Cost Sharing Contract Example Withholding Tax In Cook

Description

Form popularity

FAQ

Tax Sharing and Allocation Agreements are contracts that describe and coordinate the allocation of tax responsibility and benefits among the named parties for a particular transaction or for a specific taxable period. Depending on the context, they may be called different names.

Fairness: A profit sharing agreement, when drafted effectively, ensures that each party gets a fair profit share based on what they're bringing to the venture. This reflects the risks each party takes when taking on the project. Clarity: Your contract provides a clear framework for what's expected of each party.

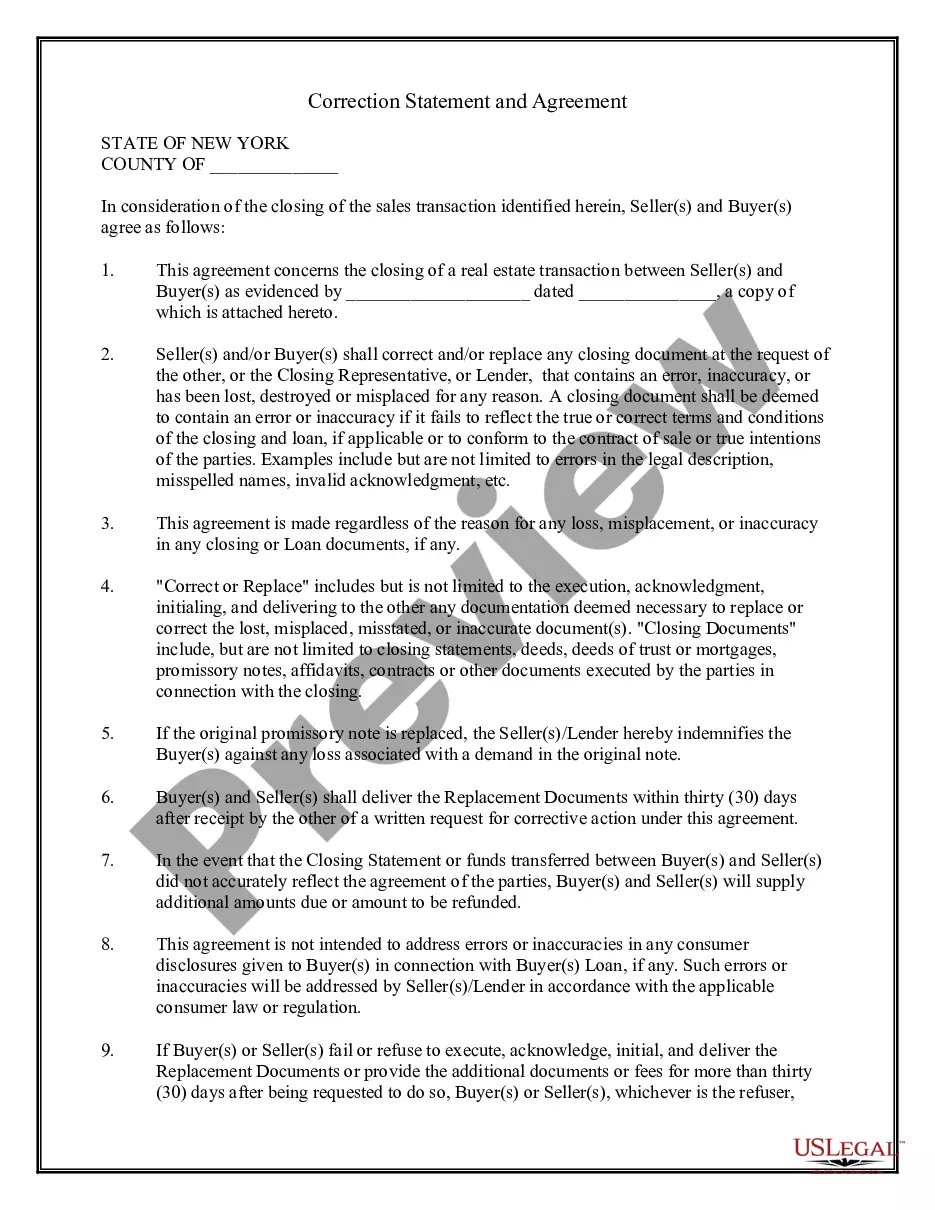

Examples include confidentiality, liability, and termination clauses, all of which serve to protect parties' interests and provide a framework for resolving potential disputes.

Vendor withholding tax is tax that you deduct when your company pays your business partners. You can post this tax already at the time you post the vendor invoice.

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

A withholding clause generally provides that the acquirer may withhold from consideration payable to the seller taxes that it is required to deduct and withhold under federal, state, local or foreign law.

Tax Sharing Agreements This allows companies leaving the tax group (for example on a sale to a third party) to rely on the 'clear exit' rule which limits that leaving company's exposure to the joint and several tax liabilities of the whole group.