Equity Agreement Statement Format In Maryland

Description

Form popularity

FAQ

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

A Maryland month-to-month lease creates a residential tenancy without a fixed end date that may be canceled at any time with 60 days' notice. Either the landlord or tenant can terminate the lease by sending a notice to the other party.

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

There is no Maryland state law requiring an LLC to have an operating agreement. However, if you don't have one, your LLC will be governed by Maryland's default LLC statutes, and you may run into difficulty if you need to prove your ownership of the LLC or if you face a lawsuit.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

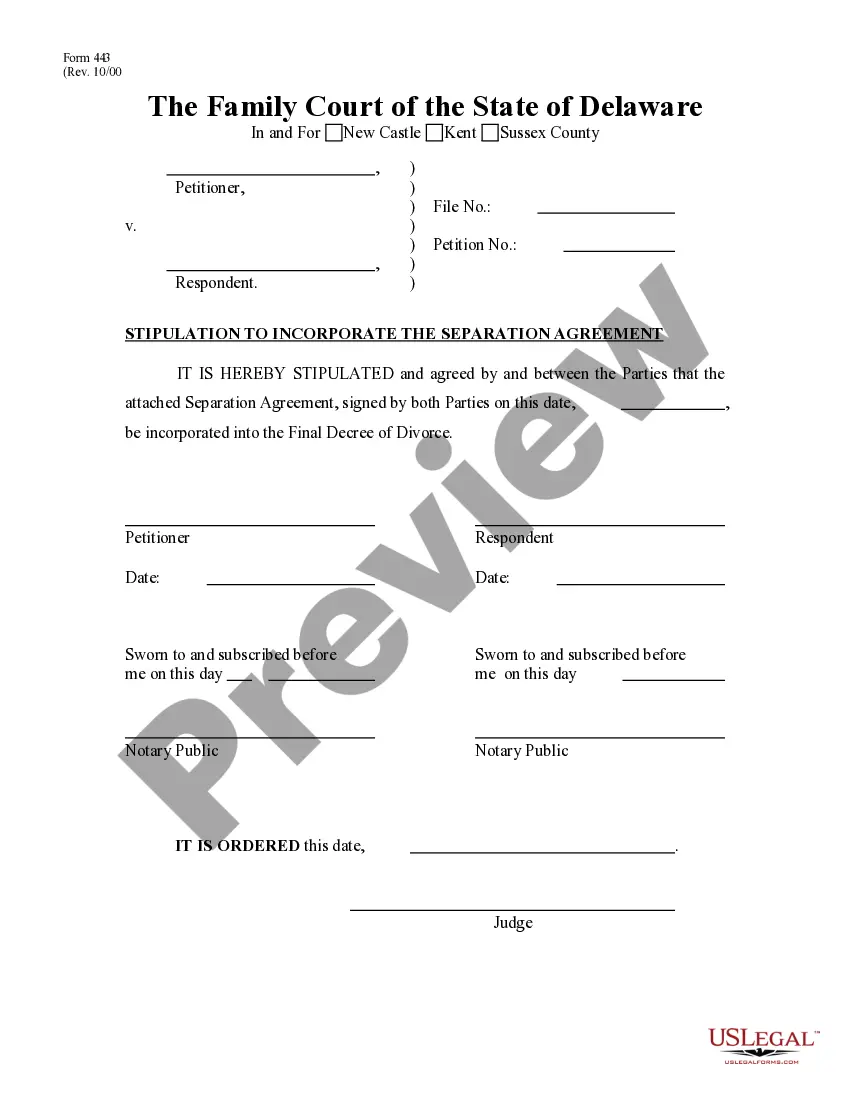

Your private process server must hand deliver the summons to the defendant. The process server may also leave the papers at the defendant's house with an adult who also lives there. Your private process server must then complete an affidavit of service. This is form CC-DR-055.

"Service of Process" is making sure the other side gets a copy of the papers you are filing (for example, a complaint). If you are starting a case, your case cannot go forward until the other side is served with your complaint. Someone who is over 18 years old and is not a party to the law suit may give service.