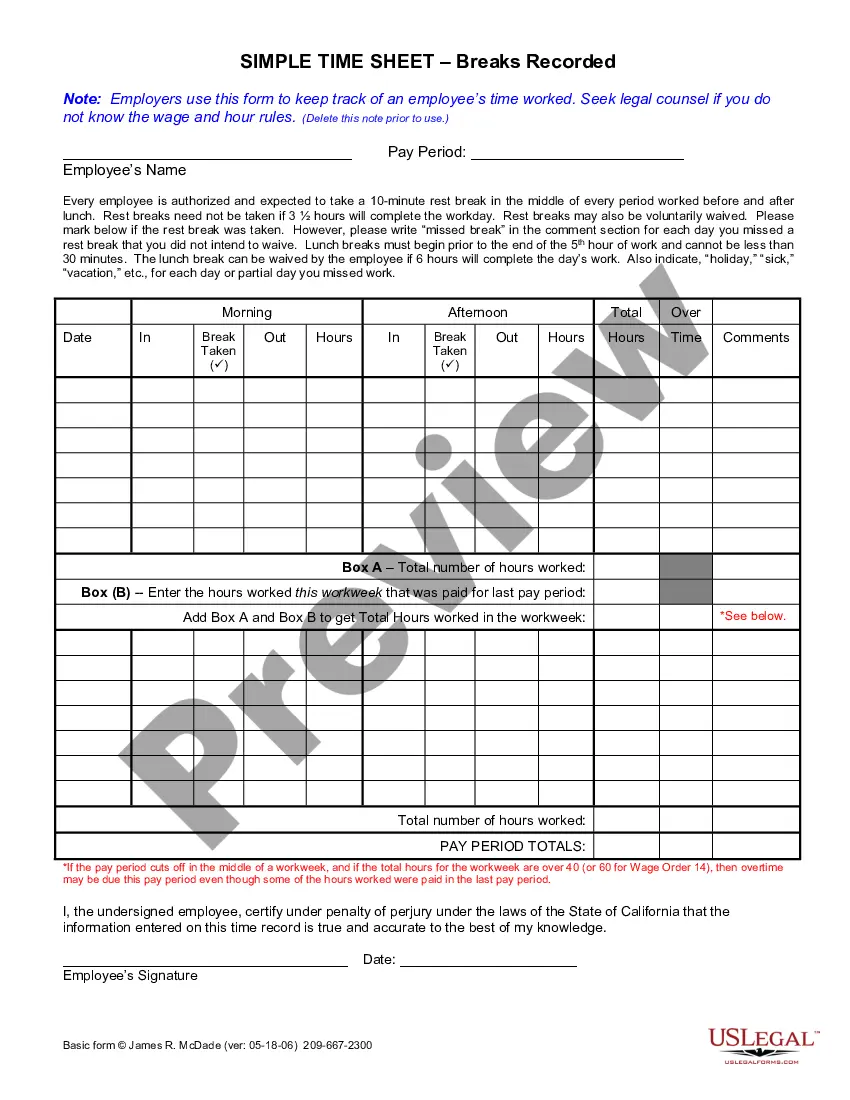

As a result, you'll need to document your crypto sales details, including how much you bought it for and when. These transactions are typically reported on Form 8949, Schedule D, and Form 1040.

How to report crypto in your tax return Report crypto disposals, capital gains, and losses on: Form Schedule D (1040) and Form 8949. Report crypto income on: Form Schedule 1 (1040) or Form Schedule C (1040). You can do this with paper forms or through a tax app like TurboTax or TaxAct. We'll walk you through both.

Crypto taxes are a percentage of your gains. The rate depends on your income and whether or not you held the crypto for more than a year. Short-term capital gains rates range from 10% to 37%. Long-term rates run from 0% to 20%.

How to Report Crypto on Your Taxes (Step-By-Step) Calculate your crypto gains and losses. Complete IRS Form 8949. Include totals from Form 8949 on Schedule D. Include any crypto income. Complete the rest of your tax return.

All crypto transactions, no matter the amount, must be reported to the IRS. This includes sales, trades, and income from staking, mining, or airdrops. Transactions under $600 may not trigger a tax form from exchanges, but they are still taxable and must be included on your return.

The IRS treats cryptocurrency as property, meaning that when you buy, sell or exchange it, this counts as a taxable event and typically results in either a capital gain or loss. When you earn income from cryptocurrency activities, this is taxed as ordinary income.

What triggers a crypto audit? Audit triggers include non-compliance with tax laws, high-value crypto transactions, privacy coins, offshore exchanges, and random IRS checks as part of routine enforcement.

Investors who are ready can use bitcoin ETFs to add bitcoin to their portfolio. You can invest in bitcoin ETFs through ETRADE to add exposure to bitcoin directly from your brokerage or IRA account–no crypto wallet or storage required.

Is bitcoin or cryptocurrency a good investment? Bitcoin tends to be incredibly volatile compared to other investment options, experiencing significant run-ups in value, followed by quick decreases in value. Despite a recent resurgence, bitcoin has lost nearly half its value after reaching all-time highs in late 2021.