Repossession Letter For Auto Withdrawal In Travis

Description

Form popularity

FAQ

Trying to reinstate or redeem your auto loan typically has to happen within a short time period, such as about two weeks, so you could have your car back soon after it's repossessed. You may have to wait longer, perhaps several months, if the car is sold at auction due to the time of the auction process.

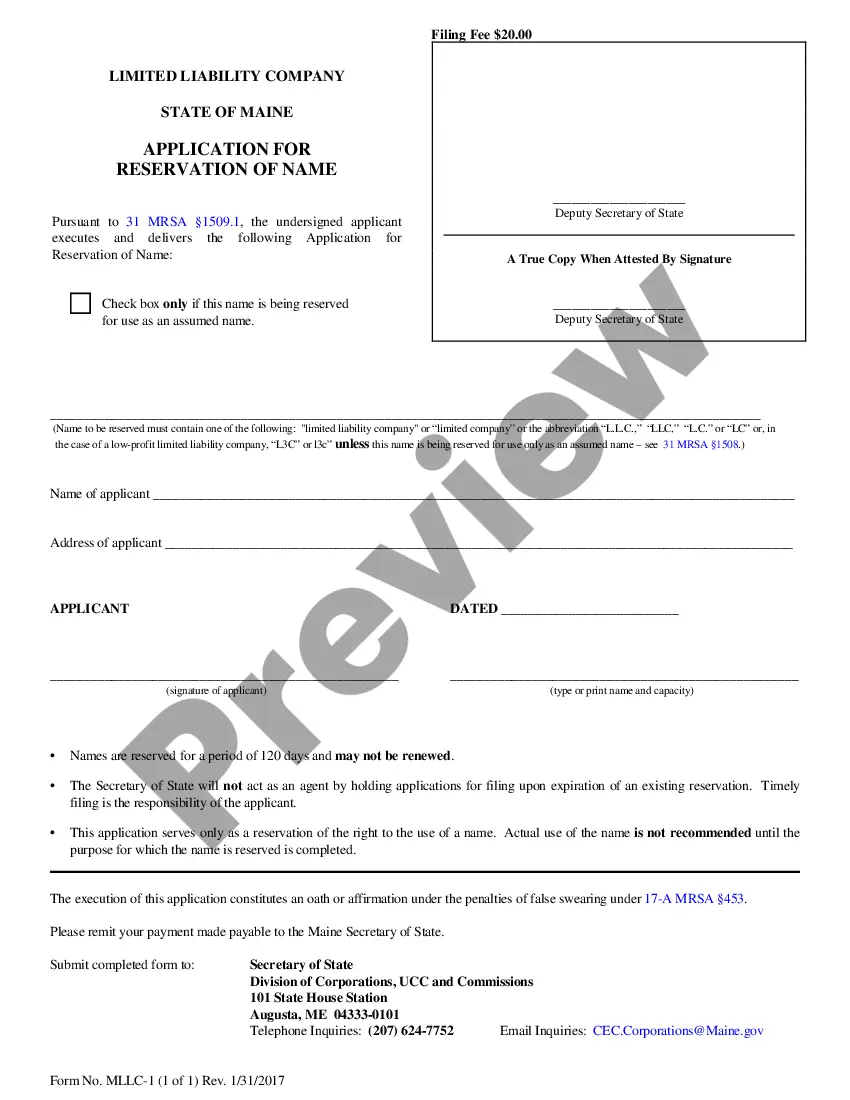

You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale. A sale could include a lease or license.

Initiate a formal dispute with all necessary credit reporting agencies (CRAs) that issued the report containing the repossession. You can dispute a repossession online with all three credit reporting agencies, and this is the most efficient way to pursue removal: Experian. Equifax.

After repossession, a consumer may have the option to redeem the vehicle before it is sold by paying the entire outstanding balance of the car loan, including interest, costs, and fees.

Good afternoon, I hope that you are doing well. Yes, it is possible to negotiate a settlement for the remaining balance of a car loan after it is repossessed. And it is also possible that you can negotiate a settlement for less than the full amount owed.

To attempt to remove repossession from your credit report, you need to initiate a credit dispute and prove to the credit bureaus that the repossession is fraudulent, outdated or otherwise inaccurate.

Most traditional and subprime lenders don't accept borrowers with a repossession that's less than 12 months old. If you apply for an auto loan with a traditional lender a few months after the repo, unfortunately, you're not likely to qualify.

A repossession typically stays on your credit report for up to seven years, so a big part of restoring your credit afterward is just waiting. But you can also be proactive in restoring your credit by paying your bills on time and working on paying off other debt.

What Happens If the Repo Agent Doesn't Find Your Car? But if you make it hard for the repo agent to get it, then the creditor may use another method to get the car back, called "replevin." Replevin can be just as costly as a repossession, if not more so.

You are hereby notified that your description of motor vehicle, year, make, model and VIN #, was lawfully repossessed on Date because you defaulted on your loan with Credit Union Name. The vehicle is being held at location address of vehicle. be sold at public sale. A sale could include a lease or license.