Shared Equity Agreements For Nonprofits In Bronx

Description

Form popularity

FAQ

An LEC is a model for homeownership in which residents collectively own and democratically control their building, usually by forming a tenant's association. In other words, each resident owns an equal share of their building, which gives them voting rights for decisions about who manages the building.

Investing in equity shares is a great idea. The reason is that an equity share indicates that you have a certain percentage of equity in the company. Thus, the returns you get are directly linked to the profits of the company. This makes it a great option as the opportunity to earn a good return is high.

An equity joint venture is an agreement between two or more entities stating that they will enter into a separate but joint business venture together. While equity joint ventures are common in practice, there are many stipulations that all parties must abide by to ensure the equity joint venture definition stands true.

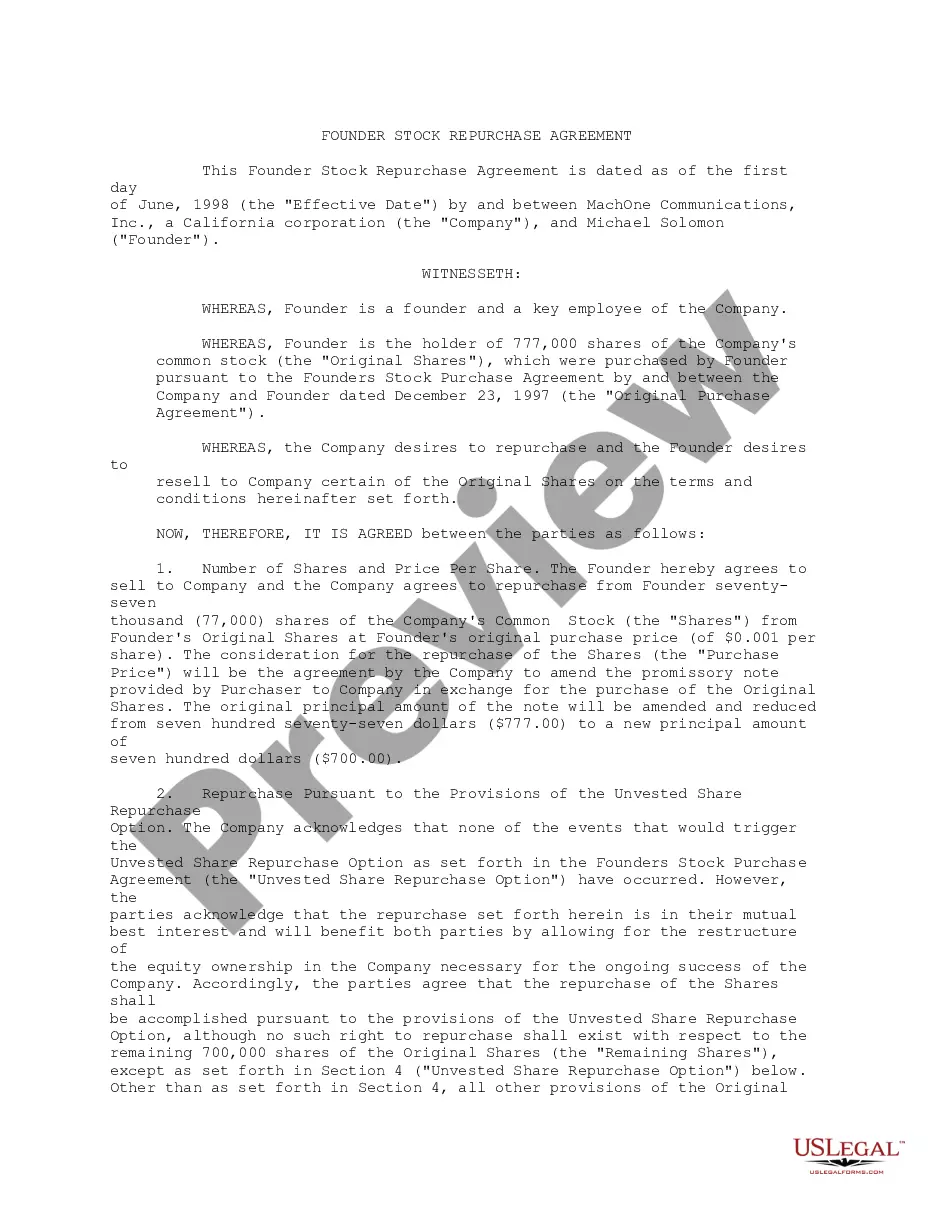

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.