I Debt With You In Cook

Description

Form popularity

FAQ

How To Fill In A Proof Of Debt Form Box 1 – This is your business name. Box 2 – This is your business address. Box 3 – This is the total amount you are owed. Box 4 – List any supporting documents you have. Box 5 – List any un-capitalised interest on the claim.

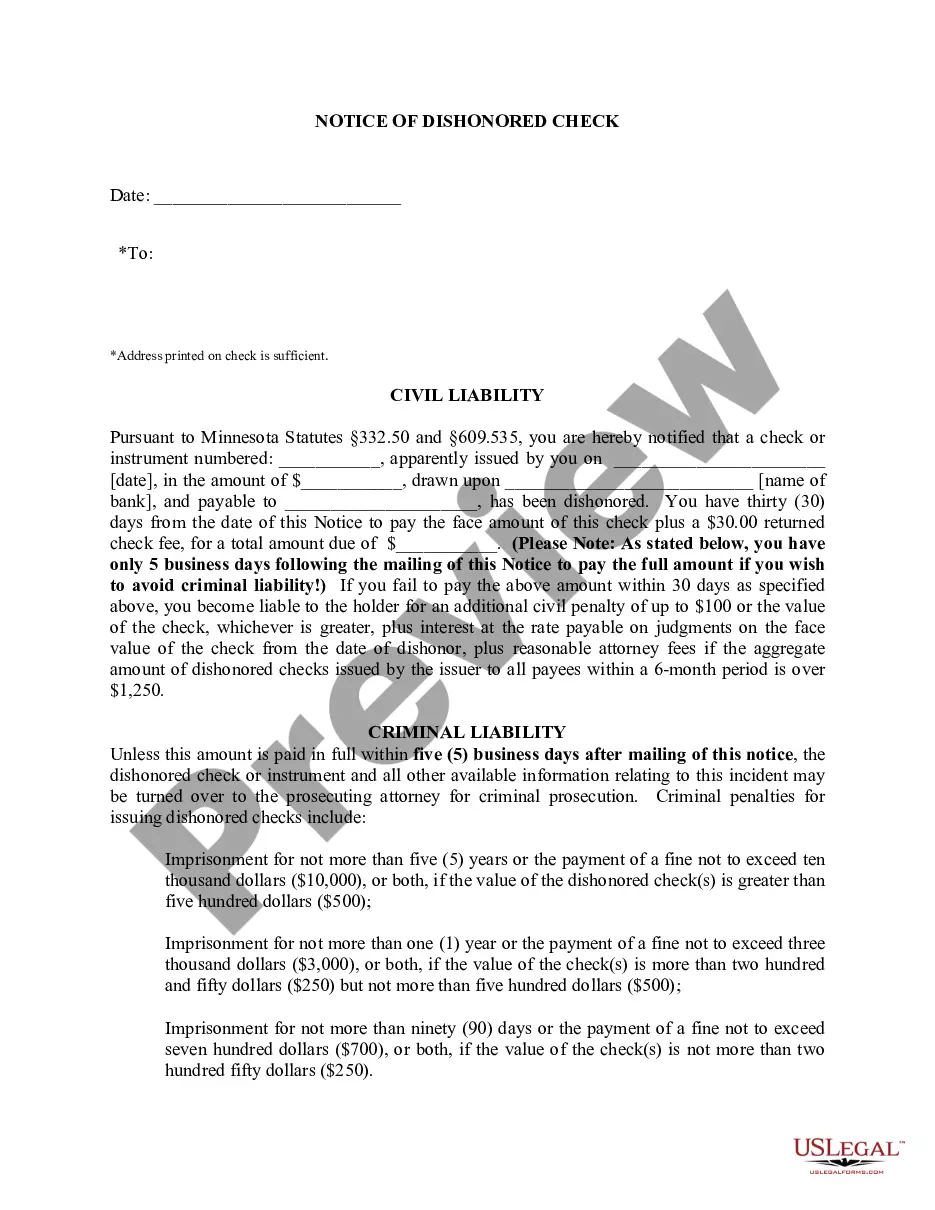

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

You would respond to the court with a general denial of all of the allegations regarding you owing the debt and the actual amount of the debt. What you do is copy the heading on the top of the complaint and then under that you title your document Answer.

Your answer should include the court name, case name, case number, and your affirmative defenses. Print three copies of your answer. File one with the clerk's office and mail (or “serve”) one to the plaintiff or plaintiff's attorney.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

Indebted, bound, owing, grateful, obliged, in debt, obligated,

$5,000 in credit card debt can be quite costly in the long run. That's especially the case if you only make minimum payments each month. However, you don't have to accept decades of credit card debt.

If you're carrying a significant balance, like $20,000 in credit card debt, a rate like that could have even more of a detrimental impact on your finances. The longer the balance goes unpaid, the more the interest charges compound, turning what could have been a manageable debt into a hefty financial burden.

Thanks to the American Rescue Plan (ARP), states, counties, and cities are canceling an estimated $7 billion in medical debt for up to nearly 3 million Americans, including: Arizona is using ARP funds to relieve an estimated up to $2 billion in medical debt for up to 1 million Arizonans.

SB 1061 by Senator Monique Limón (D-Santa Barbara) targets the devastating impact of medical debt on consumers. Under this new law, medical debt will no longer be included on consumers' credit reports, ensuring that people are not penalized for the high costs of necessary healthcare.