Simple Cost Sharing Agreement Withholding Tax In Dallas

Description

Form popularity

FAQ

Note, a payee may request a higher rate of withholding than the 20% default withholding rate on an eligible rollover distribution by filing a 2021 or earlier Form W-4P or a 2022 or later Form W-4R.

2024 Income Tax Brackets (due April 2025) Head of Household Taxable IncomeRate $0 - $16,550 10% $16,550 - $63,100 12% $63,100 - $100,500 22%4 more rows

Use the Tax Withholding Estimator on IRS. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.

CWA requests must be received at least 45 days prior to the first event to be covered by the CWA. The IRS will not process any request it receives less than 45 days before the event, and therefore such event(s) will be subject to 30% withholding of the gross income.

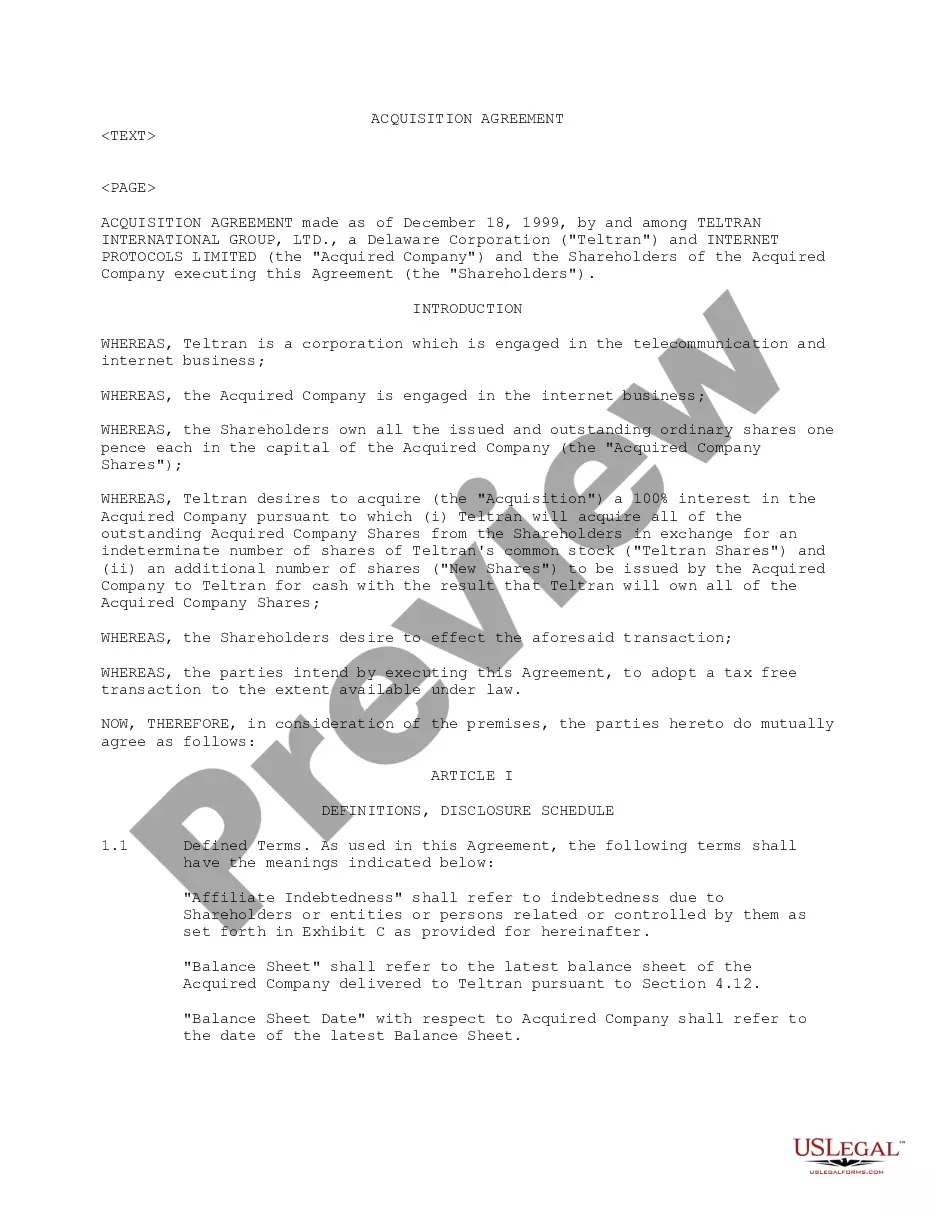

Tax Sharing and Allocation Agreements are contracts that describe and coordinate the allocation of tax responsibility and benefits among the named parties for a particular transaction or for a specific taxable period. Depending on the context, they may be called different names.

Fairness: A profit sharing agreement, when drafted effectively, ensures that each party gets a fair profit share based on what they're bringing to the venture. This reflects the risks each party takes when taking on the project. Clarity: Your contract provides a clear framework for what's expected of each party.