Part Vii Form 990 In Michigan

Description

Form popularity

FAQ

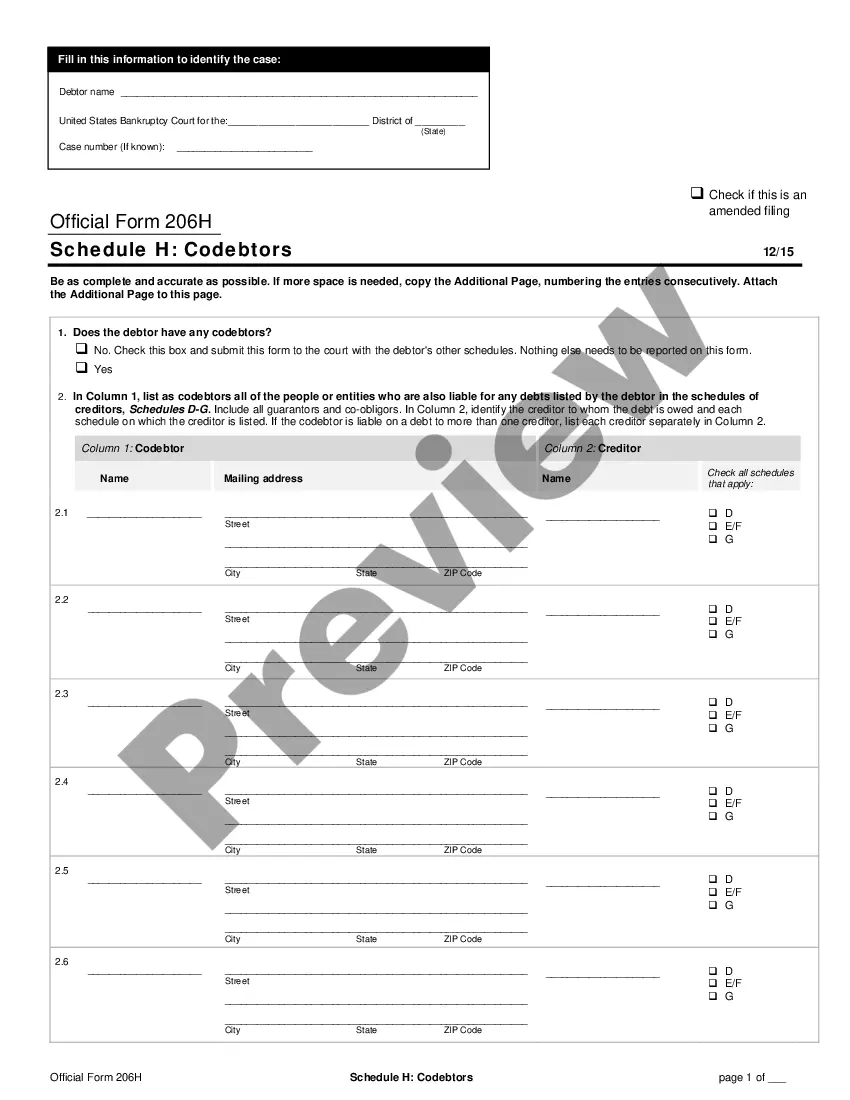

Part VII requires reporting of two types of compensation: 1) reportable compensation (amounts reportable on a person's Form W-2 (box 5) or Form 1099 (box 7)) and 2) other compensation.

Reportable compensation generally means compensation reported in Box 1 or 5 (whichever amount is greater) of the employee's Form W-2 PDF, or in Box 1 of a non-employee's Form 1099-NEC. Other compensation PDF generally means compensation that is not reportable compensation.

An exempt organization must make available for public inspection its annual information return (e.g., Form 990, Form 990-EZ). Returns must be available for a three-year period beginning with the due date of the return (including any extension of time for filing) or, if later, the date it is actually filed.

Databases for finding a nonprofit organization's 990 filings with the IRS, other financial information, and public records. ProPublica NonProfit Explorer. NYS Charities Bureau Registry. GuideStar. Charity Navigator. Give Better Business Bureau Wise Giving Alliance. Great Nonprofits.

Nonprofits are required to make this information available to the public during normal business hours, with the idea being that nonprofits are created to serve the public interest and therefore should remain transparent for accountability purposes. This information is also made available to the public by the IRS.

Column (F) asks for the amount of “other compensation” which generally includes any compensation that is not included in box 1 or 5 of Form W-2, in box 1 of Form 1099-NEC or in box 6 of Form 1099-MISC.

The IRS website is one of the most comprehensive sources for nonprofit tax returns. The Tax Exempt Organization Search is an IRS 501(c)(3) search tool where you can search by nonprofit tax ID, name, or location to find: Form 990 series returns.

Though it may appear technical and intimidating at first glance, a 990 isn't hard to navigate once you know what to look for.