Equity Agreement Form Contract Format In Maryland

Description

Form popularity

FAQ

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

SAFE Example The SAFE investor would receive 6,250 shares under the 20% discount rate term in their agreement, or 15,000 shares if they had a valuation cap of $4 million. If an Investor had both features included in their SAFE agreement, the investor would likely choose the valuation cap and receive 15,000 shares.

How to draft a contract between two parties: A step-by-step checklist Know your parties. Agree on the terms. Set clear boundaries. Spell out the consequences. Specify how you will resolve disputes. Cover confidentiality. Check the legality of the contract. Open it up to negotiation.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

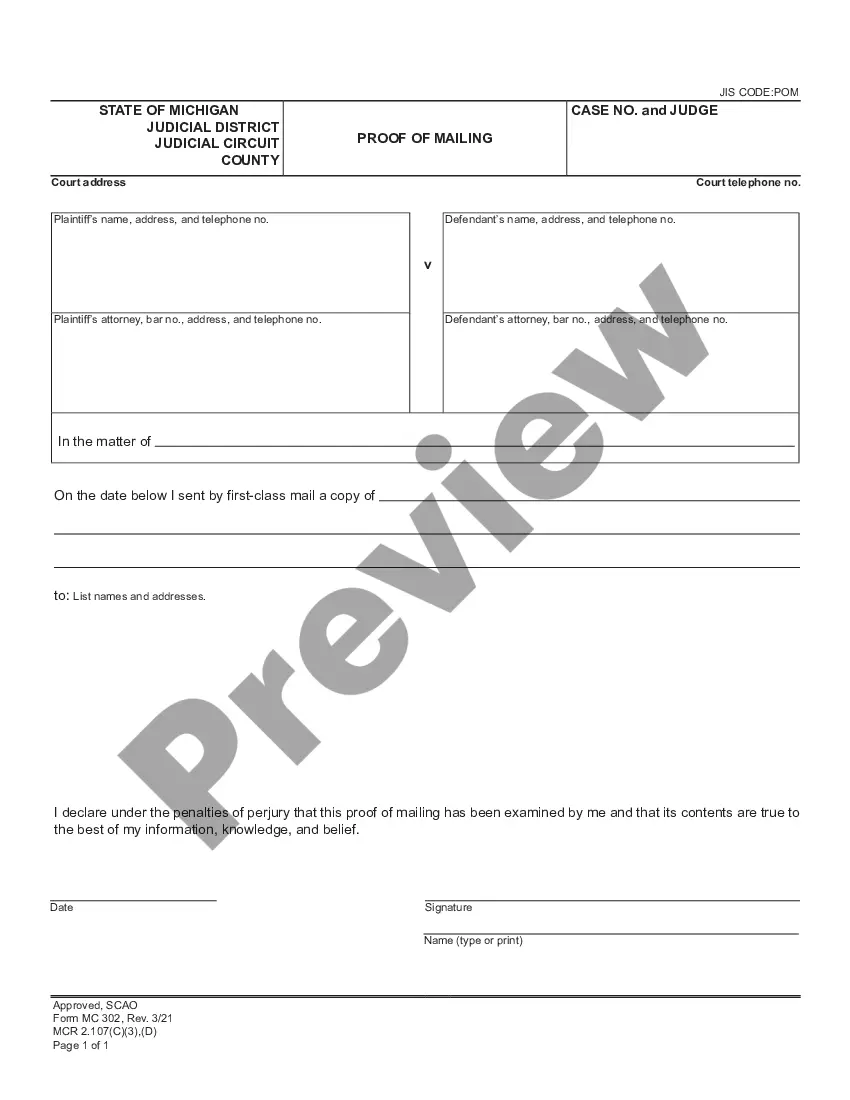

Real estate contracts commonly include the following information: Parties involved: The names and contact information of the buyer(s) and seller(s). Property description: A detailed description of the property, including its address, legal description, and any specific features.