Part Vii Form 990 Instructions In Minnesota

Description

Form popularity

FAQ

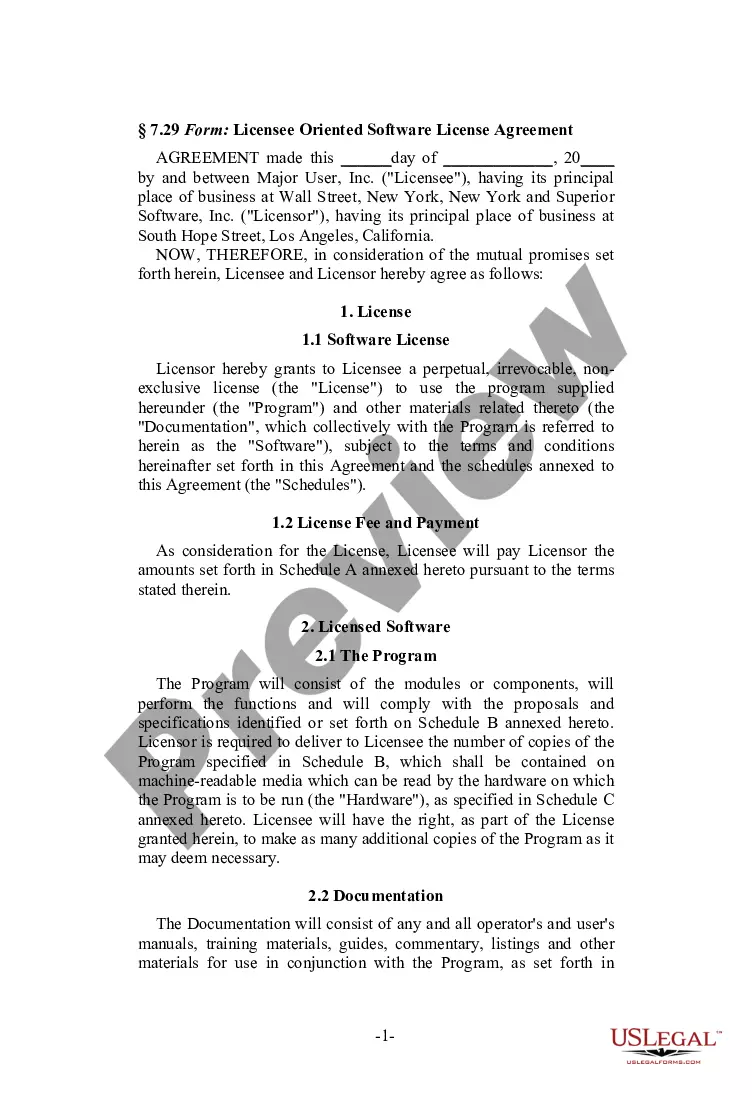

Form 990 Part VII Definitions. The U.S. IRS Form 990, Part VII, Section A requires nonprofits to disclose the names of the organization's officers, directors, trustees (both individuals and organizations), key employees, and highly-compensated employees.

Examples of program service accomplishments include A section 501(c)(6) organization that holds meetings to discuss business issues with the employees. A section 501(c)(7) social club that provides recreational and dining facilities for members.

Column (F) asks for the amount of “other compensation” which generally includes any compensation that is not included in box 1 or 5 of Form W-2, in box 1 of Form 1099-NEC or in box 6 of Form 1099-MISC.

Highest Compensated Independent Contractor means any independent contractor engaged by the Organization, whose total compensation would require the contractor to be listed in Part II of Schedule A of IRS Form 990, or in response to an equivalent question on any successor exempt organization annual return.

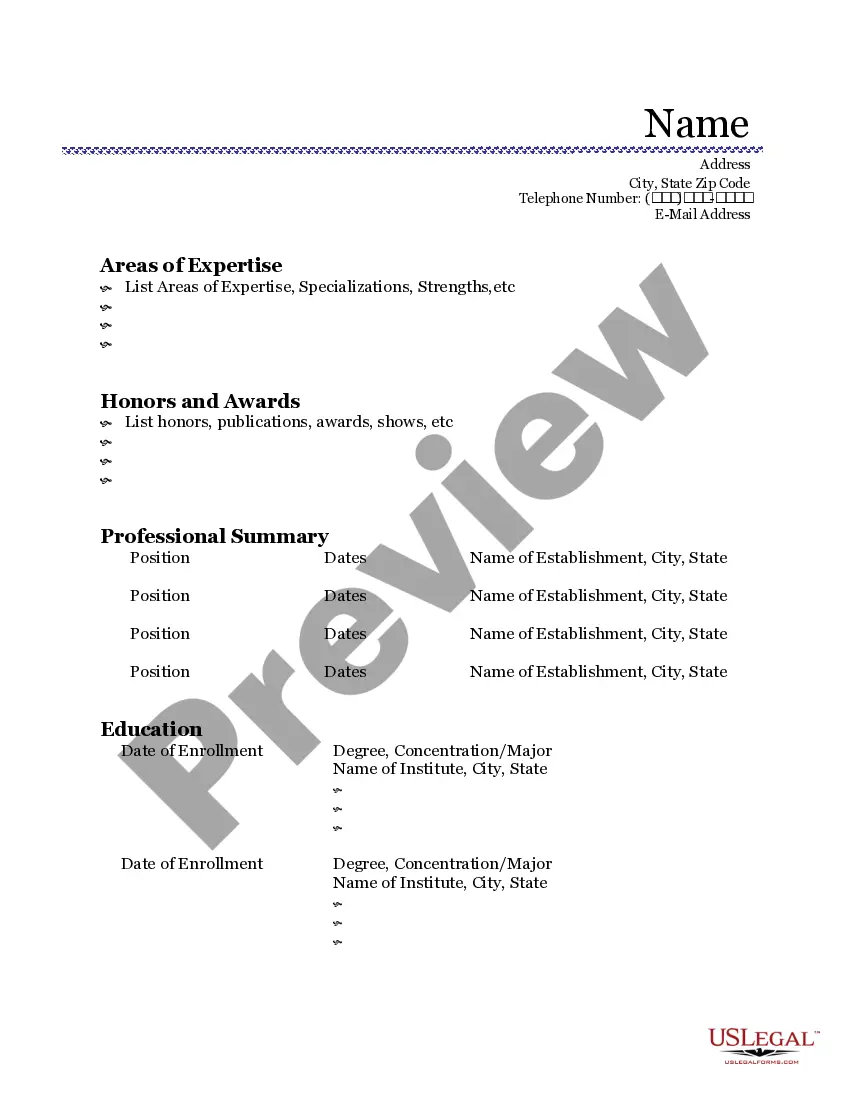

What Is Included in the Form? Your mission statement. Your financial data, including, a list of your expenses, revenue, liabilities, assets, tax deductions, and write-offs. Summaries of activities from the year. Governing body specifics, including names and salaries of top employees.

Part VII requires reporting of two types of compensation: 1) reportable compensation (amounts reportable on a person's Form W-2 (box 5) or Form 1099 (box 7)) and 2) other compensation.

Reportable compensation generally means compensation reported in Box 1 or 5 (whichever amount is greater) of the employee's Form W-2 PDF, or in Box 1 of a non-employee's Form 1099-NEC. Other compensation PDF generally means compensation that is not reportable compensation.

The Internal Revenue Code provides special rules for calculating the unrelated business taxable income of social clubs that are tax-exempt under section 501(c)(7). Under these rules, clubs are generally taxed on income from non-members who are not bona fide guests of members.

Use 1 of the following methods: Print with Form 990: Go to the. OthInfo. screen in the General folder, then mark the. Print Form 990-T (Force) ... Print with Form 990-PF: Go to the. 990-PF. screen in the General folder, then mark the. Print only Form 990-T: Go to the. OthInfo. screen in the General folder, then mark the.

An exempt organization must make available for public inspection its annual information return (e.g., Form 990, Form 990-EZ). Returns must be available for a three-year period beginning with the due date of the return (including any extension of time for filing) or, if later, the date it is actually filed.