Part Vii Form 990 Instructions In Georgia

Description

Form popularity

FAQ

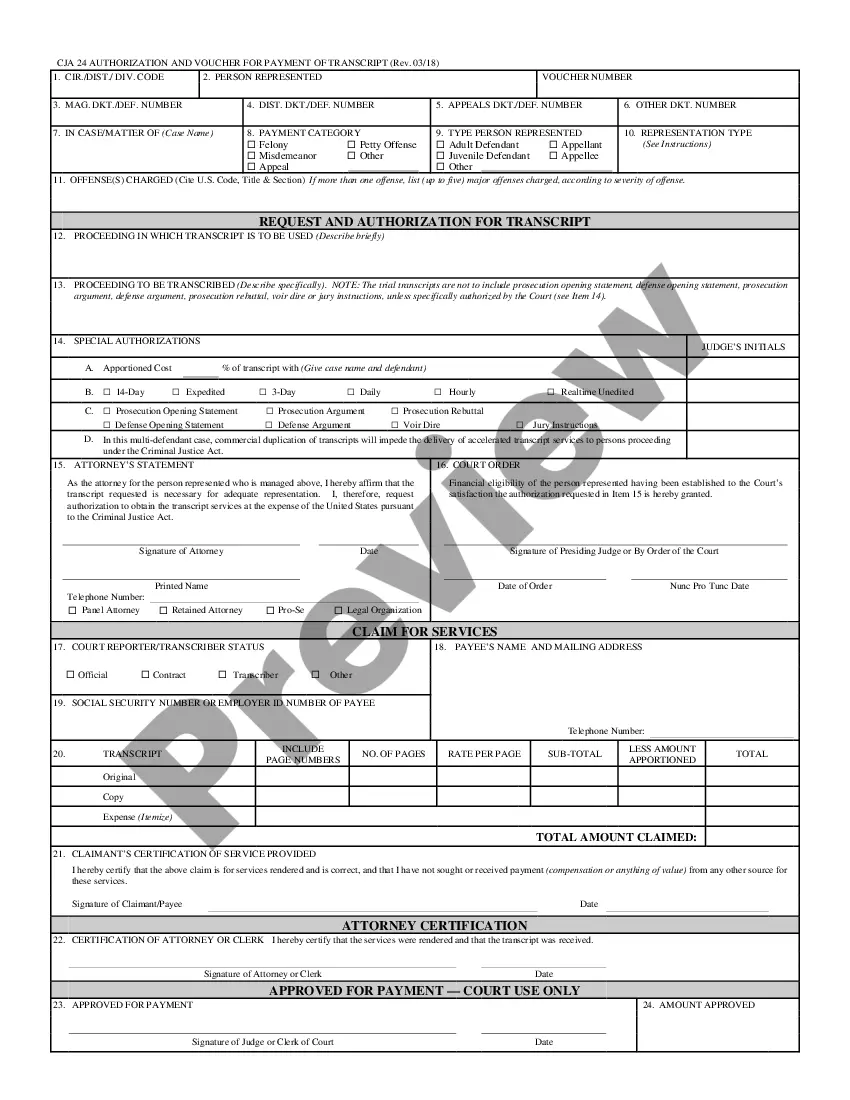

Forms 990, Return of Organization Exempt from Income Tax, and 990-PF, Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation, for tax years ending July 31, 2020 and later MUST be filed electronically.

No, TurboTax does not support Form 990, but you can download it from the IRS: Tax-exempt organizations with annual gross receipts totaling $200,000+ (or assets totaling $500,000+) should file Form 990.

Charitable Registration with the Georgia Secretary of State: The State of Georgia law mandates nonprofit organizations to complete Form C-100 (Charitable Organization Registration) along with a copy of IRS Form 990 or IRS Form 990.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

file IRS Form 8868 Online and Get up to 6 months xtension! 1 Add Organization Details. 2 Choose Tax Year. 3 nter form details. 4 Review the form summary. 5 Transmit to the IRS.

The 990, 990EZ or 990PF should be mailed to Georgia Department of Revenue, P.O. Box 740395, Atlanta GA 30374-0395.

Part VII requires reporting of two types of compensation: 1) reportable compensation (amounts reportable on a person's Form W-2 (box 5) or Form 1099 (box 7)) and 2) other compensation.

The quickest way to find an organization's 990 online is through Candid search, which offers fully searchable and digitized copies of 990s. Candid search allows you to search for a nonprofit by name, location, EIN, and more, and it provides access to all years of 990s which are available as far back as 2000.

If a nonprofit is incorporated in a state but has never been recognized by the IRS as “tax-exempt,” then it does not have an obligation to file an IRS Form 990.

The list of states requiring Form 990 (or information from the return) for the specific purpose of charitable solicitation registration and reporting is as follows: Alabama. Alaska Arkansas. California. Colorado Connecticut. Florida. Georgia.