Repossession Notice Forms With Example In Wake

Description

Form popularity

FAQ

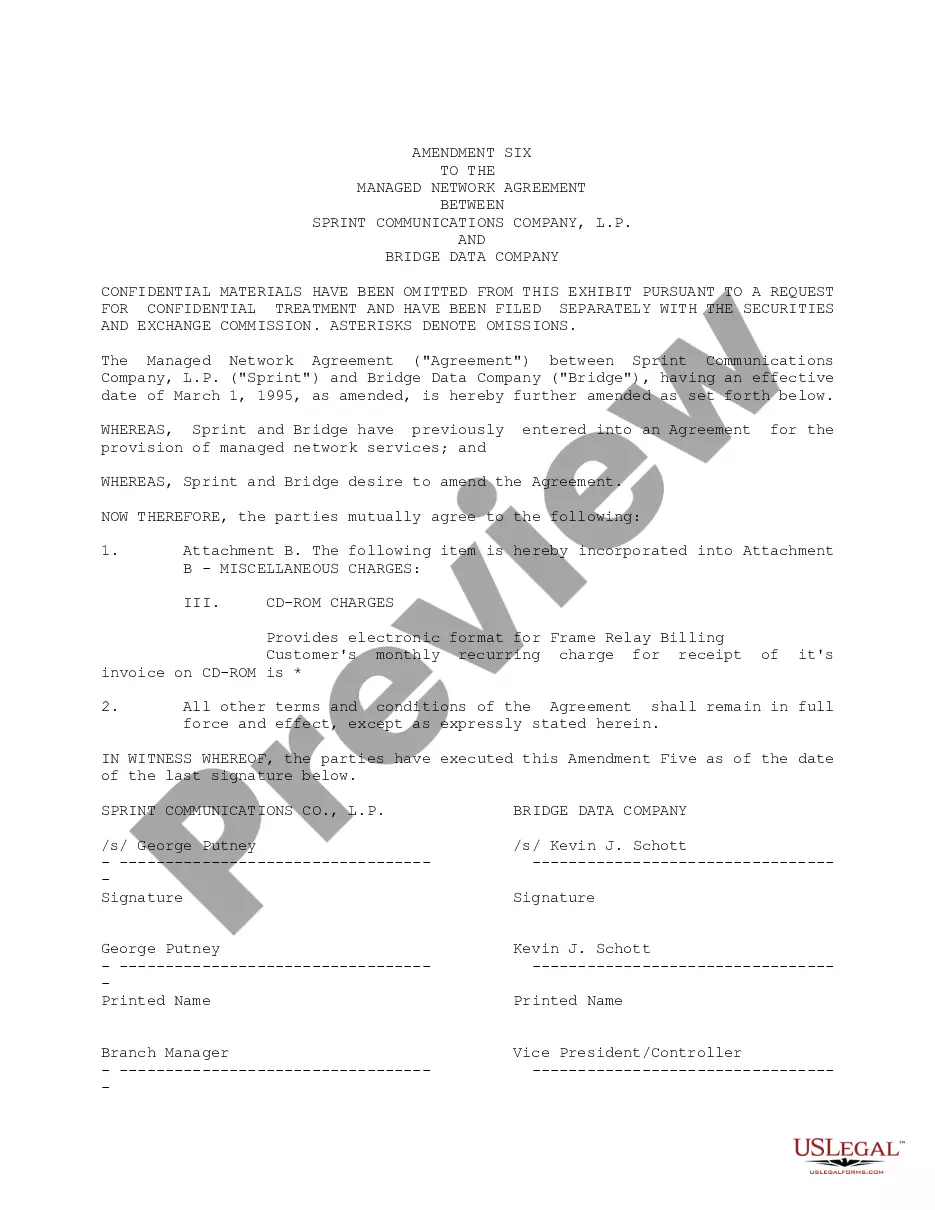

Start the letter by identifying yourself and the property. The lender will need to identify your loan, so include an account number. Give them your name, address and contact information. Tell the lender that you are voluntarily giving the item back because you can no longer make the payments.

Dear Borrower Name: You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale.

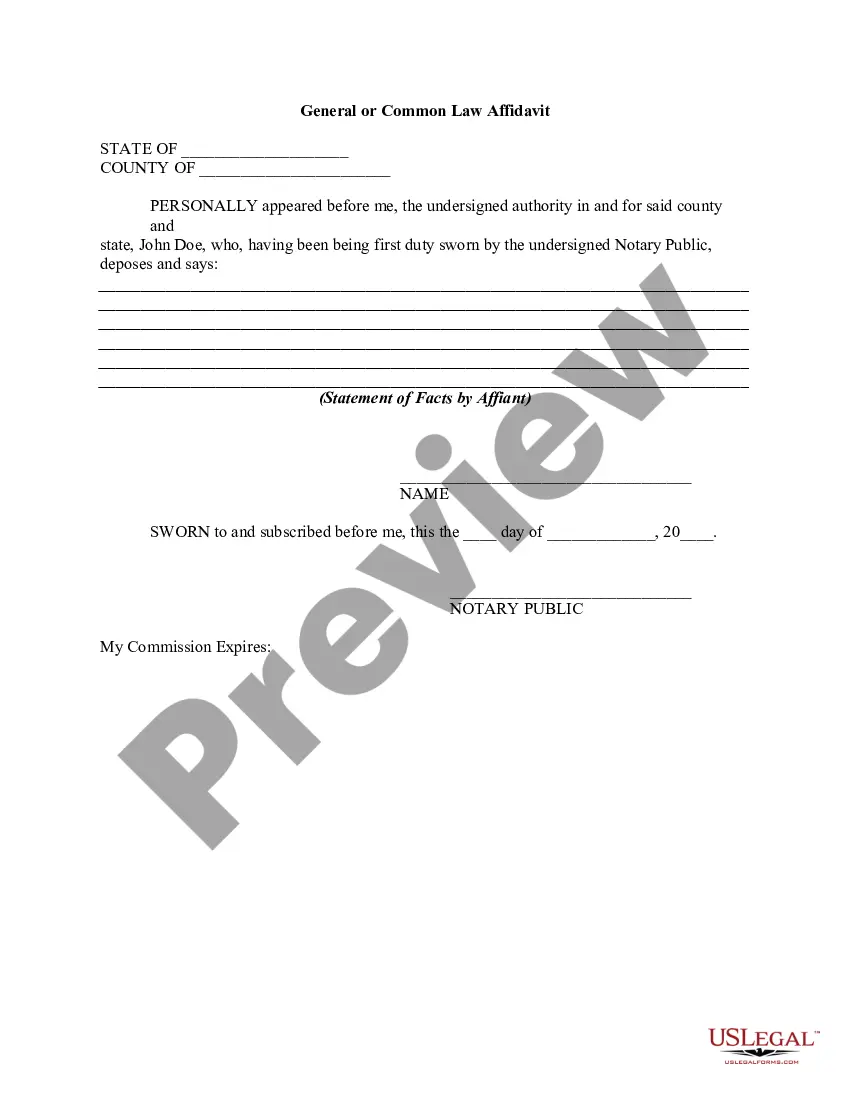

A repossession affidavit is a legal statement filed with the Department of Motor Vehicles when you repossess a car from a customer. This document provides details about the repossession such as why and how the vehicle was repossessed. It also informs government authorities that the vehicle has been repossessed.

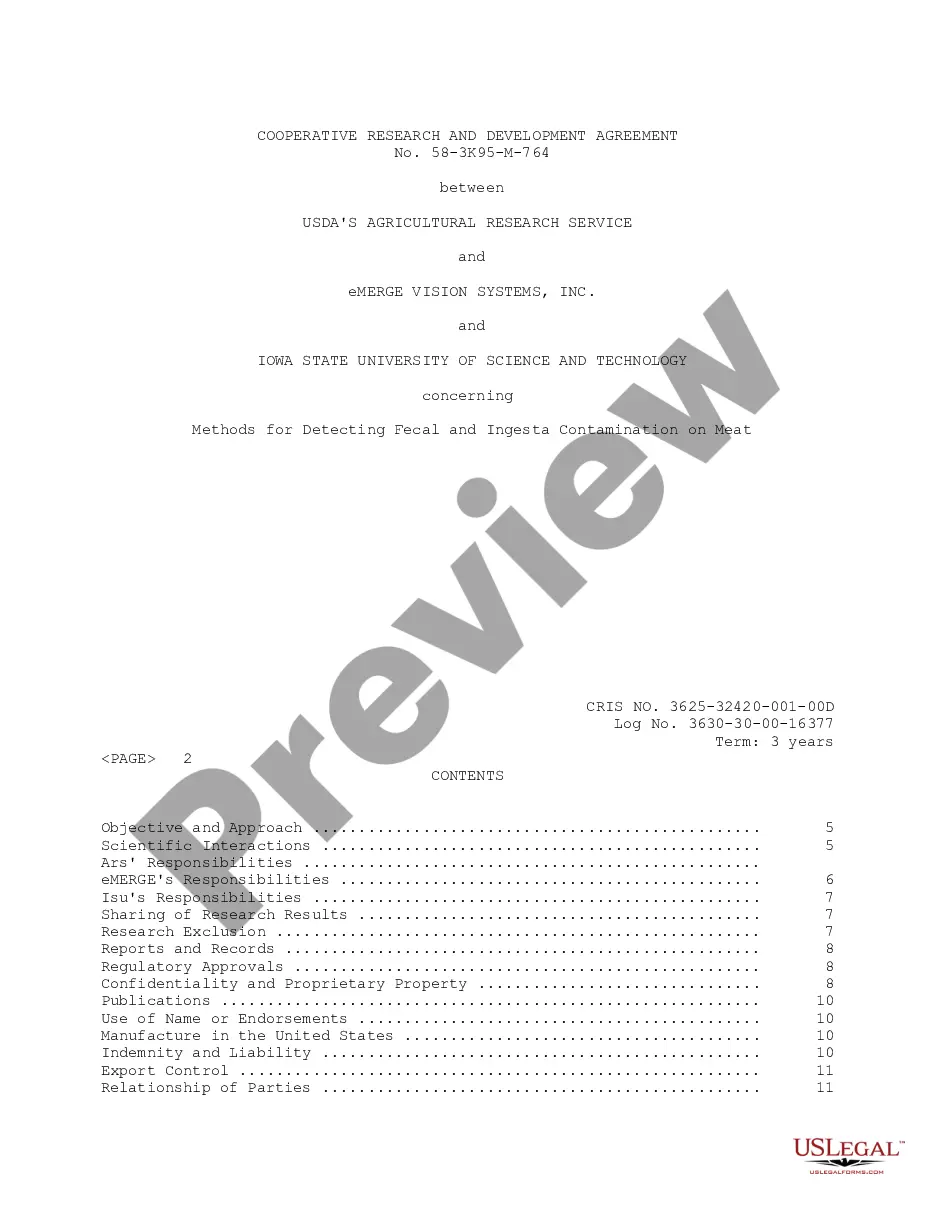

Repossession happens when your lender or leasing company takes your vehicle away because you've missed some payments on your loan or lease—and it can occur without warning if you've defaulted on your auto loan.

Repossession occurs when your lender seizes this asset because you defaulted on what you owe. Cars are the most commonly repossessed assets. However, any property tied to a loan or line of credit can be repossessed. This includes: boats, motorcycles and other vehicles, furniture, jewelry and electronics.

Repossession can show up on credit reports and impact credit, but it won't stick around forever. A repossession can result in a derogatory mark on credit reports, which can stay on the reports for up to seven years.

Types of repossession There are two types of house repossession, judicial and non-judicial. In the judicial process, which means that lenders must obtain a court order before they can take possession of the property.

Know the Repo Laws of Your State. The first thing to know about how to repo a car is you need to be aware of how repo laws stand within the jurisdictions where you will conduct business. Make Sure the Debtor Is in Default. Locate and Verify the Car. Choose the Method to Repossess. Do Not Breach the Peace.